Gold Candlesticks Signals

Gold Candle patterns manifest in various formations: you can learn these and apply them for trading and setup identification based on the candle pattern guide detailed hereafter:

The Accompanying Resources Detail How to Recognize These Specific Candlestick Formations and How to Trade Gold Utilizing Them.

Doji Gold Candles Signals

The Doji is a candlestick formation where the opening and closing prices are identical: several stylistic variations of the doji pattern can emerge on price charts.

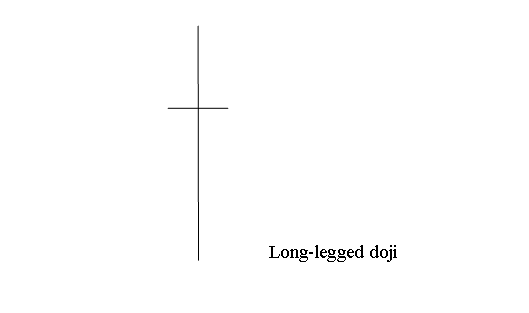

Visual representations below illustrate various configurations for the doji candlestick pattern:

The Long Legged Doji candlestick pattern is characterized by elongated upper and lower shadows, with its opening and closing prices situated near the center. When this pattern surfaces on a chart, it symbolizes a state of uncertainty between the gold traders, encompassing both buyers and sellers.

Below resides an illustrative screenshot capturing the formation of the Long Legged Doji candlestick pattern:

Doji Pattern - Doji XAUUSD Candles Signals

Doji Pattern - Doji Gold Candles Signals

Marubozu Candles Signals

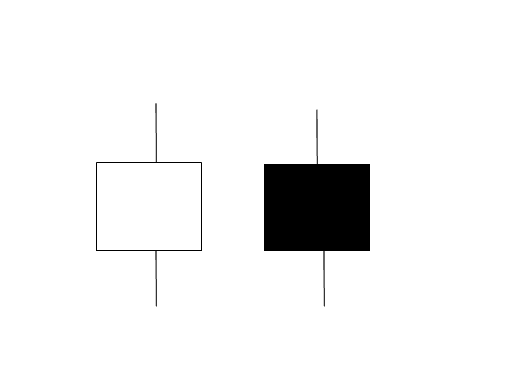

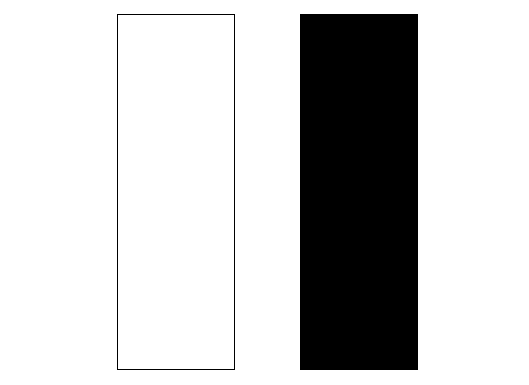

Marubozu candlesticks are characterized as elongated candles lacking any upper or lower shadows, as depicted and shown below.

Marubozu Candles - Marubozu Candles Signals

Marubozu candlesticks formations are continuation candle setups that show price is going to continue moving in the direction same as that indicated by the marubozu candlestick. The marubozu candlesticks pattern formation can be white/blue or black/red depending on the direction of the trend.

Spinning Tops Candlesticks Signals

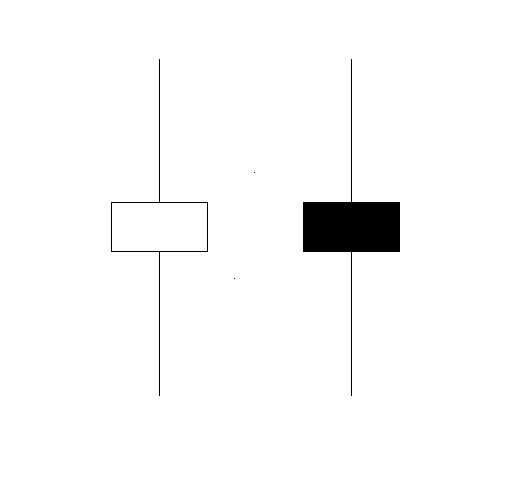

Spinning tops candlesticks pattern formation have small body with long upper and lower shadows. These spinning tops candle patterns are referred to by this term because these candles patterns are similar to a spinning top on a match-stick.

