How Do You Trade Inverse Head and Shoulders Pattern?

How to Trade the Inverse Head & Shoulders Pattern

Inverse Head & shoulders Trading Pattern

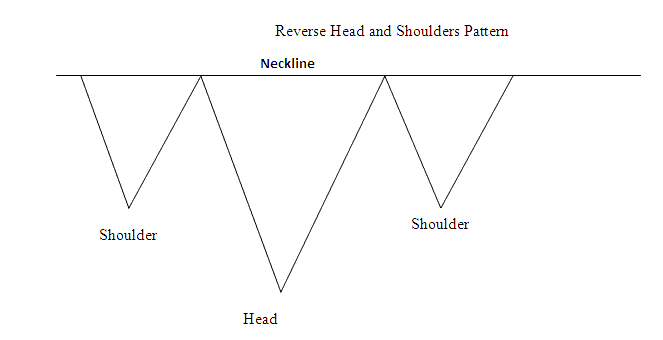

Inverse Head and Shoulders is a reversal pattern. It forms after a long downtrend. It looks like an upside-down head and shoulders.

The Inverse Head and Shoulders pattern ends when price breaks above the neckline. Draw the neckline by connecting the two peaks in the pattern.

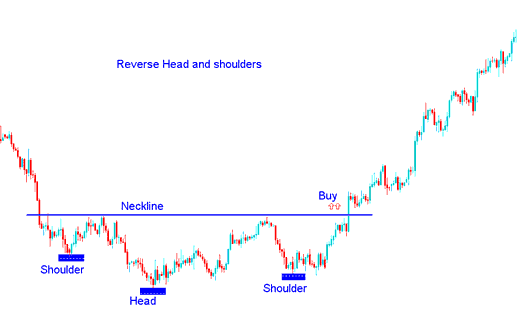

To open a buy trade buyers place their buy stop gold trade orders just above neckline.

Summary:

- Inverse Head and Shoulders Chart pattern setup formation forms after an extended move downward

- Inverse Head & Shoulders Pattern shows that there will be a reversal in the market

- Inverse Head & Shoulders Pattern setup formation resembles and looks like up side down, thus its name Inverse Head & Shoulders Pattern.

- We buy when price breaks-out above neck-line: as elaborated on the example illustration revealed and described below.

Trading the Inverse Head and Shoulders Pattern? - Analysis Techniques for Reverse Head & Shoulders Formations

Example of Inverse Head & Shoulders Pattern on Trading Chart

How to Trade Using the Inverse Head & Shoulders Pattern - How to Read/Understand Inverse Head and Shoulders Patterns

Get More Tutorials & Topics:

- How do you add XAUUSD orders in MT4 charts?

- Where can beginners study gold trading online?

- How Do You Understand the MT5 Fibonacci Expansions Tool on MetaTrader 5?

- Spotting a Trend Reversal in XAUUSD Trading

- Gold Broker Gold Account

- How Do You Use Fibonacci Expansion Points on MetaTrader 4 Software?

- Free Examples of Gold Indicators Here

- A Detailed Look at Gold Leverage and Margin Concepts with Illustrations

- How do you draw a downward trendline in MetaTrader 4?

- Is Trading XAUUSD Possible with $5?