Gold Account Management

The best way for a gold investor to manage their money is to ensure their losses are less than the money they earn. This is known as risk to reward ratio.

Account Management Strategies

This approach boosts strategy profits. Trade only when gains could top risks by three times or more.

A risk-reward ratio of 3:1 or higher boosts long-term profits. The XAUUSD chart below shows how this works.

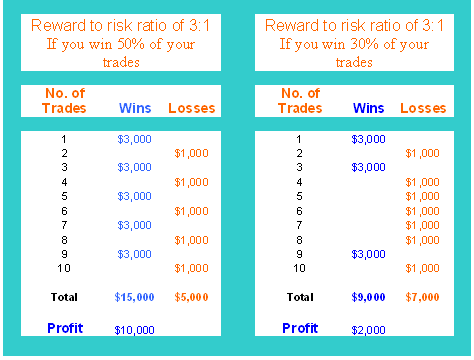

In the first example, you can see that even if you only won 50% of your trade positions in your trading account, you would still make a profit of $10,000 dollars.

Even if your success rate dipped to around 30%, maintaining profitability would still be achievable – this aligns with the principle of Account Management within Money Management.

It's important to note that a favorable risk-to-reward ratio significantly increases your chances of being profitable as a trader, even with a lower strategy win percentage.

Avoid risk-reward ratios that let you lose more pips on a trade than you expect to gain. It makes no sense to risk $1,000 just to earn $100.

This is because achieving the $1,000 recovery requires ten successful trades. A single loss necessitates forfeiting all accumulated trading gains.

This type of investment trading strategy makes no sense & you will lose on the long term.

Account Management Strategies

The percentage risk strategy is when you risk the same percentage of your account balance on each trade - this relates to Account Management Methods.

% risk based method/technique says that there'll be a certain percentage of your account equity balance that is at risk per trade. To calculate the percentage risk per each trade position, you need to know 2 things, the percentage risk that you have chosen and contract/lot size of an opened/executed trade order so that to calculate where to put the stoploss order. Since the percentage is known, we shall use it to calculate the lot size of the order to be placed in the market, this is referred to as position size.

Example

If you are a trader with a total of $50,000 in your account and your risk percentage stands at 2%

Then 2 % is the same as $1,000

Other factors to consider include:

Maximum Number of Open Trades

One factor to determine when managing your account funds is the maximum acceptable number of open positions - that is, the ceiling on the volume of trade transactions you wish to maintain simultaneously at any given moment.

If e.g., you select a 2 %, you might & may also say choose to be in a maximum of 5 trade transactions at any one specified time. If you open 4 trades and all 4 of those trading positions close-out at a loss on the same trading day, then you'd have an 8% decrease in your trading account balances that day.

Invest with Sufficient Capital

One critical mistake in gold trading is opening an account without adequate equity, which can lead to unnecessary risks and financial instability.

Traders with limited capital often face heightened anxiety about minimizing losses, which can lead them to exit trades prematurely. This approach hinders their ability to achieve lasting success with their chosen strategy.

- Exercise Discipline

Self-control is the most important quality a trader needs to learn in order to make money. Self-control means sticking to your trading plan.

It means letting a trade play out without quickly exiting just because you feel uneasy about the risk. Also, discipline means sticking with your xauusd plan, even after you've had some losing trades. Try your hardest to build the discipline you need in order to make money.

Trading Account Management Basics

Managing equity in gold trading forms the base of any plan. It boosts odds of profits in the market. This matters most in leveraged trades, a highly liquid yet risky financial space.

To invest well in the market, know that good money management for gold trades is key. You use leverage for orders. This covers basic account rules.

Calculate the gap between average profits and losses carefully. Profits should beat losses on average. Otherwise, you make no money from trades. Traders need their own money management rules for gold accounts. Success ties to personal traits. Each person builds a gold trading plan. They base it on these rules too.

When you are entering your orders, ensure that Stop Loss orders are properly positioned to prevent substantial financial drains. Stop Loss orders also function as tools to secure achieved gains.

Think of the chance to make money compared to the chance of losing money as 3:1 - the profit side of this risk:reward comparison should be better.

Considering these trading rules and guidelines, you can use them to improve profitability of your trade strategy and try to create your own strategy that will possibly give you good profits when trading with it.

Explore More Classes and Lessons:

- How Do I Read Rising Wedge Chart Trade Pattern?

- MT5 XAU USD Charts Bar & Charts Tabs

- Learn How to Open A XAU/USD Account

- XAUUSD Platform/Software MT4 Gold Platform Lesson Tutorial

- How Do I Set & Place a StopLoss XAU USD Order on MT5 iPhone XAU USD App?

- How to Draw a Trend-line Correctly On a Chart

- How to Set Pending Gold Order on MT4 Software Platform