MACD Fakeouts in Gold Bull and Bear Zones

Given that the MACD technical indicator is considered leading and can occasionally produce misleading false signals (whipsaws), we will review an instance of a trading whipsaw generated by this MACD indicator. This illustration will underscore the importance of awaiting a confirming signal before acting.

MACD Whipsaw - Gold Whipsaws

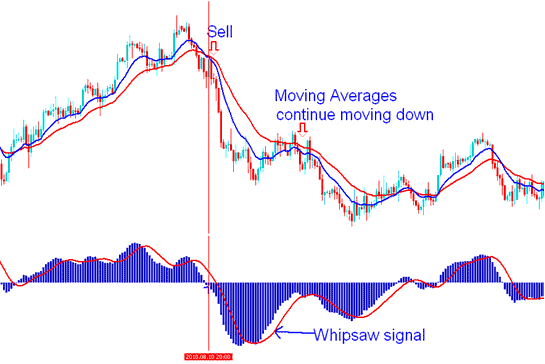

The MACD indicator told people to buy, but this buy signal happened when the MACD indicator line was still under the zero center-line mark. Because of this, the buy signal was not proven to be correct, and it caused a trading whipsaw, like the MAs that kept going down.

A spurious breakout signal in gold trading stems from a rapid, sharp surge or decline in price movement occurring within a brief period, in a manner that distorts the input data used for calculating the moving averages integral to the MACD visualization. These deceptive, volatile movements - often termed whipsaw fakeouts - are typically triggered by market instability introduced by specific news events.

Traders should be prepared to assess a trading whipsaw and endure its fluctuations. A whipsaw may lead to alternating upswing and downswing sessions. To mitigate the risk of false signals, it's advisable to wait for confirmation through the MACD crossing above or below the zero center-line.

Avoiding Whipsaws Through the Combined Use of MACD Crossover and Center Line Crossover Techniques

Buy signal - A buy signal is confirmed when there is a cross-over, followed by a steep rise in price, and then a center-line cross over.

Sell trading signal - Confirmation for a sell signal is established following a crossover, succeeded by a sharp downward price movement, and subsequently confirmed by a crossover of the center line.

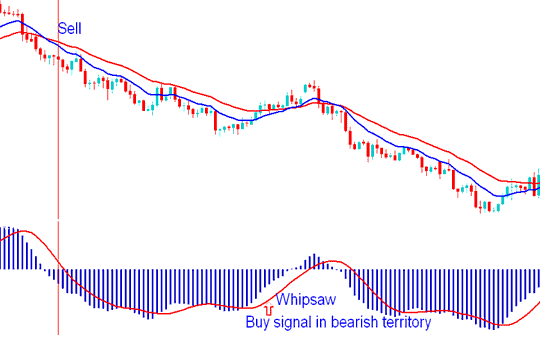

1. Buy Trading Signal in Bearish Territory Region Whipsaw

In a negative market, a purchase signal may lead to a gold whipsaw, particularly if it is not immediately followed by a MACD centerline crossover.

In the trading example shown and described below, MACD indicator generates a buy signal even though it's in bearish territory, the MACD indicator then turns downwards & starts moving down again resulting into a gold whipsaw. By waiting for center-line cross over it's possible to avoid the whipsaw.

However, in this instance there was a brief center-line crossing: this trading whipsaw would have been hard and difficult to trade using this MACD indicator alone, that is why it's good to combine the use of MACD indicator with another indicator. In the example illustrated and explained below MACD is combined with the moving average indicators analysis.

MACD Gold Whipsaw - Buy Signal in Bearish Territory

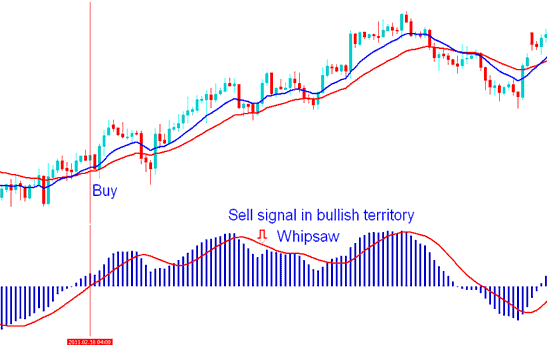

2. Sell Trading Signal in Bullish Territory Region Whipsaw

A sell signal in an uptrend for gold can cause a fake out. Watch for a MACD centerline cross to confirm.

In the example shown & described below, MACD indicator generates a sell trading signal even though it's in bullish territory, the MACD indicator then turns up and starts moving upwards again resulting into a whipsaw. By waiting for center line cross-over it's possible to avoid the trading whipsaw. In the example shown and explained below by combining this MACD indicator with the Moving Average Cross over Strategy you'd have avoided this whipsaw.

MACD Gold Whipsaw - Sell Signal in Bullish Territory

To avoid gold whipsaws completely when trading the market with this MACD it's best to use the Center-Line Crossover Signal as the Official Buy or Sell Signal of MACD Indicator.

Get More Topics and Tutorials:

- Indicator Trading System Based on RSI for XAU/USD

- How Can I Use Gold Sell Limit Order on MT5 Platform Software?

- 5 Min XAUUSD Chart Strategies

- How to Add Stochastic Oscillator Gold Indicator in Chart in MetaTrader 4 Platform

- OBV Breakout – XAU/USD System Indicator Explained

- How Do I Set a Gold Sell Stop Trading Order on MetaTrader 4 Platform?