Spinning top candles have long upper and lower shadows compared to the body. The patterns below demonstrate this. Check XAU/USD charts in MetaTrader 4 to spot them. These screenshots aid gold traders in grasping the formation.

How to Interpret and Analyze Gold Candlestick Charts - Understanding Spinning Tops in Gold Candlestick Signals.

The specific color of a Spinning Tops candlestick pattern is generally less critical: what this pattern signifies is a state of equilibrium or indecision between the buying and selling forces within the Gold market. When these XAUUSD setups appear at the culmination of an uptrend or the trough of a downtrend, they can be indicative that the prevailing direction is nearing its conclusion and a reversal may soon occur, initiating a shift in the opposite direction. Nevertheless, it is prudent to seek supplementary confirmation signals indicating a definitive change in market direction before acting upon the trading signal derived from this candlestick formation.

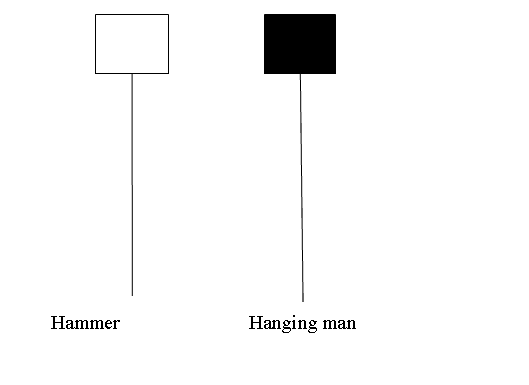

Utilizing Hammer and Hanging Man Candlesticks for XAUUSD Trading Signals

Hammer Candle Pattern and Hanging Man Candle Pattern candles look very similar, but the hammer is a sign of a price increase, while the hanging man is a sign of a price decrease.

Analysis of the Hammer Candlestick Pattern and the Hanging Man Candlestick Pattern - Signals derived from Candlesticks.

Hammer XAUUSD Candle-sticks Signals

Hammer candle formations are bullish patterns that typically emerge during downtrends. This pattern signifies that the market might be establishing a bottom, resembling the act of hammering one into place.

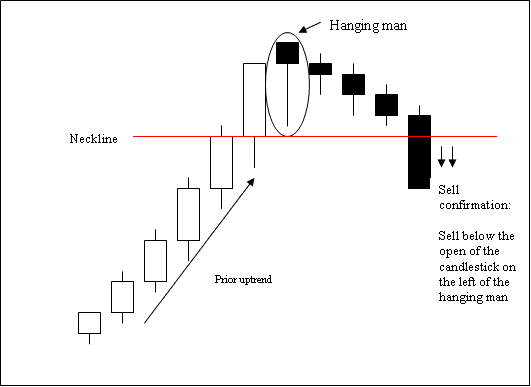

Hanging Man Candles Signals

The hanging man pattern is a bearish gold reversal signal that forms during an uptrend. Its appearance resembles a figure hanging high above from a noose, hence its ominous name.

Hanging Man Candle Pattern.

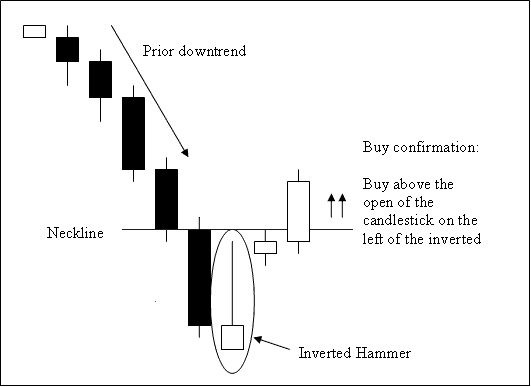

Inverted Hammer XAUUSD Candle-sticks Signals

This is a bullish price reversal candlesticks pattern formation. It occurs at the bottom of a trend.

