XAUUSD Candle Patterns for Day Trading

Drawing Candlesticks on the MT4 Platform

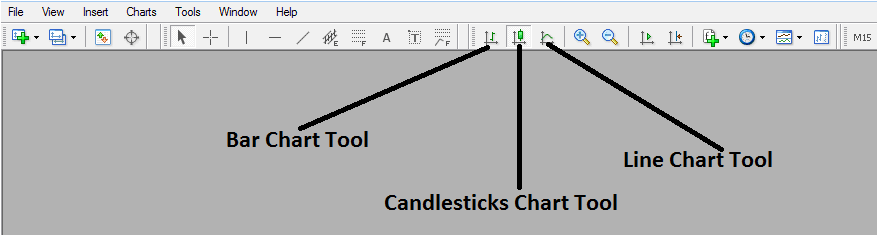

To put these candles on MT4, pick the chart tools from the "MT4 ToolBar," as shown in the picture below.

To find this toolbar in MT4, go to "View" next to the file option in the top left corner of the MT4 program, select "View," then select "Tool-Bars," and select the "Charts" button: the toolbar above will then show.

Once the above tool-bar, appears you can then choose & select the type you as a trader want to convert to, If you as a trader want to trade using the bar charts, click the bar tool button like illustrated above, for line charts press the line tool button, for Japanese candles patterns format setup click the "candlesticks chart tools button".

Candle Sticks Training Course

Doji Candles Tutorial

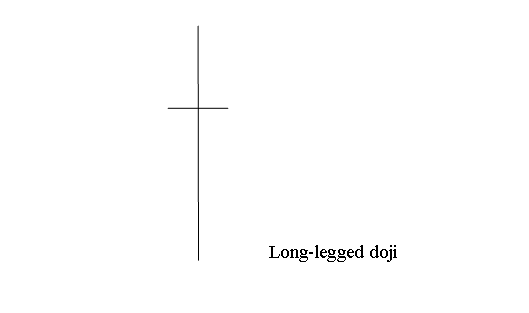

This is a pattern where the price at the start and end of the time period is the same. There are different kinds of these patterns on charts.

These drawings show various doji candle shapes.

The long-legged doji candle pattern is characterized by extended upper and lower shadows, with the opening and closing prices converging in the middle. When this pattern emerges on a chart, it reflects indecision among Gold traders, including both buyers and sellers.

Shown below is a sample screenshot of the Long Legged Doji candlestick setup for xauusd gold trading.

Doji Candle Pattern - Guide to Doji Candles.

Doji Candle Pattern - Guide to Doji Candles.

Marubozu Candles Tutorial

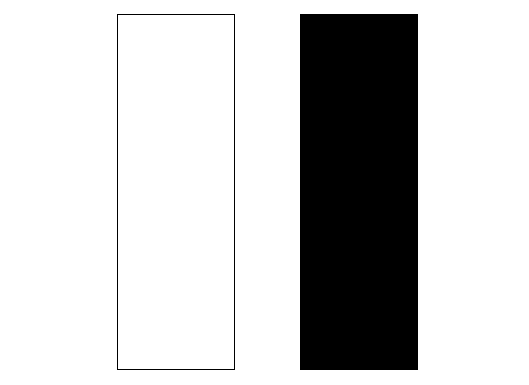

As illustrated beneath, Marubozu candlesticks are characterized by long bodies with absolutely no upper or lower wicks (shadows).

Marubozu Candle - Marubozu Candles Lesson Guide

Marubozu candlestick patterns are continuation patterns that suggest the price will keep moving in the same way as shown by the marubozu candlestick, and these patterns can be white/blue or black/red, based on where the trend is going.

Spinning Tops Candlesticks Tutorial

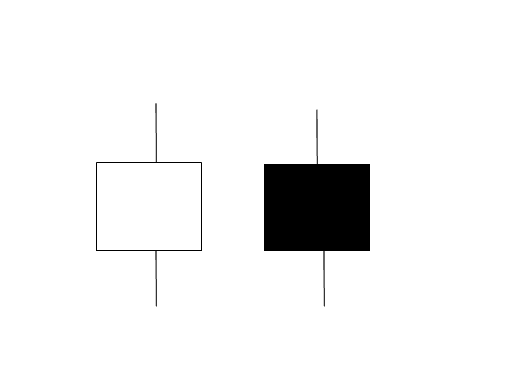

Spinning tops are candlestick formations characterized by small bodies and long shadows, earning their name due to their resemblance to a spinning top on a matchstick.

