Best Ichimoku Setting for H4 Chart

How to Add Ichimoku Indicator in Meta Trader 4 Charts

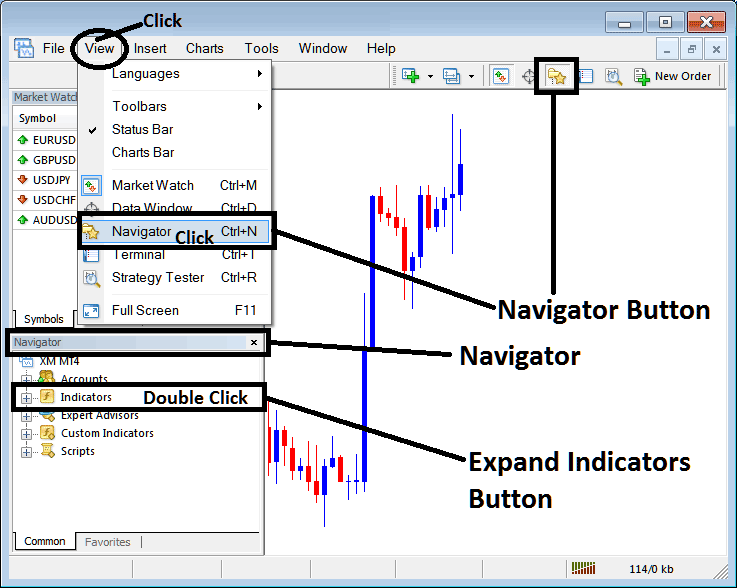

Step 1: Open Meta Trader 4 Platform Navigator Panel

Open MT4 Navigator window panel as displayed below - Navigate to "View" menu (then click it) and then choose the "Navigator" window (click), or From Standard Tool Bar click the "Navigator" button key or use keyboard shortcut keys "Ctrl+N"

On MetaTrader 4 Navigator window, select "Indicators", (DoubleClick)

Best Ichimoku Settings for 1 Hour Chart - Best Ichimoku Settings for 4 H Chart

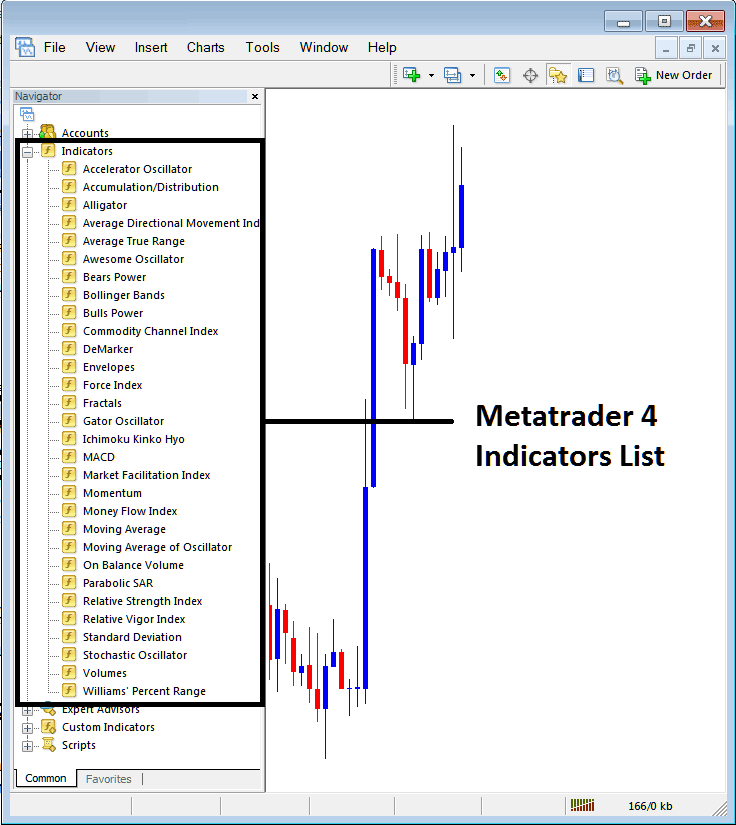

Step 2: Expand the Indicators Menu on the Navigator

Expand the menu by clicking expand button marked (+) or double click the "indicators" menu, after this the button will appear as (-) and will now display a list as shown below - select the Ichimoku indicator from this list of MetaTrader 4 indicators so as to add the Ichimoku indicator on the chart.

Best Ichimoku Settings for 1 Hour Chart - Best Ichimoku Settings for 4 H Chart

How to Add Custom Ichimoku Indicator in Meta Trader 4

If the Ichimoku technical indicator you want to add is a custom technical indicator - for example if the Ichimoku technical indicator you want to add is a custom Ichimoku technical indicator you'll need to first add this custom Ichimoku indicator in MetaTrader 4 platform & then compile custom Ichimoku indicator so that the newly added Ichimoku custom indicator pops up on the list of custom technical indicators in Meta Trader 4 platform.