Inverted hammer candles pattern forms at the bottom of a down gold trend and reflects possibility of reversal of the downwards trend.

Inverted Hammer Candle Pattern - Candlesticks Signals

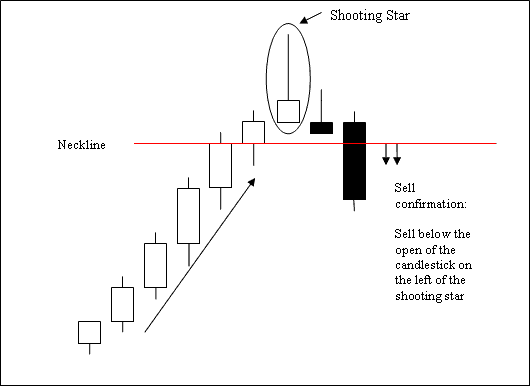

Shooting Star XAUUSD Candle-sticks Signals

The Shooting Star Candle pattern signifies a bearish reversal in price action. This formation characteristically manifests at the peak of an existing upward trend.

Shooting Star candles pattern formation form at the top of an upward trend in the market where the opening price is same as the low and price then rallied upwards but was forced & pushed back downwards to close near the open.

Shooting Star Candle-stick - Candles Signals

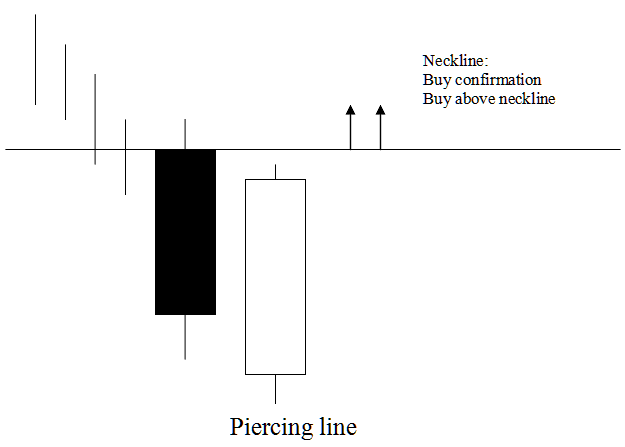

Piercing Line XAUUSD Candle-sticks Signals

Piercing line candle pattern is a long black body followed by long white body candle.

The white body cuts through the middle of the last black body.

The Piercing Line is a bullish reversal pattern at downtrend lows. It opens below the prior close but ends above the middle of that black candle.

The Piercing Line candlestick pattern indicates weakening bearish momentum in a downward XAU/USD trend, suggesting a possible upward reversal in price.

The formation of the Piercing Line candlestick pattern indicates that the market is piercing the lower boundary, signifying a potential market floor for a downward price trend.

Piercing Line XAUUSD Candlestick Pattern - Candlesticks Signals

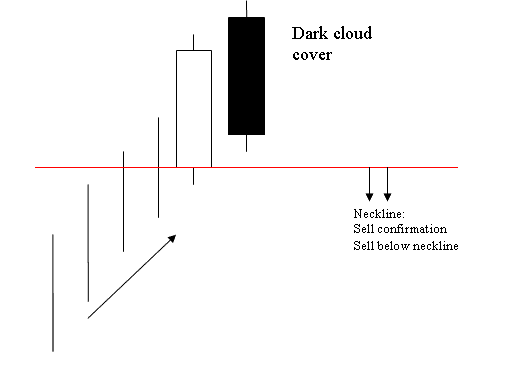

Dark Cloud Cover XAUUSD Candle-sticks Signals

Contrary to piercing candle candlestick.

This specific candle formation consists of an elongated white body immediately followed by an elongated dark body.

