McClellan Oscillator: Signals Explained

Developed & Created by McClellan.

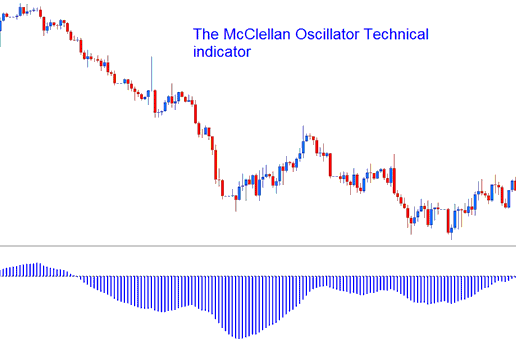

The McClellan Oscillator smooths the gap between bullish and bearish candles. It works much like the standard MACD indicator.

McClellan Oscillator

XAU/USD Analysis and How to Generate Trading Signals

This Oscillator is a momentum indicator which can be transacted in the same way as the MACD indicator. There are 3 methods that McClellan Oscillator indicator can be used to generate trading signals.

Zero Center Line Cross over Signals:

Bullish Signals- When oscillator crosses above zero centerline a buy signal is given.

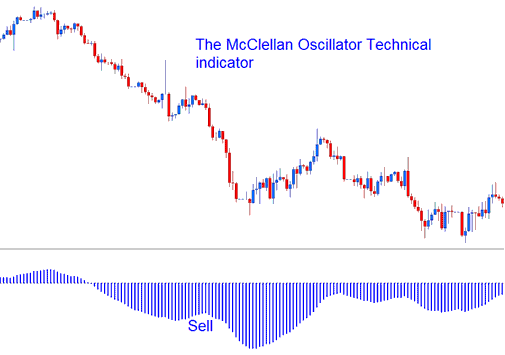

Bearish Signals- When the oscillator crosses below zero center line a sell signal is generated.

Technical Analysis in XAU/USD Trading

Divergence Trade Setup Signals:

Looking for divergences between the McClellan Oscillator and price can prove to be very effective in spotting potential reversal and/or trend continuation points in price movement.

There are different types of divergences:

Classic Trade Divergence ( Regular Trade Divergence )

- Bullish Divergence: Lower lows in price action & higher lows in the McClellan Oscillator.

- Bearish Divergence: Higher highs in price & lower highs in the McClellan Oscillator.

Hidden Divergence Trading Setup

- Bullish Divergence: Higher lows in price action & lower lows in McClellan Oscillator.

- Bearish Divergence: Lower highs in price action and higher highs in McClellan Oscillator.

Overbought/Oversold Levels on Indicator

The McClellan Oscillator is also used to identify the potential over-bought and oversold levels in price action movements. The over-bought and oversold conditions are generated/derived when oscillator moves to extreme levels on one side and starts to turn, however, in a strong trending market the oscillator will stay in the over-bought and oversold levels for a long time. It's not recommended to trade over-bought & oversold levels to generate trade signals. Best signal to use is the Center Line cross over signals to generate signals.

Get More Tutorials:

- Best RSI Settings for 5-Minute XAU USD Charts

- How do you trade the SMI buy signal in forex?

- An Introduction to Gold Trading

- Shifting Your Psychological Mindset to Achieve Improved XAUUSD Trading Outcomes

- How do you trade with the Bollinger Band indicator?

- Tips and Methods for Enhancing One's Gold Trading Psychology

- Gold Indicators List on Gold Charts Menu on MT4 Software

- Engaging with XAUUSD Patterns for Effective Analysis

- Short-Term & Long-Term XAU/USD with Moving Averages

- The McClellan Oscillator Indicator as a Technical Tool for Generating Buy Trading Signals