The upper & lower shadows of the spinning tops candlesticks setup are longer than the body. The examples illustrated below shows the spinning tops candle pattern. You can look for the pattern in your MT4 Platform charts. The examples shown illustrated below shows a screenshot to help the Gold traders when it comes to learning and understanding these candle pattern.

A Lesson Guide on Interpreting Candlestick Charts: Understanding Spinning Tops Formation

The color of the spinning tops candlestick setup holds little importance: this pattern universally illustrates market indecision between the buyers and the sellers (bears). When these formations appear at the apex of an uptrend or the nadir of a downtrend, it suggests the current trend may be concluding and a reversal to the opposite direction could be imminent. However, it is prudent to seek additional confirming signals that the market direction has indeed shifted before initiating a trade based solely on this candlestick formation.

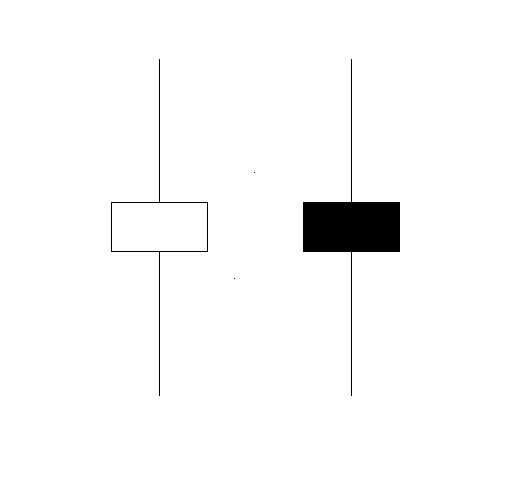

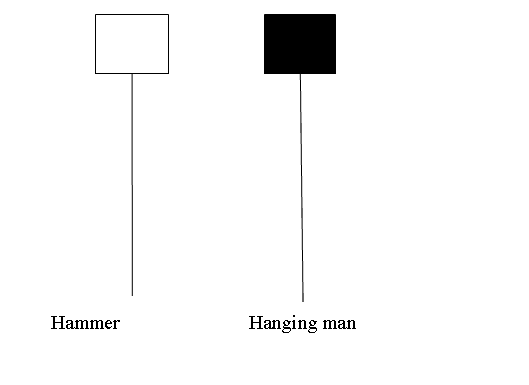

Hammer Candlestick Pattern & Hanging Man Candles Tutorial

The Hammer and Hanging Man candle patterns appear similar but have different meanings. The Hammer is a bullish price reversal pattern, while the Hanging Man signals a bearish price reversal.

Hammer Candlestick Pattern and Hanging Man Candlestick Pattern - Candlestick Chart Tutorial Guide

Hammer Candles Tutorial

The Hammer candlestick setup is recognized as a potentially bullish pattern forming during a preceding downtrend. It earns its name because the market appears to be forcefully testing or "hammering" a market bottom.

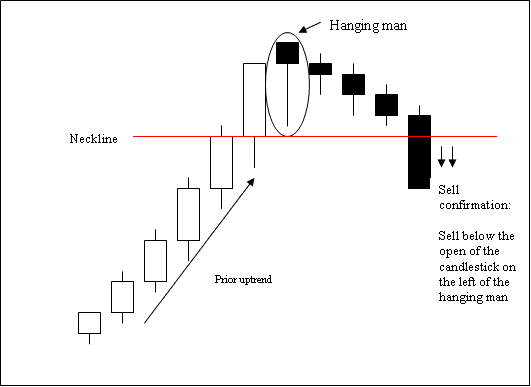

Hanging Man Candles Tutorial

This hanging man candlestick setup is a potentially bearish trading reversal signal which forms during a upward trend. It's named and called so because it looks like a man dangling on a noose up high.

Hanging Man Candle Pattern.

