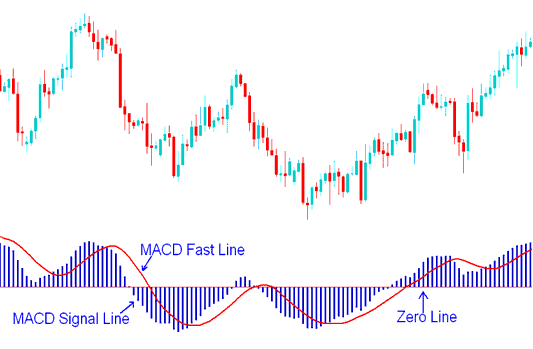

MACD Oscillator: Fast Line and Signal Line Analysis

MACD indicator is used in various ways to give trading analysis data.

- MACD center line crosses show bullish or bearish markets: below the zero is bearish, above zero is bullish.

- MACD Cross-overs indicate a buy or sell xauusd trade signal.

- Oscillations can be used to indicate oversold and overbought regions

- Used to look for divergence between gold price & indicator.

Construction of MACD

The MACD tool is made using two moving averages that change over time, and this tool for gold shows 2 lines. The two moving averages that are used first are 12 and 26. Also, a number of 9 is used to smooth things out when drawing the MACD tool.

How the MACD Indicator Gets Drawn: A Quick Summary

MACD uses 2 EMAs + a way to smooth things out (12, 26 Exponential MAs & 9 smoothing times)

The MACD technical indicator graphically represents only two distinct lines: the faster MACD line and the slower MACD signal line.

MACD lines include the fast line and signal line for trading cues.

- The FastLine is the difference between the 26 Exponential Moving Average & 12 EMA

- The Signal-line is the 9 period moving average MA of MACD fast line.

Implementation of MACD Indicator

MACD indicator implements the MACD line as a continuous line while the signal-line is implemented as a histogram. These two MACD LINES are then used to generate xauusd signals using the crossover strategy method.

There is also the MACD middle line, also called the zero point, which is a balanced spot where buyers and sellers are trading in the market.

Values above the center mark are considered bullish signals while those below are bearish gold trade signals.

The MACD indicator, functioning as an oscillator trading indicator, fluctuates above and below the center line.

Find More Subjects & Instructions:

- Best Platforms for XAU/USD Trading Online

- Linear Regression Gold Indicator

- XAUUSD in MT5 Platform Download Chart Templates

- Which is the Best XAUUSD Leverage for $500 Gold?

- Method of How to Save a Work Space or Trade Strategy on XAUUSD Platform

- Guidelines for trading the Fibo pullback indicator on MetaTrader 5.

- XAU/USD Demo Trading Account MT5 Free XAU USD Account

- Learn XAU USD Lessons

- Trading Strategies for XAU USD on a 5-Minute Chart

- How Can I Read MT5 App and Download MetaTrader 5 App?