Setting A Forex Trading Schedule and a Written Forex Trading Schedule Example

Forex is a market that is global in nature. The global nature of the forex market means that it is open around the clock throughout the week and there is a wide range of currencies to choose from. Traders therefore have a lot of flexibility when it comes to choosing when to trade the FX market. However, not all times are suitable for placing forex trade transactions.

Forex traders should set up a schedule based on the most active forex market hours which are the best hours to help maximize profits.

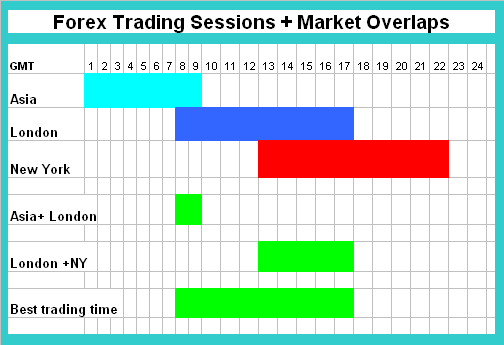

USA, London sessions are the most active forex market trading times, there is also the Asia Session which is the third forex market session. These three major market sessions make up the largest volumes of forex trade transactions from across the world on a daily basis, although Asia market session is one of these 3 forex market sessions it is best not to trade during this particular market session.

There are also forex market session overlaps in between the three forex sessions, where two forex market sessions are open at the same time, these market session overlaps are the most active forex market trading periods. These forex market session overlaps provide a great opportunity to trade in multiple markets at once and maximize your potential profits.

The best forex market session overlap is the one that occurs between the US and London markets. This is when the currency trade transactions are the most active and more opportunities present themselves.

Asian forex market session is the least active of the three major forex market sessions. Many currency pairs will move slowly or consolidate at a single point throughout the Asia market session. This is not a good time to be in the forex market - this is the best time to take a break from trading forex. Even Asian investors avoid transacting forex currencies at this time and wait until night time to trade the market when the Europe and US markets are open.

Because the forex trading day lasts all day and night and it is not possible to stay up all night long, investors and traders should set up a workable forex trading schedule. By gaining an understanding of these forex market hours, a trader can set appropriate hours for trading so as to increase chances of maximizing profits.

When setting up a forex trading schedule, it should accomplish the following goals:

1. Familiarize yourself with the various forex market sessions. These are: New York market session, the London market session, the Tokyo market session.

London Market Session 3a.m. To 12p.m. EST ( 8:00 GMT 1700 GMT.)New York Market Session 8a.m. To 5p.m. EST (1300 GMT 2200 GMT.)

Tokyo Market Session 7p.m. To 4a.m. EST (00:00 GMT-9:00 GMT.)

2. Trade during this time when currency pairs are most active.

3. Plan a workable forex trading schedule. So as to keep a balance between your time to get adequate rest. The best time is between 3a.m. To 5p.m. EST

When the USA and UK forex market sessions are both open currencies will generally trend up or down and move a good number of pips in one direction. As a technical analyst, this is the time when the technical indicators will provide good and profitable signals that catch the market trend.

When the forex prices are trending and moving fast in a particular trend direction, forex traders will find it much easier to make money when trading a market that is moving upwards or moving downwards in a forex trend as compared to when there is no market trend direction and the forex market is moving in a range - sideways market movement.

On the other hand, during the other times for example the Asian forex market session, the forex prices will be in a range movement - sideways movement and traders using technical indicators will have a hard time making profits as the indicators will generally tend to be more prone to whipsaws (fake out forex signals). A trader will find it difficult to make money in this range bound price action sideways market movements.

It is 10 times easier to make money when the market is moving up or moving down than it is to make money when market is ranging.

During the best forex market times to open orders, i.e. 800 GMT and 1800 GMT the forex currency prices will trend in one direction, during other times like Asian Market Session, the forex currency prices movement are likely to be Range Bound.

Some currencies are more active during a particular forex market session than others and understanding this will allow you to make the most out of the forex market.

- London forex market session 08:00 GMT - 16:00 GMT most active currencies: EUR, GBP and USD.

- US forex market session 13:00 GMT - 22:00 GMT most active currencies: USD, EUR, GBP, AUD and JPY.

- Asian forex market session is a relatively slow for all currency pairs and not suitable at all for most traders. The most active currency is only the JPY.

Basically your forex trading plan should target 800 GMT and 1800 GMT as the time that you trade forex currencies.

Example of a Forex Trading Schedule on a Forex Trading Plan

The example below shows how to specify your forex trading routine and time of day to watch the forex market and open forex trades. This will form the basis of your forex trading schedule. The time frame that you use will also be specified and mostly it will depend on what type of trader you are. The time set for this example is during the day when the UK and USA market sessions are open as shown on example below.

Written Forex Trading Schedule Example - How to Write a Forex Trading Schedule Explained - Forex Trading Plan Sections