Stop Loss Trading Summary: Points to Remember When Setting Stop Loss Orders

The key to setting stop losses in Gold trading is not to set too tight or too far and not exactly on the support or resistance levels.A few pips below support or above resistance levels are the best place to set stops.

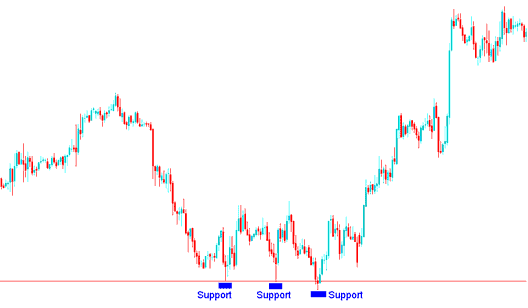

If you're going long (buying Gold pair), just look for a nearby support level that is below your entry point and set this stop loss order about 20 to 30 pips below that support level. The example below shows the level where a Gold trader can set up their stops on the Gold price chart just below the support level.

Support Level for Setting Stop Loss Level for Buy Trade on Gold Trading Chart

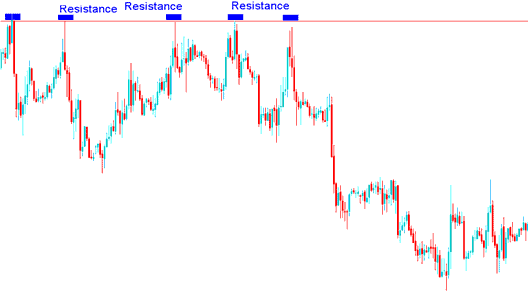

If you're going short (selling Gold pair), just look for a nearby resistance level that is above your entry point and set this order about 20 to 30 pips above that resistance level. The example below shows the level where a Gold trader can set up their stops just above the resistance level on a Gold trading chart.

Resistance Level for Setting Stop Loss Level for Sell Trade on Gold Trading Chart

You can also use stop loss orders to lock in profits, Not Just for Preventing Losses

The advantage of a stop loss order is that you do not have to monitor on a daily basis how the Gold price chart is performing. This is especially handy when you are in a situation that prevents you from watching your trades for an extended period of time, or when you want to go to sleep after trading Gold the whole day, but leave that 1 Gold trade open.

The disadvantage of a stop loss order is that the price at which you set these orders could be activated by a short-term fluctuation in Gold price. The key is picking a stop-loss percentage that allows the Gold price to fluctuate within the day to day range while preventing the downside risks.

These stop loss orders are traditionally thought of as a way to prevent losses thus the name. Another use of these orders is to lock in profits, in which case it is referred to as a trailing stop loss.

For a trailing stop-loss order it is set at a percentage level below the current Gold market price. This trailing stop loss level is then adjusted as the trade unfolds. Using a trailing stop loss level allows you to let profits run while at the same time guarantees that should the market turn you will have locked in some of your profits.

These stop loss orders can also be used to eliminate risk if a Gold trade becomes profitable. If a trade makes some reasonable gains then the stop loss can be moved to breakeven point, the point at which you bought the Gold pair, thereby ensuring that even if the trade moves against you, you will not make any loss, you will breakeven on that Gold trade.

Trailing stop loss orders are used to maximize and protect profit as the Gold price rises and limit losses when the price falls.

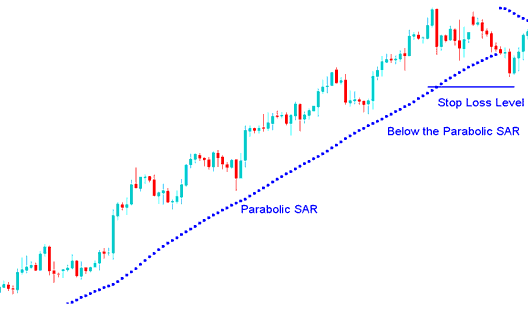

A good example of an indicator that can be used to set a trailing stop is when you use the parabolic SAR chart indicator and keep moving your stop loss to the parabolic SAR level.

Parabolic SAR Indicator for Setting Trailing Stop Loss in Gold Trading

Another example is where a Gold trader moves his stop loss order by a certain number of pips after every few hours or after every hour or after every 15 minutes depending on the Gold trading chart time frame that the trader is using.

In the example above the parabolic SAR which had a setting of 2 and 0.02 was used as the trailing stop loss level for the above chart. The trader would have kept moving the trailing stop level upwards after every SAR was plotted until the time when the Parabolic SAR was hit and the trend reversed.

Conclusion

A stop-loss order is a simple tool yet so many traders and investors fail to use it. Whether it is used to prevent excessive losses or to lock in profits, nearly all investing styles can benefit from this trading tool.

Points To Remember When Setting These Stop Loss Orders

Here are some important points to remember:

Be careful with the points where you set these stop loss orders. If Gold price normally fluctuates 50 points, you do not want to set your order too close to that range else you will be taken out by normal market volatility.

Stop Loss orders take the emotion out of trading decisions and by setting a sop loss order one you set a predetermined point of exiting a losing trade, meant to control trading losses and preserve your account equity.

Gold traders can always use technical indicators to calculate where to set these stop loss levels, or use the concepts of Resistance and Support levels to determine where to set these stop orders. Another good MetaTrader 4 indicator used to set these orders is the Bollinger bands indicator where traders use the upper and lower band as the limits of price therefore setting these stop loss orders just outside these bands.