Accumulation/Distribution Trading Analysis & Accumulation/Distribution Signals

Created by Marc Chaikins

This indicator is used to assess the cumulative flow of money into and out of gold.

Stock volume started in stock trading. It measures shares traded in a stock. This shows cash flow in and out.

The basic principle behind AD indicator is that volume(or money flow) is a leading indicator of the gold price. (Volume precedes price).

The trading approaches detailed in this guide are among the most commonly applied methods in the context of gold trading, as well as in other financial markets such as equities and commodities.

Interpretation

This volume indicator is used to see if the amount of trading is going up or down as the price of gold on a chart goes up or down.

UpGold Trend

If the price trajectory for gold demonstrates an increase, the Accumulation/Distribution line ought to follow suit. This visual confirmation implies that volume supports the move in gold prices, lending credibility and sustainability to the upward momentum.

When price rises but volume does not, the move loses strength. This creates divergence between price and the indicator. It hints at a possible reversal.

DownXAUUSD Trend

If the price of gold is observed to be decreasing on the chart, the AD (Accumulation/Distribution line) should also show a downward movement, confirming that the volume supports the downward price action, lending it strength.

When prices fall but volume does not, the move loses power. This gap between price and volume signals a possible shift to the other direction.

Analysis and Generating Signals

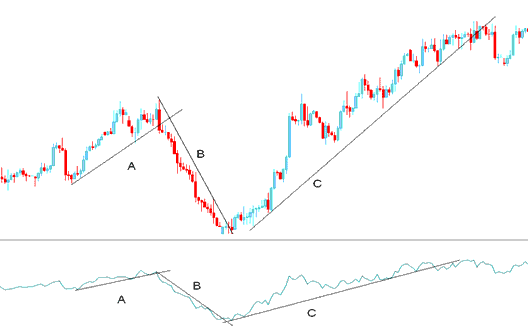

Below is example of a chart and the trading analysis explanation

From the chart, we divide it into three parts: A, B, and C.

A - Upward trendline on chart as well as on the AD

B - Downward trendline on chart as well as on the AD

C - Upward trendline on chart as well as on the AD

When gold prices and your chosen indicator both move the same way, that's a good sign. The price action probably has enough momentum to keep going.

XAUUSD Trend Line Break

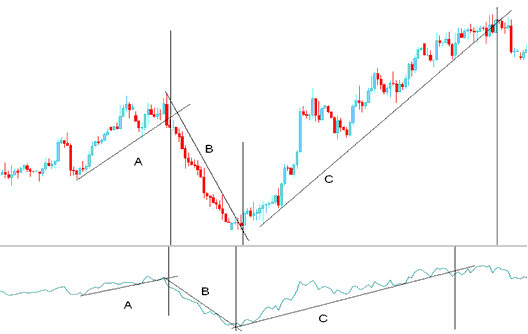

As seen in the chart above, breaking the trend line in AD correlates with the gold price trend line breaking as well.

On the chart below, vertical lines mark where trend lines broke. They appear on both the gold price and the indicator.

When comparing the trendlines on the tool and the gold price, the lines on the tool changed before those on the chart. This is because the amount of trading always comes before the price.

Signals

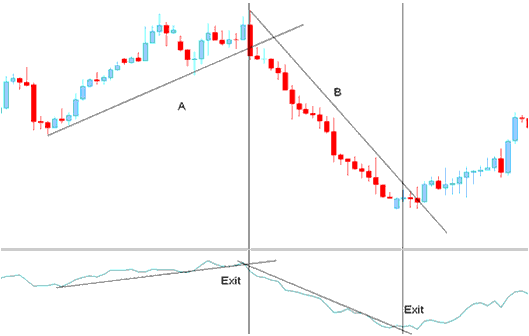

Exit

Exit signals are generated/derived when the trend line on the Accumulation/Distribution is broken. A trend line break on the technical indicator warns of a potential reversal.

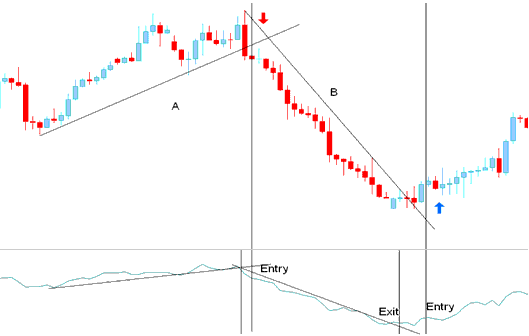

Entry

A Break in the AD Trend Line Signals a Possible Price Turn.

However if we want to take a trade position in the opposite market direction it is always best to wait and chill for a confirmation signal.

A confirmation signal is considered complete once both the indicator & the gold price breaks both their trend lines.

Entry Signal Generated by Trend Reversal

More Instructions and Educations:

- Where Do I Study How to Trade in MetaTrader 4 App illustrated?

- MT4 XAUUSD Demo Account Login

- Day XAU USD Strategies Guide

- XAUUSD Box Pattern Analysis

- How Can I Use MetaTrader 4 XAUUSD Platform/Software on My Android Phone?

- MT4 Trade Copying Platform for Automated Trading and MT5 Trade Replication Software

- How to Choose & Select a Good Regulated XAUUSD Broker