To learn how to install Ichimoku indicator on MT4, how to add Ichimoku indicator window to MT4 and how to add Ichimoku custom MT4 indicator on MT4 - How to add a custom Ichimoku Indicator in MetaTrader 4.

Ichimoku Indicator Described

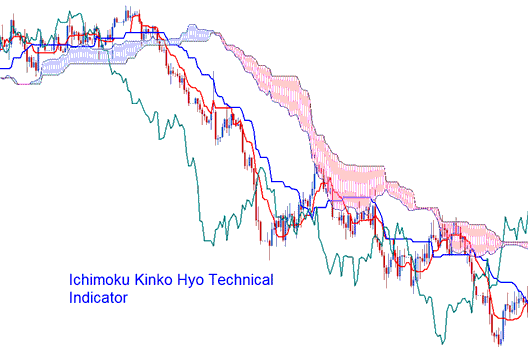

Ichimoku Technical Indicator

Ichimoku is a Japanese charting method

- Ichimoku means "a glance" or "one look"

- Kinko means "equilibrium" or "balance"

- Hyo is the Japanese term for "chart"

Thus, Ichimoku means, "a glance at an equilibrium chart". Ichimoku technical indicator attempts to spot the likely direction of price & help the trader to figure out the most suitable time to enter or exit the trading market.

Best Ichimoku Setting for Swing Trading - Best Ichimoku Setting for Scalping Trading

Calculation

Ichimoku technical indicator consists of five lines drawn using the midpoints of previous highs and lows. The five lines are calculated as follows:

1) Tenkan-Sen: Conversion Line: Red Line (Highest High + Lowest Low) / 2, for the last 9 price periods

2) Kijun Sen: Base Line: Blue Line (Highest High + Lowest Low) / 2, for the last 26 price periods

3) Chikou Span: Lagging Span: Green Line Today's closing price plotted 26 price periods behind

4) The Senkou Span A: Leading Span A = (Tenkan-Sen + Kijun Sen) / 2, drawn 26 price periods ahead

5) Senkou Span B: Leading Span B: (Highest High + the Lowest Low) / 2, for the past 52 price periods, plotted 26 price periods ahead

Kumo: Cloud: area between the Senkou Span A and B

Ichimoku Analysis & Generating XAUUSD Ichimoku Signals

Bullish trading signal - Tenkan-Sen crosses the Kijun-Sen from below.

Bearish signal - Tenkan - Sen crosses Kijun - Sen from above.

However, there are different areas of strength for the buy and sell xauusd trade signals generated.

Best Ichimoku Setting for Swing Trading - Best Ichimoku Setting for Scalping Trading

Bullish gold crossover signal occurs above the Kumo (clouds),

Very strong buy signal.

Bearish gold trading cross-over signal occurs below the Kumo (clouds),

Very strong sell signal.

If a bullish cross-over signal or bearish crossover signal takes place within the Kumo (clouds) it's considered a medium strength buy or sell signal.

A bullish crossover signal that occurs below the clouds is considered a weak buy signal while a bearish crossover signal that occurs above the clouds is considered a weak sell signal.

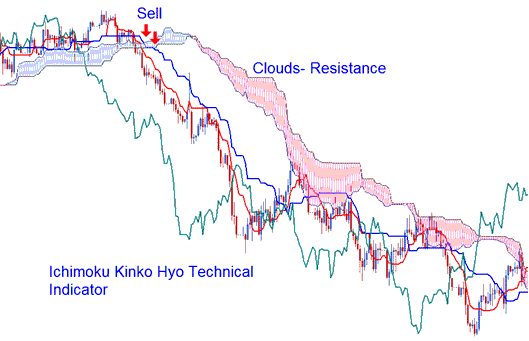

Support & Resistance Zones

Support and resistance levels can be predicted by the presence of Kumo (clouds). Kumo can also be used to identify the current price trend of the price.

- If price is above the Kumo, the prevailing price trend is said to be upwards price trend.

- If price is below the Kumo, the prevailing price trend is said to be downwards price trend.

The Chikou Span or Lagging Span is also used to determine the strength of the buy or sell signal.

- If the Chikou Span is below the closing price of the last 26 periods & a sell signal is given, then the strength of the price trend is down-wards, otherwise the signal is considered to be a weak sell signal.

- If there is a buy signal & the Chikou Span is above the price of the last 26 periods, then the strength of the price trend is to the upside buy signal, otherwise it is considered to be a weak buy signal.

Best Ichimoku Settings for 1 Hour Chart - Best Ichimoku Settings for 4 H Chart - Best Ichimoku Setting for Day Trading - Best Ichimoku Settings for Swing Trading - Best Ichimoku Setting for Scalping Trading