Dark Cloud Cover Bearish Candle Sticks Setup

Dark Cloud Cover Candle Pattern

The Dark Cloud Candlestick Pattern represents a trend opposite to that of the piercing candlestick pattern.

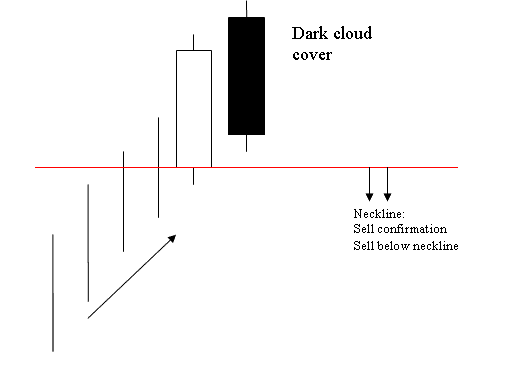

Dark cloud cover candle setup is a long white body followed by a long black body.

Black body pierces the mid-point of the prior white body.

The Dark Cloud Cover candle formation represents a bearish reversal pattern that takes shape near the peak of an uptrend.

The dark cloud cover candle formation is characterized by the market opening higher, followed by a close occurring below the midpoint of the preceding white candle's body.

The price trend is likely to reverse and move in a downward direction, according to the dark cloud cover candle arrangement, which indicates that the force of the up trend is declining/decreasing.

Dark cloud cover is a candlestick pattern. It acts as a roof blocking price rises.

Dark Cloud Candlestick Pattern - How to Trade Dark Cloud Cover Candles Setups - How to Interpret/Analyze Dark Cloud Cover Candles Setup

Technical Analysis Dark Cloud Cover Candlestick Pattern

A sell signal is confirmed when the price goes below the neckline, which is where the candlestick on the left of this Dark cloud cover pattern starts.

This is a bearish candle pattern. Price should keep falling. A trader entering a sell trade should set stop loss just above the highest price.

Study More Tutorials & Courses:

- 1H Candlestick Breakout XAU USD System

- Islamic Account for Gold Trading

- How to Use Bar and Tab Charts for XAUUSD in MT5

- Introduction to the XAU USD Price Action System

- How to Accurately Draw Trend-lines Directly onto Charts within the MT4 Program

- Beginner's Lesson: Getting Started with Gold Trading

- How do you start XAU/USD trading with a micro account?