Commodity Trading Long and Short and Charts

In trading, there are two types of trades, these are:

- Long (buy) - long is if the commodity trend is buy/bullish.

- Short (sell) - short is if the commodity trend is sell/bearish.

Buying/Long and Selling/short in Commodities

Both terms in Commodities, refer to things we do when open a trade.

Buying Long - commodity term to use when buying and when opening a trade.

Selling short - commodity term to use when selling and when opening a trade.

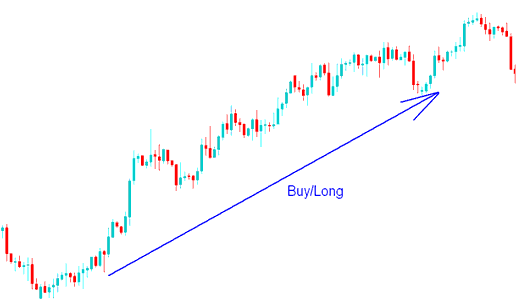

Long - Long is another term used to refer to buying in commodity, If a trader goes long it means that he buys the commodity instrument that is heading in an upward trend direction. When the price is moving in an upward commodity trend the trend is referred to as bullish commodity trend.

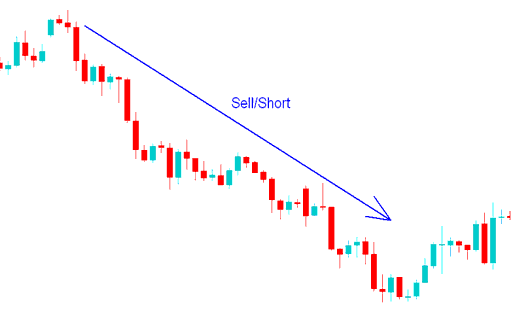

Short - Short is a term used to refer to selling of a commodity instrument that is going in a downward trend direction. When the price is going downwards then it is referred to as a bearish commodity trend.

Basically the term, "selling short" can be refer to selling in the commodity markets. Selling short is used to transact a commodity instrument that is predicted to depreciate in its value compared to another, when this instrument is sold then it is the same as not holding value in this commodities and holding the same value in another form against which this instrument is traded against - mostly US Dollars.

Buy/Long

If the price is going up we buy, this is referred to as going long - Therefore long is just another term for buy. When the commodity market trend is going up it is referred to as bullish, this is when a buy commodity trade is placed. A bullish commodity trend is identified by drawing an up-ward commodity trendline on a commodity chart. The example portrayed and described below highlights a long/buy trade signal.

Buy/Long

Sell/Short

If the price pair is heading down we sell, this is referred to as going short. When the commodity market trend is going down it is referred to as a bearish. The example portrayed and described below highlights a downward trend, this is when a short sell is placed. The short/sell is identified by drawing a down ward commodity trendline on a commodity chart. The example portrayed and described below highlights a short/sell trade signal.

Sell/Short - Commodity Buy Trade and Commodity Sell Trade

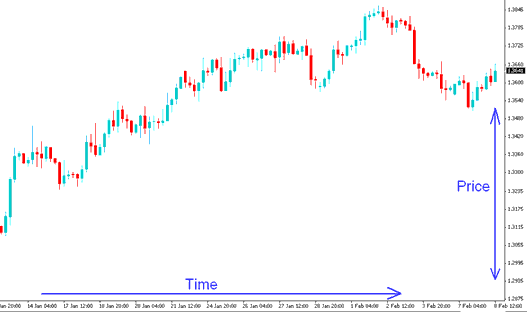

Commodities Charts

A trading chart provides a visual representation of prices (drawn on the y-axis) against time (drawn on the x-axis) for commodity. The movement of prices is plotted on these commodity charts. The commodity chart can be drawn as candlestick charts like the one below or as line charts or bar charts.

Commodities Chart - Candlesticks Charts

The three common types of charts used in commodities trading are:

- Candlesticks Charts

- Line Charts

- Bar Charts

These 3 are explained in the topic Commodities Chart Types.

Trading Platform

This is the commodity software which's provided by a broker to help commodity traders place their transactions. Once you download and installs this software on your computer you can then begin to trade in the Commodities market. All commodity trades are executed through this platform. If you want to learn a commodity platform, MT4 Platform is a good commodity platform to begin with.

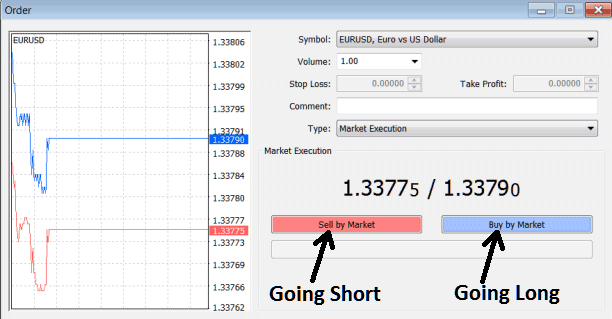

To set these trade orders, open MT4 Platform, open a 'chart', rightclick +oon the 'chart', choose 'New Order', then choose the commodity order either sell or buy as shown below. (Keyboard Short Cut Keys - Press F9 Key)

Placing Buy Long Order and Sell Short Order in MT4 Software