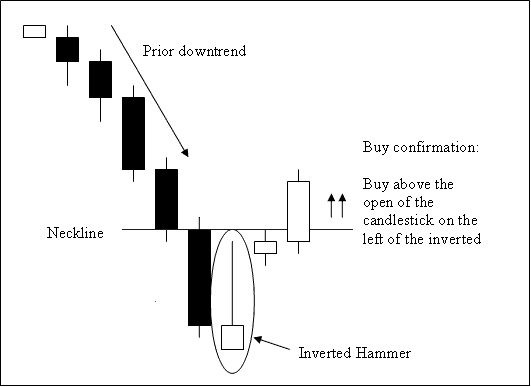

Inverted Hammer Candles Tutorial

This particular candlestick structure signals a potential upward price reversal and typically materializes at the trough of a preceding downtrend.

The Inverted Hammer candle appears at the end of a downtrend. It hints at a possible price reversal upward.

Inverted Hammer Candle Pattern - Candles Lesson Guide

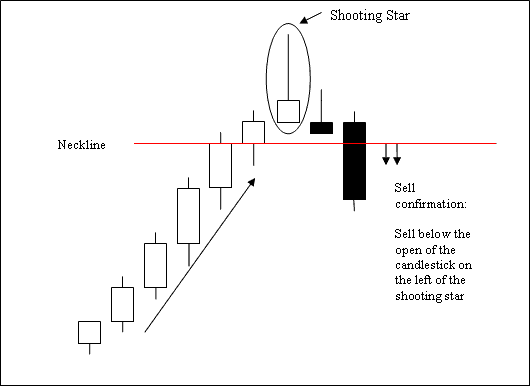

Shooting Star Candles Tutorial

Shooting Star Candle is a bearish price reversal candle pattern. It occurs at the top of a trend.

A Shooting Star candlestick pattern occurs at the peak of an uptrend. In this formation, the opening price matches the low, the price surges upwards but then falls back sharply to close near its opening level.

Shooting Star Candle - Candles Lesson Guide

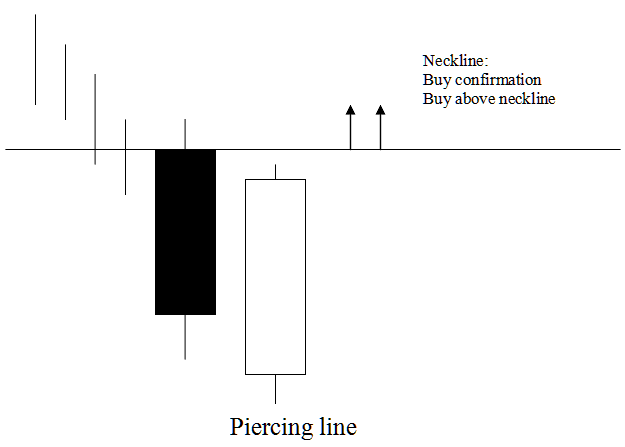

Piercing Line Candles Tutorial

The piercing line candle setup pattern consists of a long black body followed by a long white body candle.

The white body pierces the mid-point of the prior black body.

The Piercing Line is a bullish reversal pattern. It forms at the end of a downtrend. The market opens lower but closes above the black body's midpoint.

This Piercing Line candle pattern illustrates that the force of the down trend is reducing/decreasing & the price trend is likely to reverse & move in an upward direction.

The Piercing Line candle pattern indicates a market reversal, signaling that prices could be finding support while illustrating a potential bottom in a downward trend.

Piercing Line Candle Pattern - Candles Lesson Guide

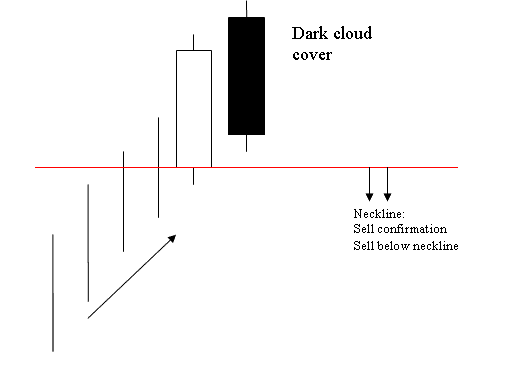

Dark Cloud Cover Candles Tutorial

Contrary to piercing candle candlestick.

