Analysis of Linear Weighted MA Technical Indicator

XAU/USD Trend Identification

Traders use the gold MA indicator to spot signals. It creates a buy signal when price crosses above the linear weighted moving average. A sell signal forms below it.

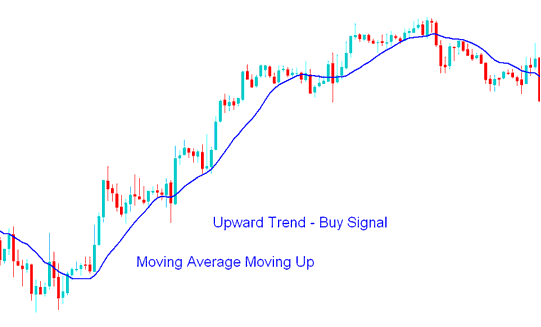

If the Linear Weighted Moving Average exhibits a distinct upward diagonal slope, it indicates that the prevailing overall market trend is ascending.

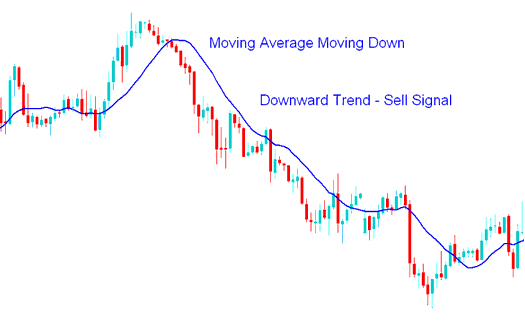

Conversely, if the Linear Weighted Moving Average exhibits a consistent downward slope, the prevailing and overall market trajectory is bearish.

LWMA Bullish XAUUSD Trend

When the Linear Weighted Moving Average goes up, it means the trend is going up, and the trading signal that comes from this is to buy xauusd gold.

As long as the price is above the MA indicator - then the market trend will remain as an upwards trend. The MA will act as a "support area" and price action should not close below the Linear Weighted Moving Average Indicator.

Buy Gold Signal

When the price crosses above the Linear Weighted MA and closes above the MA indicator - a buy signal gets generated.

XAU USD Traders who want to be sure before trading should wait for the Linear Weighted Moving Average to turn and start going up. It is always best to wait for confirmation to avoid a gold whipsaw fakeout.

Identification of the most effective Linear Weighted Moving Average settings suitable for analysis on a 1-hour chart, a 1-minute chart, a 15-minute chart, and specifically for Gold trading.

Bearish Trend

If Linear Weighted MA is moving down, then the trend is downwards and the trading signal derived and generated is a sell signal.

As long as price is below the Linear Weighted Moving Average then the trend will remain as downwards trend. The Linear Weighted Moving Average will act as a "resistance zone" and price action shouldn't close above the LWMA.

Sell Signal

A sell signal is officially generated at the moment the price crosses beneath the Linear Weighted Moving Average and confirms this by closing below that moving average.

Those that want to confirm the signal should wait until Linear Weighted MA line turns and starts to move in a downwards direction. This will minimize the chance of trading a xauusd fake out.

Best Linear Weighted Moving Average for 4 H Chart Gold - Best Linear Weighted Moving Average for 5 Min Chart - Best Linear Weighted Moving Average for Daily Chart Gold

Range Gold signals

Gold trading signals indicative of a ranging market can also be extracted by employing the Linear Weighted Moving Average (LWMA) Indicator.

LWMA Cross-over Method Strategy

The linear weighted moving average crossover stands out as another common signal method. Traders like it alongside the earlier approach. Simple moving average crossovers form the basis of many systems. This weighted version pairs well with other indicators for advanced setups.

The Optimal Linear Weighted Moving Average for the 1 Hour, 1 Minute, 15 Minute, 4 Hour, 5 Minute and Daily Chart in Gold

Get More Guides & Tutorials:

- What is the method for picking the XAUUSD style that fits different types of XAU USD traders?

- RSI Overbought and Oversold Levels Explained

- Gann HiLo Activator for Gold Analysis

- What is the Margin Call for XAU/USD in XAUUSD Trading?

- Gold Trading through Elliot Wave Theory

- Step-by-Step Guide on Opening a Real Gold Account (XAU/USD) and Account Registration?

- How do you add XAUUSD orders in MT4 charts?