Stochastic Oscillator Bullish Divergence and Bearish Divergence Trading

Divergence in Stochastic Oscillator - Divergence forex trading is one of the signals that can be generated when using the stochastic oscillator trading technical indicator.

Divergence forex trading is a signal that a rally or retracement is losing steam and is likely to reverse. It means that the last buyers or last sellers are pushing the trading price in one way while the majority of other traders have stopped trading in that direction and are cautious of a price correction or retracement.

There are 4 types of divergence trading setups

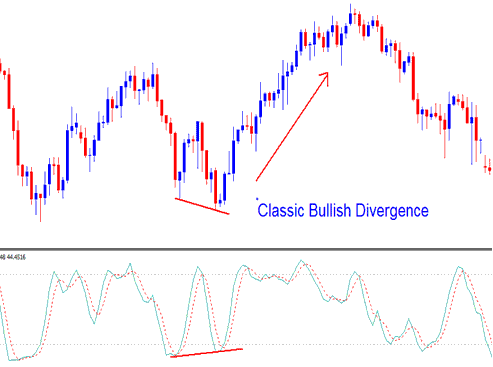

Example 1: Classic Forex Bullish Divergence

A Classic Bullish Divergence in the stochastic indicator and the trading price is followed by a rise in trading price.

Stochastic Oscillator Classic Forex Bullish Divergence

When the trading price is making new lows the Stochastic indicator is not moving past its previous lows it is an indication that the downward trend is about to reverse and a bullish forex rally is likely to occur.

In the trading example above the trading price set a new low but it was not coupled with a new low in the measure of Stochastic indicator, when price formed a new low then the stochastic indicator should have followed suit, but the stochastic indicator did not therefore the classic divergence trade setup.

Forex classic divergence trading setup is even stronger because there is combination of a divergence trade setup and then followed by a rise above the 20% indicator level. This combines the Overbought and Oversold levels with this divergence trade setup.

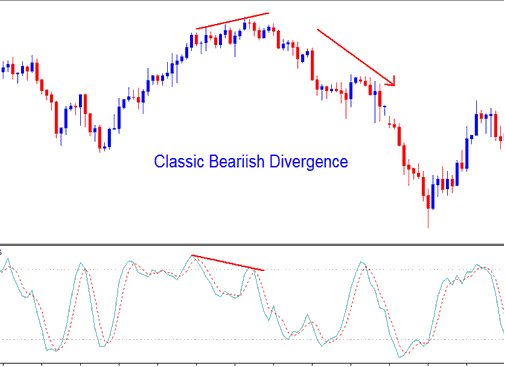

Example 2: Classic Forex Bearish Divergence

A Classic Forex Bearish Divergence trading setup in the stochastic indicator and the trading price is followed by a drop in trading price.

Stochastic Oscillator Classic Forex Bearish Divergence

When trading price is making new highs but the Stochastic indicator is not moving beyond its previous high it is an indication the upward trend will reverse and that a bearish divergence trade setup will follow.

This classic forex bearish divergence trade setup is even stronger because there is a combination of a divergence with a dip below the overbought 80 level.

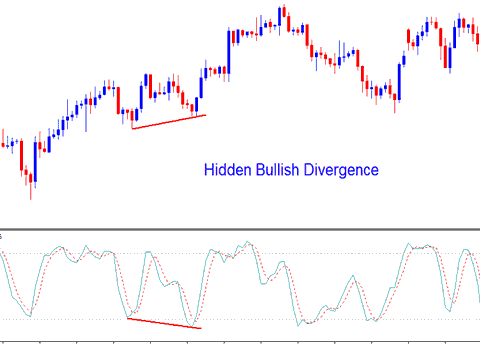

Example 3: Hidden Forex Bullish Divergence

Hidden Forex Bullish Divergence trade setup signifies a retracement in an up-ward trend. This forex hidden divergence trading setup is the best type of divergence trading setup to trade, because you aren't trading a price reversal, but you're trading within the direction of the trend.

Stochastic Oscillator Hidden Forex Bullish Divergence

Even though, the stochastic indicator made a lower low the trading price low was higher than the previous low (higher low). This means that even though the sellers made a good attempt to push trading price down as indicated by the stochastic indicator, this was not reflected on the trading price, and the price did not make a new low. This is the best place to open a buy trade, since it is even in an up-ward trend there is no need to wait for a confirmation signal, because you are buying in an up-ward trend.

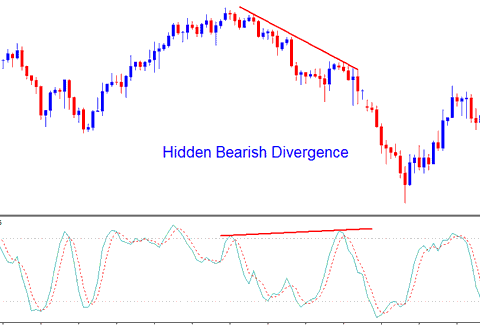

Example 4: Hidden Forex Bearish Divergence

Hidden Forex Bearish Divergence setup signifies a retracement in a downward trend.

Stochastic Oscillator Hidden Forex Bearish Divergence

Hidden forex bearish divergence trading setup is the best type of divergence to trade, because you aren't trading a price trend reversal, but you're trading within the direction of the trend. This is the best place to open a sell trade, since it is even in a downward trend there is no need to wait for a confirmation signal, because you are selling in a downward trend.