RSI Hidden Bullish Divergence and Hidden Bearish Divergence Trade Setups

Hidden divergence trading setup is used as a possible sign for a trend continuation. Hidden divergence trading setup occurs when price retraces to retest a previous high or low.

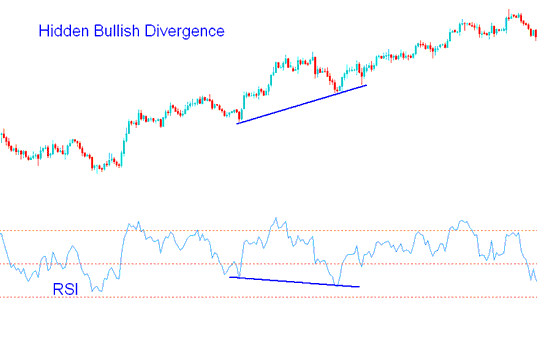

Hidden RSI Bullish Divergence

Hidden RSI bullish divergence setup forms when price is making a higher low (HL), but the oscillator is showing a lower low (LL).

Hidden bullish divergence occurs when there is a retracement in a uptrend.

RSI Hidden Bullish Divergence - Hidden Divergence Setup

This hidden divergence set up confirms that a price retracement move is exhausted. This hidden divergence indicates underlying strength of an upward trend.

Hidden RSI Bearish Divergence

Hidden RSI bearish divergence setups forms when price is making a lower high (LH), but oscillator technical indicator is showing a higher high ( HH ).

Hidden bearish divergence forms when there's a retracement in a downtrend.

Hidden Bearish Divergence - Trading Hidden Bearish Divergence Setup

This hidden bearish forex RSI trading set-up confirms that a price retracement move is exhausted. This divergence indicates strength of a downwards trend.