Add Trend line in Chart

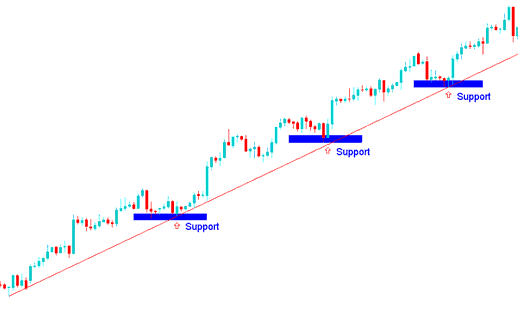

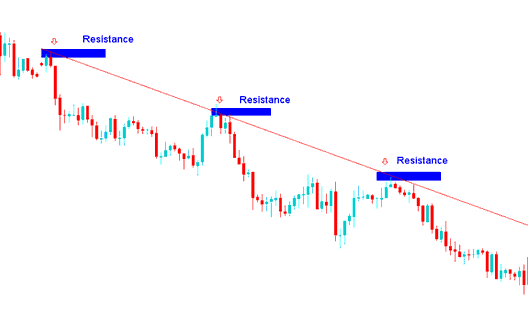

Diagonal support and resistance levels can sometimes form a staircase-like pattern, creating a trend that moves steadily either upward or downward.

A trendline shows where the price finds support and resistance, based on which way the price is moving. It shows support levels when the market is going up, and resistance areas when it is going down, and many investors use them to find these support and resistance levels.

A gold trendline links two or more price points and stretches ahead to mark support or resistance zones. It comes in upward or downward forms. Traders use these lines to guess future price moves. You must learn to draw them and read their signals.

The basis of this market analysis is based upon the idea that the markets move in trends. They are used to show 3 things.

- The overall direction - up or down.

- The power of the ruling move - and

- Where future support and resistance will be likely located

If trend lines manifest in a specific orientation, the market has a strong tendency to maintain movement in that direction for an extended duration until such time as the line is decisively broken.

Plotting these on a chart portrays the general trend of the price which can either be upwards or downward.

Shown Below is an example of how to draw these on charts

Instructional Steps: Drawing and Executing Trades Following an Upward Market Move

Guide to Drawing and Trading Downward Moves from

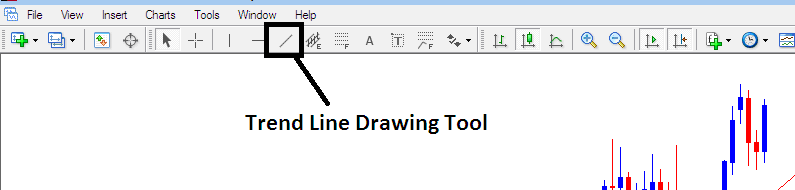

The MT4 software provides charting and trading tools for drawing these on charts. To draw them onto a chart, investors can use the tool provided on the MT4 that is shown below.

To draw on this on a chart just click the drawing tool above on the MetaTrader 4 technical analysis software & select point A where you want to start drawing and then point B where you as a trader want the it to touch. You also can right-click the trendline & on the properties option select the choice/option to extend its ray by ticking "ray tick box", if you do not want to extend it, then uncheck this option on your software. You also can change other properties such as color and width on this property pop up panel of the properties. You can download MT4 software & learn analysis with it.

"The trend is your friend" is a widely recognized axiom among investors, underscoring the importance of never counteracting established market direction. This approach represents the most dependable method for executing trades, as once prices commit to a specific trajectory, that movement can persist for a substantial duration, thereby creating profit-making opportunities when employing this technique.

Principles of How to Draw

Use candlestick charts

- The points which are used to draw are along the lows of the price candlesticks in a upward market. An upwards bullish move is defined by higher highs & higher lows.

- The levels used to draw are along the highs of the price candlesticks in a falling market. A downward bullish move is defined by lower highs and lower lows.

- The points used to draw are extremes points - the high or the low price. These extremes points are important because a close beyond the extreme tells investors the trend may be changing. This is an entry or an exit trade signal.

- The more often a trend line is hit but not broken, the more powerful its signal.

There are 2 main ways of trading this setup:

- Bounce

- The Break

Analysis Methods

A bounce is a signal that the price is about to keep moving the same way. Say the market's dropping - when the price hits resistance, it bounces lower and the downtrend continues. If it's climbing and hits support, it bounces upward and the uptrend rolls on.

The break is a reversal signal where the market goes through the line & starts heading and moving in the opposite market direction. When an up-trend is broken then the sentiment of the market reverses and becomes bearish and when a down trend is broken then the sentiment reverses & becomes bullish.

In strong trends, price consolidates after a break before reversing. In short trends, it may turn right away.

In trading, both bounces and breakouts on charts depend on these technical levels - support and resistance.

Entry, Exit and Setting stops:

This technique is utilized to identify favorable entry and exit points, with protective stops positioned just below these points. The bounce serves as a low-risk entry approach traders adopt to place trades after a price pullback. Trade setups occur at these levels, with a stop-loss order positioned just above or below.

The trend-line break is a crucial technical technical indicator of possible reversal. When a trend its broken price starts to move in the opposite market trend price trend direction. This provides an early exit signal for investors/traders to exit their open trade positions and take profits. When there is a penetration of these technical levels, it is a trade signal that price can start heading in the opposite market direction.

Unlike other technical analysis tools, there's no math involved: you just draw this pattern between two different spots on the chart.

Study More Guides and Topics:

- Drawing an upwards channel for XAUUSD in the MetaTrader 5 software.

- Gold MT4 App Review for Android Users

- The Dark Cloud Cover Bearish Candlestick Pattern

- Trading with the Linear Regression Acceleration Indicator

- Trading the Ascending Triangle Chart Pattern in Gold

- Fibonacci Levels on Gold Price Charts

- Steps to Set Up XAUUSD Quotes on MetaTrader 5

- Bollinger Band Technical XAU/USD Technical Indicator Analysis

- Divergence Gold Analysis in XAUUSD Trading

- What is Nano Lot Trading in Gold? Explanation for Nano Accounts