The dark bar passes through the middle of the previous light bar.

This configuration represents a bearish setup for a gold price reversal, typically forming at the apex of an uptrend.

The Dark Cloud candlestick pattern indicates that the market began higher and concluded below the midpoint of the preceding white candle's body.

The Dark Cloud candlestick formation indicates that the upward trend's momentum is weakening, signaling a potential downward reversal in gold price movement.

The Dark Cloud candlestick pattern manifests as a cloud formation, suggesting a ceiling that price is unlikely to surpass in its upward movement.

Dark Cloud Cover Candle Pattern,

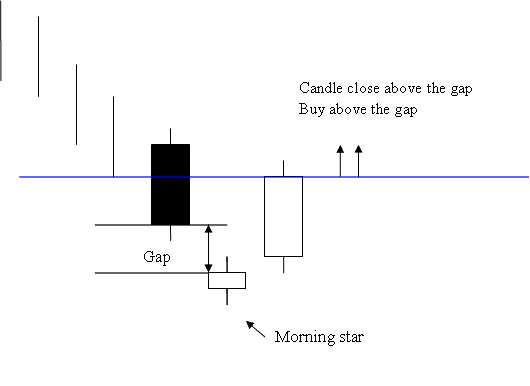

Morning Star Candles Signals

Morning star candlestick pattern - Candlesticks Signals

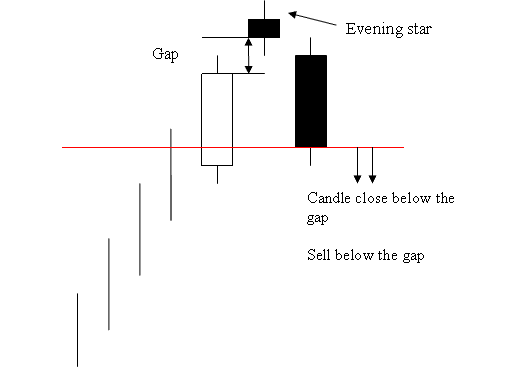

Evening Star Candles Signals

Opposite of morning star candles pattern formation

Image of Evening Star on a Chart - Candlesticks Signals

Gold Candles Signals

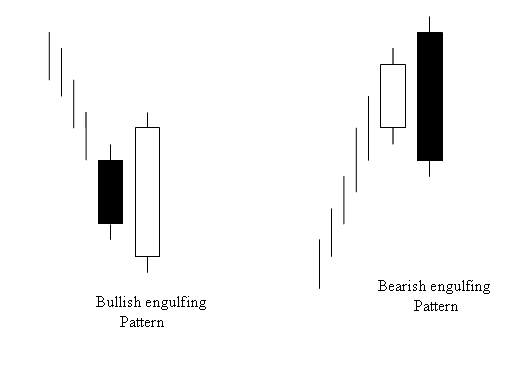

Engulfing is recognized as a candlestick pattern signaling a reversal, which can signal either bearish or bullish movement, contingent on whether it appears following a market decline in XAUUSD or at the culmination of an upward market trajectory.

Bullish and Bearish Engulfing Candlestick Patterns - Candlestick Signals

Interpreting Japanese Candlestick Patterns - Visual Illustrations of Gold Japanese Candlestick Patterns

Study additional tutorials and courses at.

- How Do I Trade XAUUSD Symbols in MT4 Platform Software?

- What are the Best Trade Times for Gold Trading?

- What's a XAUUSD Trend Reversal in Gold Trading?

- XAUUSD Equity Management Trading Methods Tutorial Lesson

- No Nonsense XAUUSD ADX Technical XAUUSD Indicator Guide Tutorial

- XAUUSD Take-Profit Order Setting on Mobile Trade App

- Steps to Load a MetaTrader 5 Chart Template in MT5

- Technical Analysis Darvas Box Indicator Buy Trade Signal

- Understanding How to Use MetaTrader 4 App on iPhone

- Implementing a XAU USD Sell Limit Order Through the MT4 Software Interface