This specific candle formation consists of an elongated white body immediately followed by an elongated dark body.

The dark bar passes through the middle of the previous light bar.

This pattern signifies a bearish price reversal and forms at the peak of an upward trend.

The Dark Cloud Cover candle pattern occurs when the market opens higher and closes below the midpoint of the white body.

The Dark Cloud Cover candlestick pattern suggests a weakening of the prevailing uptrend's strength, indicating a high likelihood that the price trend will reverse and move lower.

The Dark Cloud Cover candlestick pattern is also called a cloud cover, and it's seen as a ceiling for when the price is trending upwards.

Dark Cloud Candlestick Pattern

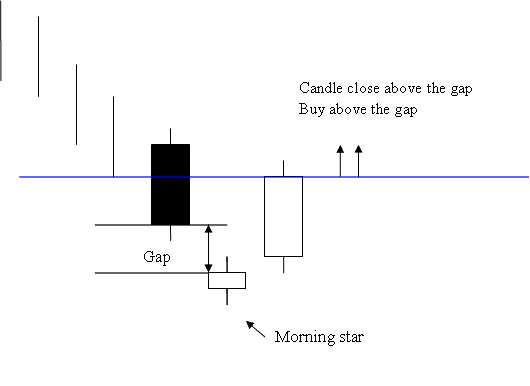

Morning Star Candles Tutorial

Morning star candlestick pattern - Candles Lesson Guide

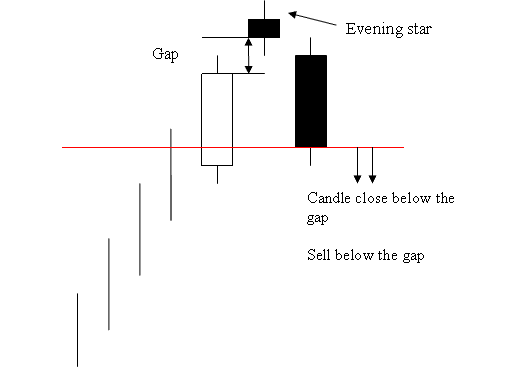

Evening Star Candles Tutorial

The inverse of the pattern known as the morning star. candle pattern

Image of Evening Star on a Chart - Candlesticks Guide - Candlestick Guide

Candle Sticks Tutorial

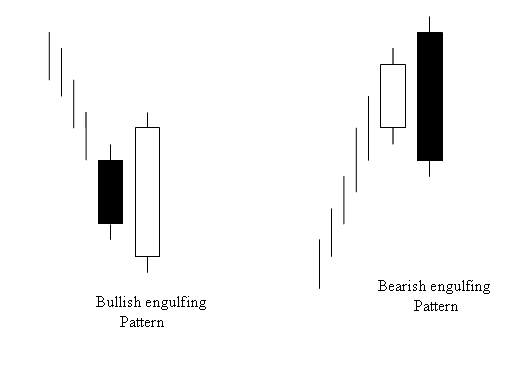

Engulfing forms a reversal candlestick pattern that can be either bullish or bearish, depending on whether it occurs at the conclusion of a downtrend or an uptrend in the market.

Bullish & Bearish Engulfing Candles Setups - Candles Lesson Guide

Instruction Manual for Drawing Candlesticks on the MT4 Platform - A Candlesticks Patterns Guide for Day Trading

Learn More Courses:

- Elliot Wave XAUUSD Theory

- Types of Candles & Their Definition Tutorial Course

- How Do I Read 100.0% XAU/USD Fibonacci Extension Level?

- XAU/USD Tips for Improving Gold Results

- How to Trade XAU USD Price Break Outs in XAUUSD Trading

- Applying XAU/USD Accumulation/Distribution Indicators in Trading

- Simple H4 XAUUSD Strategy

- Activate XAUUSD EAs in MetaTrader 4 Platform

- MT5 XAU USD Platform/Software Web Pages Guide

- Information on Different Versions of the Desktop MetaTrader Software Platform