MA Crossover Trading

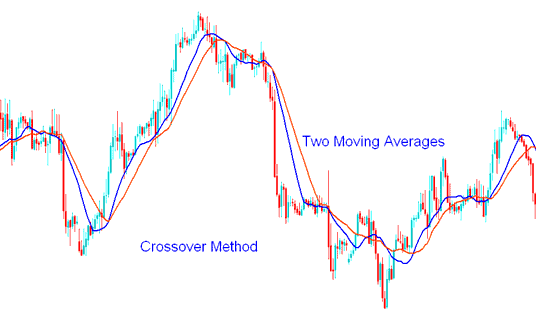

The Moving Average crossover technique employs two distinct moving averages to originate trading signals. The initial one is a Moving Average calculated over a shorter historical price period, while the second is based on a longer price period.

MA Crossover Technique - MA Cross over Trading

The term "crossover technique" for this trading crossover moving average strategy comes from the fact that trading signals are produced/derived when two averages cross one another.

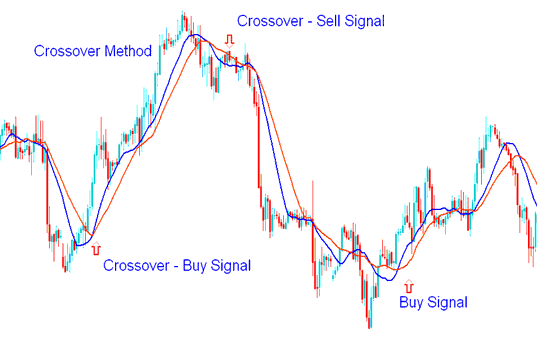

Buy Trade Signal

A buy signal is generated when a shorter Moving Average (MA) rises above a longer Moving Average.

A Buy Generated when the Shorter MA Crosses above Longer MA

Sell Trading Signal

A sell trade signal is generated when the shorter-term Moving Average (MA) crosses beneath the longer-term Moving Average.

A Sell signal is produced when the Shorter Moving Average falls below the Longer Moving Average.

The Moving average trading strategy above is the most basic of all the systems traders use when trading gold.

More How-To Guides and Subjects: