XAU/USD 20 Pips Price Range Moving Average(MA) Strategy

20 Pips Price Range MA Strategies

The 20-pip range strategy uses moving averages on 1-hour and 15-minute charts. Add 100 and 200 SMAs to XAUUSD.

Both the 1-hour and 15-minute charts use the 100 and 200 Simple Moving Averages (SMA) to show which way the trend is heading.

The 1H chart timeframe checks the long term direction of the trend, upwards or downward trend, depending on the direction of the Moving Averages. All xauusd trade positions taken should be in this trend direction.

We then shift to the 15-minute chart to pinpoint the ideal moment for entering XAUUSD trades. Trade positions are initiated solely when the price falls within a 20-pip proximity of the 200-period Simple Moving Average: otherwise, no XAUUSD trade positions are opened.

XAUUSD Uptrend/Bullish Market

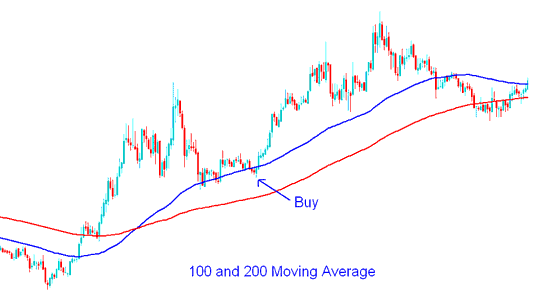

To generate purchase signals (suggesting an upward market) utilizing the 20-pip Moving Average Gold strategy, we will employ both the 1-hour and 15-minute time perspectives.

On the H1 chart timeframe, ensure the price remains above both the 100 and 200 simple moving averages. Then switch to the 15-minute chart timeframe to generate potential trade signals.

If the price goes 20 pips over the 200 Simple Moving Average on a 15-minute chart, we start a buy trade and set a stop loss 30 pips under the 200 Simple Moving Average. You can change the stop loss to fit how much risk you want, but using a 30 pips stop loss is best to avoid being stopped out by Gold's normal ups and downs.

You can open a buy trade when price hits the 100-period simple moving average. This works if it's close to the 200 simple moving average. Usually, the 100 SMA stays within 20 pips of the 200 SMA.

100 and 200 Simple MA Buy Signal - MA Strategy

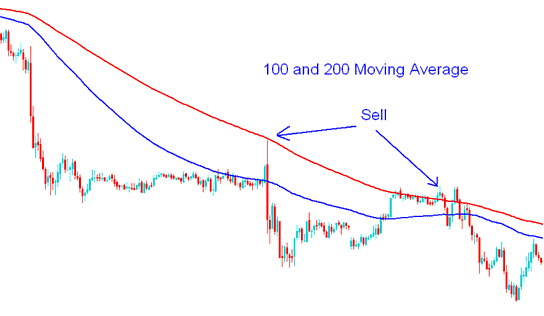

Downtrend/Bearish Market

Use H1 and 15-minute charts for 20-pip MA gold sells. They help generate short signals.

On the one-hour chart, prices stay under the 100 and 200 simple moving averages. Switch to the 15-minute chart for a signal.

On a 15-minute chart, if the price dips 20 pips below the 200 Simple Moving Average (SMA), initiate a sell trade and set a stop-loss order 30 pips above this SMA level.

100 and 200 Simple MA Sell Signal - Moving Average(MA) Trading Method

In this gold strategy, prices often rebound from support and resistance. Many traders eye these areas and enter trades nearby.

These identified support and resistance levels function as short-term barriers defining either resistance or support areas on price charts.

profit taking level for This Trading Method

Using this gold plan, the price will go back and move in the same direction as before. This move will be about 60 - 70 pips.

For gold trading, an optimal profit-taking level is typically considered to be within 60–70 pips of the 200 SMA (Simple Moving Average).

More Topics & Tutorials:

- T3 Moving Average XAU/USD Technical Indicator Analysis

- Advanced XAU/USD Chart Analysis in MT5 Platform

- McClellan Histogram XAUUSD Indicator Analysis

- MT4 William Percentage R XAU/USD Indicator Analysis

- How to Analyze/Interpret Different Types of Gold Candlestick Patterns Analysis

- Setting TP and SL Orders for XAUUSD in MetaTrader 5

- How to Set MetaTrader 5 Accumulation Distribution Indicator in Gold Chart

- MT5 Lesson Guide Android XAUUSD App Course for Beginners

- Best RSI for 5 Min Chart XAUUSD