MACD Crossover Signals

MACD centerline crossovers create trading signals right off the center line. When the MACD crosses above the centerline, it shows bullish market sentiment. When it crosses below, that's a bearish signal. Traders use these crossovers to confirm the overall mood of the market.

- When the Fast Line crosses below MACD Line (not center mark) it shows market momentum is slowing - this is not a reversal setup or a sell trading signal, wait for the center line crossover.

- When Fast-line crosses above the MACD Line (not center mark) it shows the market momentum is slowing - this isn't a reversal setup or a buy signal, wait for the center line crossover.

- The Center-Line cross-over trading signals will be the best signals for confirming buy & sell signals.

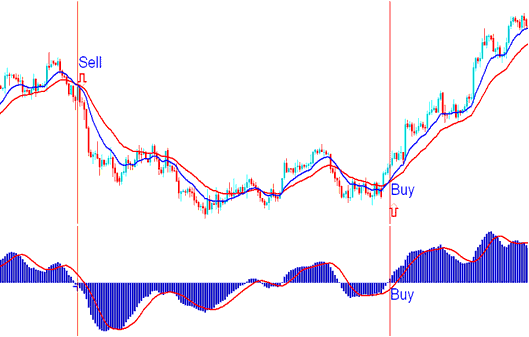

In the chart example below, when the MACD fast line crossed below the zero center mark, a sell signal was confirmed, signaling a shift in market sentiment towards a bearish or downward trend.

Furthermore, in the trading illustration detailed and explained below, a buy signal was generated and market sentiment shifted bullishly (upward trend) when the faster MACD line subsequently crossed above the zero baseline.

MACD Zero-Line Cross over - Precisely When a Sell Signal & Buy Signal are Generated

Oscillation of MACD Indicator

MACD swings up and down around a zero line. That line marks neutral. Above zero means bullish trends. Below means bearish ones.

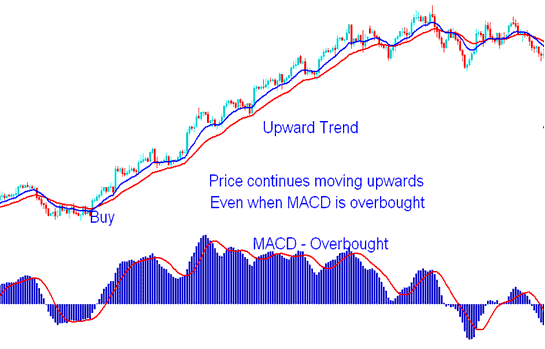

The MACD indicator also shows when something is over-bought or over-sold. When the MACD gets too high or low, gold is then overbought or oversold. But, when prices are strongly going up, they will stay over-bought, so it's better to buy.

Furthermore, in a robust downtrend market, adopting a selling approach is preferable, as the price may remain in the oversold territory for an extended period.

Conditions indicating overbuying are evident when the reading is far above the zero level, conversely, oversold appears well beneath the zero mark.

MACD Overbought Region - Trend Continuation Signal

Learn More Lessons and Courses:

- Strategies for Breakouts on Gold Trend Lines

- Configuration of Grid, Volume, Auto Scroll, and Chart Shift Features in MetaTrader 4 Software

- How to Trade XAUUSD: What New XAU USD Traders Need to Know

- What's an XAU/USD Margin Call?

- How to Set Up MT4 Demo Practice Account and How to Use MetaTrader 4 Practice Demo Account

- Locating the List of Gold Indicators within the Trading Charts Menu on the MetaTrader 5 Interface?

- A Guide to Trading Against a Downward Trend-line within the MT4 Interface

- Adding the Accelerator Oscillator Indicator to a Chart Using MT4 Software