Shooting Star Candlestick Pattern

Inverted Hammer Bullish Candle Patterns

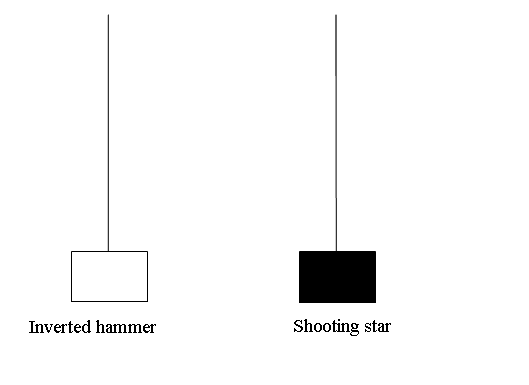

Inverted Hammer Candlestick Pattern and Shooting Star Candlestick Pattern candles look alike and similar. These candlesticks have a long upper shadow and a short body at the bottom. Their colour doesn't matter. What matters is the point at where these candle-sticks appear whether at the top of a trend (star) or the bottom of a trend (hammer).

The difference is that inverted hammer candle is a bullish price reversal trade pattern while shooting star candle is a bearish price reversal trade pattern.

Upwards Trend Reversal - Shooting Star Candles

Downward Trend Reversal - Inverted Hammer Candlesticks

Analysis of the Inverted Hammer and Shooting Star Candlestick Formations within Chart Patterns.

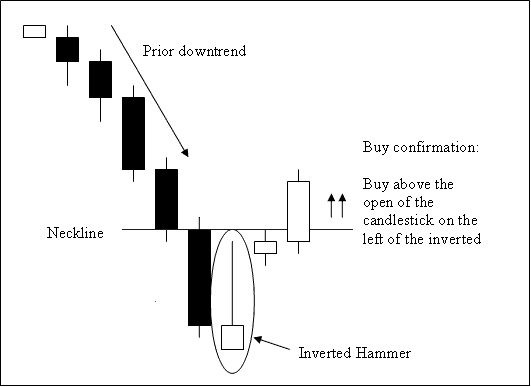

Inverted Hammer Candle

This is a bullish market reversal candle pattern. It occurs at the bottom of a trend.

Inverted hammer candle occurs at the bottom of a down trend & reflects possibility of a market price reversal of the downwards trend.

Inverted Hammer Candle

Analysis of the Inverted Hammer Candlestick

A buy signal triggers when a candle closes above the neckline. This line is the left candlestick's open in the pattern and forms resistance.

Stop orders intended for buy trades should be positioned a few pips beneath the lowest price recorded in the most proximate low point.

An inverted hammer candlestick gets its name from signaling a market bottom. It looks like a hammer turning upside down.

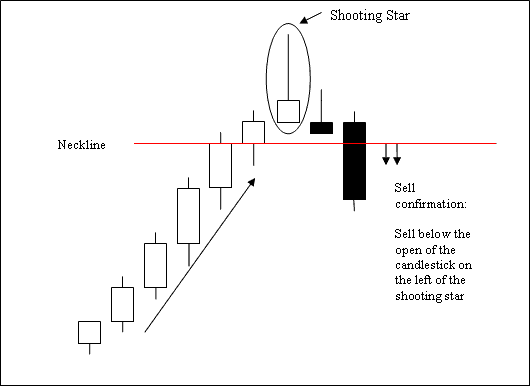

Shooting Star Candlestick

This is a bearish price reversal candlestick pattern. It forms at the top of a trend.

It happens when prices are rising, and the starting price is the same as the lowest price. Then, the price went up but was forced back down to finish near the starting price.

Shooting Star Candle

Technical Analysis of the Shooting Star Candlestick

A sell signal appears when a candlestick closes under the neckline, which is the support line on the left of this pattern.

Stop orders for sell trades should be placed a few pips above the highest price of the latest market peak.

The candlestick called a Shooting Star has that name because at the peak of an upward trend it looks like a shooting star in the night sky.

Obtain Further Instructional Material & Programs:

- Upwards Gold Trendline Bounce Example & Downwards XAUUSD Trendline Bounce Example

- Logging into an XAU/USD Account in MT5

- How to Draw Downward XAUUSD Trendlines in Gold Charts

- Types of Engulfing Gold Candlestick Indicator Patterns

- Best XAU USD Indicators Combination & Best XAU USD Indicators Guide

- How to Set Standard Deviation on Gold Chart

- Starting to trade gold with MT4 brokers and learning about gold trading platforms.

- Setting Up the Ichimoku Indicator on Gold MT5 Chart

- How Do I Setup MT4 XAUUSD Platform/Software Lesson Guide Guide Guide?

- MT5 Calculator for XAU USD Margin Level