MACD Classic Bullish & Bearish Divergence Trade Setup

The MACD Classic divergence pattern can act as a possible signal that a trend might change direction. MACD classic divergence is used to find areas where the gold trading price might reverse and head in the opposite direction. Therefore, the MACD classic divergence setup is used as a low-risk way to enter and accurately exit a trade.

1. This approach carries minimal risk for initiating a short sale near market peaks or entering a long position close to market troughs, resulting in comparatively small potential losses relative to the possible gains on the trade.

2. This tool serves to forecast the optimal zone for concluding a positioned trade.

There are two different types of Classic Divergence:

- XAU/USD Classic Bullish Divergence

- XAU/USD Classic Bearish Divergence

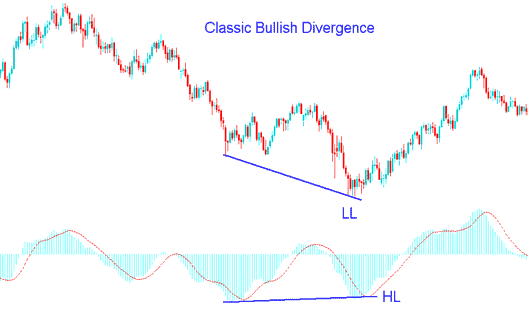

XAU/USD Classic Bullish Divergence in XAU USD Trading

Classic bullish divergence in gold appears when price forms lower lows, but the oscillator builds higher lows.

MACD Classic Bullish Divergence in Gold - MACD Divergence Strategy

Classic bullish divergence in gold trading warns of a possible change in the trend from downwards to upwards. This is because even though price headed & moved lower the volume of the sellers(bears) who moved price lower was less as shown by the MACD. This demonstrates underlying weakness of the down-ward trend.

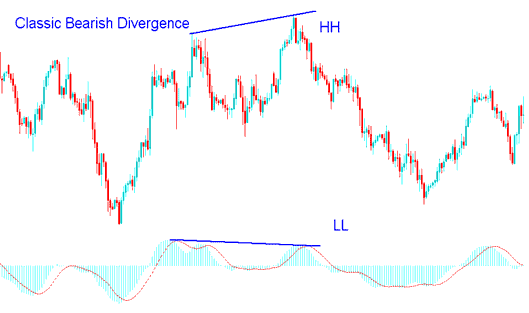

Classic bearish divergence in XAU USD Trading

A typical bearish divergence in gold trading happens when the price shows a higher high (HH), but the oscillator tool shows a lower high (LH).

MACD Classic Bearish Divergence in Gold - A strategy focused on MACD divergence.

Classic bearish divergence gives you a heads-up that the trend might flip from up to down. Even if the price keeps rising, if the buying volume (like what the MACD shows) is shrinking, that's a sign the uptrend is getting weaker.

Study Additional Lessons and Classes:

- How Can I Login in to MT4 XAU/USD Account?

- Analyzing Fibonacci Extensions with the MT4 Indicator

- How to Analyze/Interpret XAU/USD Strategy Training Tutorial Course

- XAU USD Platform/Software MT4 Toolbars

- XAUUSD in MT5 Platform Download Chart Templates

- How to Transform Your Gold Psychology & Mindset When Gold

- How Much is 1 XAU USD Micro Lot in XAU USD Trading?

- XAU/USD Sign Up for a Real Account: XAU/USD Real Account Sign Up

- How Can I Trade New Gold Order on Gold MT5 iPad App?

- Techniques for Trading XAUUSD Price Action within Active XAUUSD Trading Positions