Mapping Fibonacci Retracement Tiers for Ascending and Descending Trends

The price on a chart does not move upward or downwards in a straight line. Instead it moves up or down in a zigzag pattern. Fibonacci Retracement is the tool used to calculate where the zigzag will stop. The retracement levels are 38.2 %, 50 % and 61.8%. These form the points at which the price is likely to make a retracement.

What does retracement mean? It is when the price pulls back before the market continues its original trend/direction of movement.

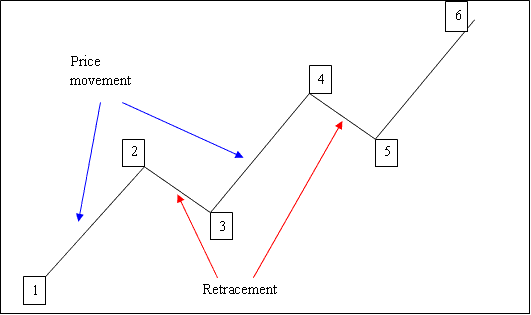

Zigzag Pattern Example: Price Moves Up in a Zigzag.

The diagram below shows movement in an upwards market.

1-2: Price moves up

2-3: Pull-back

3-4: Moves up

4-5: Pullback

5-6: Moves up

Given that we can pinpoint the initiation point of a retracement on a XAUUSD chart, the next logical question is determining its potential target level.

The answer is we use Fib retracement tool.

This is a specific line analysis applied in gold trading to forecast and determine those levels. This technical tool is directly applied on the chart within the platform provided by your broker, and it will automatically compute these technical figures on the trading display.

What are The Retracement Levels

- 23.6 %

- 38.2%

- 50.0 %

- 61.8%

The 38.2% and 50.0% levels are the most frequently observed targets for retracements, with the 38.2% level being the most popular and widely anticipated benchmark.

The 61.80% level is also frequently designated as the placement for stop orders in transactions initiated using this specific approach.

This tool will be drawn in line with the trend direction, as illustrated below.

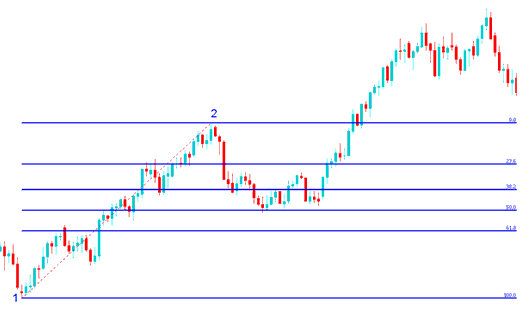

How to Draw on an Upward Bullish Market

In the diagram, price rises from point 1 to 2. After point 2, it pulls back to the 50% level. Then it resumes the upward move. The indicator draws from point 1 to 2 along the trend direction, which points up.

We spot this as a simple pull-back from our indicator-based strategy. So we place a buy order between the 38.2% and 50% levels. We set the stop loss right below the 61.8% pull-back line. In the trade example shown and explained below, a buy at this spot would net you plenty of pips.

Explanation for the Above XAUUSD Example

When the gold trade hit 50.0%, that area held prices up. Then the market went back to rising.

23.60% provides minimum support and is not an ideal place to open an order.

The 38.2% retracement level provided some temporary support, yet in this specific instance, the price continued to retreat up to the 50 percent zone.

The 50% level offers strong support, making it a good spot for a buy order here.

For this example, the retracement reached the 50.00% pull-back area, but most of the time the market will retrace up to 38.2 % and thenceforth most of the times traders set their buy limit orders at the 38.2 % level, while at the same time setting a stop just below 61.8%.

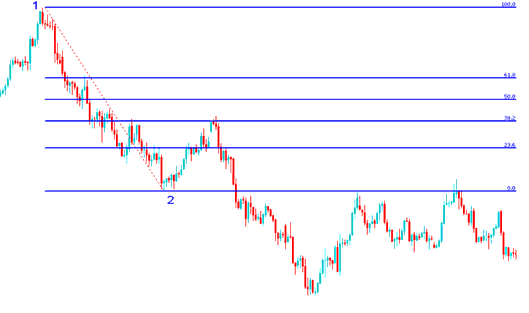

How to Draw on a Downward Bearish Market

In the diagram below the market is moving down between 1 & 2, then after 2 it retraces upto 38.20 % retracement then it continues moving downward in the initial downward trend. Notice that this technical indicator is drawn and plotted from point 1 to point 2 in the direction of the market trend (Downwards).

Because we're sure this is just a short-term move, we place a sell order at 38.20 % and a stop loss just above 61.80 %.

If you had placed a sell order at the 38.20% retracement level, as illustrated in the Gold trade example below, you would have secured a substantial number of pips subsequently. In that specific trade scenario, the market's retracement extended to the 38.2% mark but did not continue through to the 50.00% threshold. Based on accumulated experience, utilizing the 38.20% level is often prudent, as retracements frequently halt short of the 50.00% measurement.

Explanation for the Example Above

The preceding graphic depicts the ideal scenario where the market reverses its course immediately after touching the 38.20% Fibonacci Level.

This zone provided significant resistance for the retracement, making it an ideal point for investors to place a sell limit order, as the market promptly declined after reaching this level.

Study More Guides & Lessons: