Best Automated Platform for Transacting

Best Automated Platform is a popular topic these days with traders looking at new techniques of trading where they can automate & trade their accounts mechanically using a program or what's oftenly referred to as a robot.

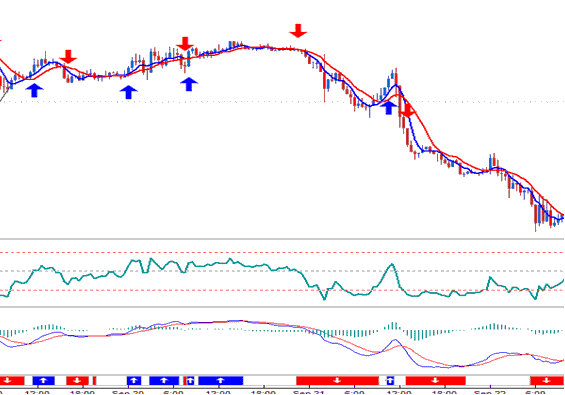

Automated trading platforms are programmed to profit from market fluctuations, which is why they are sometimes referred to as robots, capable of trading the markets in a mechanical manner.

XAUUSD EAs or Bots

Suppose you want to begin automated trading. Or you already trade automatically but seek ways to enhance it. What steps and methods can you apply to make it better.

Methods to improve automated Trading System.

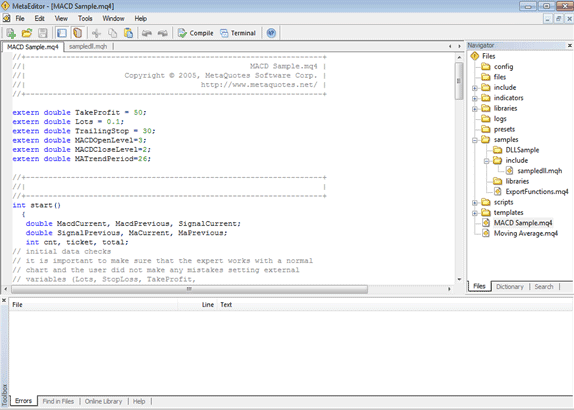

1.Learn MQ4 EA Robot Coding language or what is basically C++ coding language.

A good place to begin and start with is the MQL4 community where you can get several MQL4 guides or ask traders using these systems where you can get these guides to learn this coding/programming language.

You want to learn how to program these robots so that you can code one according to the trade regulations that you have established for your system. You will have a better perspective on how to convert a manual trading system into an automated platform.

For programming advice, always define the pseudo-code or logical structure of your system before transforming it into an automated solution.

Gaining a basic understanding of programming can significantly assist you as a trader. While it may not seem relevant now, once you start coding trading systems, it will become clearer. Without defining the pseudo code, as shown in the example above, you will struggle to develop an automated program, as you would not have clarified what functions you want the trading system to perform or how you intend to initiate the process.

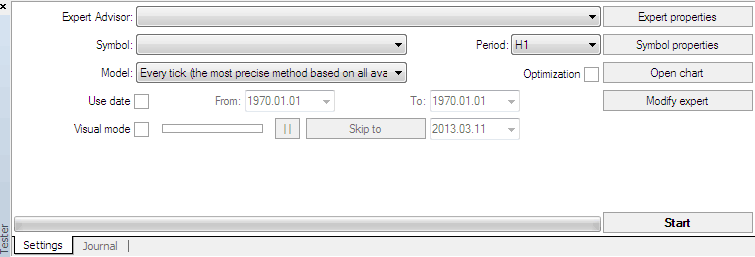

2. Learn what metrics the automated system requires

Automated trading platforms operate using algorithms designed to execute strategies without human involvement. These algorithms inherently represent the strategies they implement.

Traders using automated trade method will take a trading strategy, program that trading strategy to create an automated system, some traders using the popular MT4 platform, will often refer these programs as Automated Expert Advisor or Automated Expert Advisors, which are implemented using the popular MQL4 coding language, found within the MT4.

MetaTrader 4 software

A good example is MT4 bots with numerous optimization parameters. For beginners, failing to refine these parameters may result in an Expert Advisor (EA) system that performs below its potential profitability.

Therefore, it's crucial to understand which parameters to optimize and how to optimize these settings.

MetaTrader 4 Expert Advisor Robot Simulator Strategies Tester

3. Host your Expert Advisor automated trading strategies on VPS server

Another thing happening with these systems is VPS for EA hosting, which means using a virtual private server for automated EA robots, so they can trade from the server at all times instead of from your computer.

VPS - Virtual Private Server

The thing is, automated gold trading systems require a lot of testing to handle the market's changes and keep up with how it moves.

For Automated EAs you need to host it on a VPS server that can run your EA robots 24 hrs non-stop, all you've to do is to hire a VPS for about $20 - $50, then install a MT4 from your broker on this VPS server and then install you automated system in MT4 and log in to your account and activate the trading EAs to run continuously on the VPS host server.

Hosting on a Virtual Private Server (VPS) guarantees that external internet outages will not disrupt your trading bots, which require continuous market connectivity. Furthermore, running your Automated Expert Advisors (EAs) on a personal computer (PC) around the clock is impossible.

4. Get a reliable broker

While this point might seem inconsequential for enhancing your automated system, consider this scenario: A broker dealing in gold observes your profitable trade executions, especially when these transactions are managed by scripts associated with Expert Advisors. If this broker operates as a market maker (profiting from client losses), they possess superior market longevity and knowledge compared to you. Upon receiving a client with a successful automated system, the broker deploys their proprietary virtual dealer plugin, which is designed to outperform your automated strategy. This dealer plugin then institutes requotes when your automated system attempts to enter a trade, thereby confusing the EA robots. Furthermore, the virtual dealer might occasionally issue off-quotes for your XAUUSD trades or intentionally disconnect your platform for a period, forcing your trading software to re-establish a connection, at which time the generated signals become erratic and unpredictable.

So, find a good gold broker who won't mess with your automated systems when you use them for trading.

Get More Courses: