Ehler MESA Adaptive Moving Average Analysis - Ehlers MESA Trading Signals

Mesa Adaptive Moving Averages was developed by John Ehler

Originally used to trade commodities and stocks.

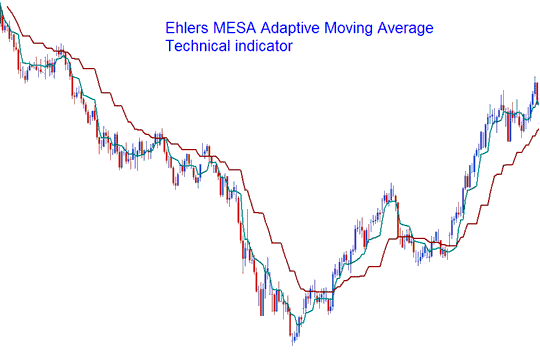

The MESA Adaptive average looks like two moving averages. The difference is that the MESA moves in steps and not in a curved line like the MA(Moving Average). The example shown and described below shows this indicator drawn on a price chart.

Ehler MESA Adaptive MA

The MESA Adaptive Moving Average is a trend-following indicator that adjusts to price movement, using the rate of change measured by the Hilbert Transform Discriminator. This tool gives you a trade signal when the two moving averages cross each other. You want to open trades in the direction of the MESA averages.

This way of doing things has a fast MA and a slow MA so that the combined average quickly follows the price changes and keeps the average value until the next candlestick closes. This indicator is less likely to have false signals compared to regular Moving averages. This is because of the math used to figure out how quickly the price is changing.

Study More Lessons:

- What's the best way to trade XAUUSD price consolidation in gold trading?

- How do you draw XAU/USD trading channels in MetaTrader 4?

- Using MQL5 Signals on MetaTrader 4 and MetaTrader 5

- Placing a Pending XAUUSD Order in MT4 on Android

- What is the Difference if any between Fibonacci Retracement and Expansion?

- Gold Trading Lessons for Beginners

- Stochastic Momentum Index Indicator for XAU/USD

- How do you trade gold in the MT4 iPad app?

- How to Use the Gann HiLo Activator for Buy Signals in Forex

- Learn MetaTrader 5 Mobile App Trading Guide Tutorial