Bollinger Band Gold Price Action in Trending Markets

The Bollinger Band indicator is employed to identify and analyze trending markets: in a trending market, this gold indicator distinctly indicates upward or downward directions.

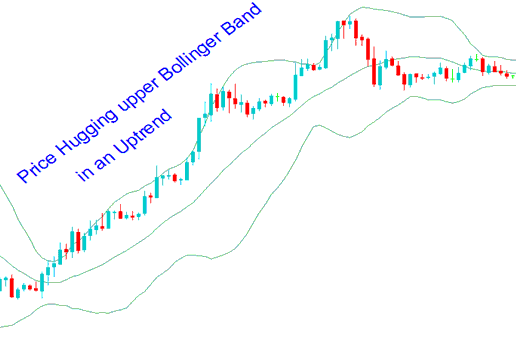

Bollinger Band technical indicator can be used to determine the direction of the XAUUSD trend. In an upward trend Bollinger Bands indicator will clearly show the direction of the price trend, it will be heading upwards & price will be above middle Bollinger.

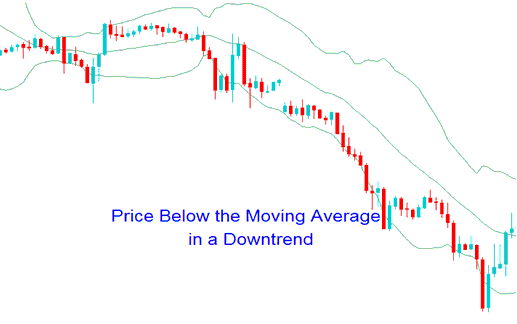

In a downward gold trend, the price will dip below the middle band, while the bands will direct downwards.

Watch Bollinger Bands patterns on gold to see the market's next move.

Bollinger Band Patterns and Continuation Signals

Upward Trend

- During an upswing, the candles will stay within the upper band the central moving average MA.

- Prices that close above the upper band are a sign of bullish continuation signal.

- Prices can hug/ride the upper band during an upwards gold trend

Upward Trend Trading Strategy Using Bollinger Bands Strategy

Downwards Trend

- During a downward swing, the candles will stay within the moving average MA and the lower band.

- Prices that close below the lower band are a sign of bearish continuation signal.

- Prices can hug/ride the lower band during an downwards gold trend

Down-wards Gold Trend Trading Strategy Using Bollinger Bands Strategy

Learn More Tutorials & Guides:

- Strategies for Trading in an Upward Trend

- How Do You Trade MT5 Downwards Trend-line in MetaTrader 5 Platform?

- Guide on How to Successfully Integrate Gold Expert Advisor (EA) Bots into MT4

- Common Question & Answers About XAU USD

- How do you place a new XAU/USD trade order on MetaTrader 5 for iPad?

- What Does Margin Level Mean in MetaTrader 5 Software?

- Methods for Displaying Multiple Trade Charts Concurrently within the MetaTrader 4 Trading Software.

- How Do You Place a XAU USD TakeProfit Order MT5 Platform Software?

- Indicator for Gold Trend Trigger Factors

- How do I set up Fibonacci Expansion numbers in the MT4 program or platform?