Trading Short Term and Long-Term Price Period of MA

A trader can select to adjust the price bars periods used to calculate the moving average MA.

If a trader employs shorter price periods, the Moving Average will respond more swiftly to price variations.

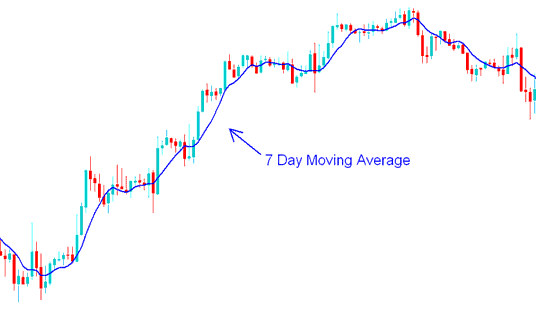

For example illustration if a xauusd trader uses the 7 intra-day trading moving average then, the moving average indicator will react to the price change much faster than a 14 day or 21 intraday trading MA would. However, using short time price bars periods to calculate the MA may result in the technical technical indicator giving false signals (whipsaw signals).

7 Day Moving Average(MA) - MA Trade Methods

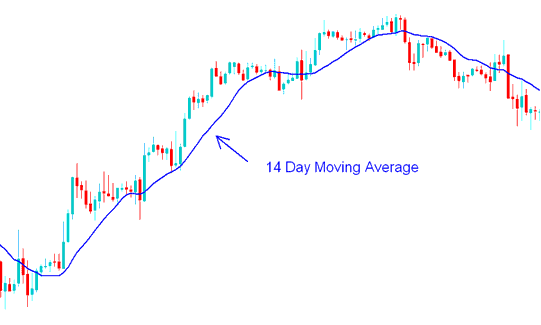

If a trader opts for longer intervals when viewing chart timeframes, the Moving Average's response to price shifts will be considerably slower.

For example illustration, if a trader uses the 14 day Moving Average then the average will be less prone to whip saws but it will react much slower.

14 Day Moving Average(MA) - Moving Average Trade Strategy Example

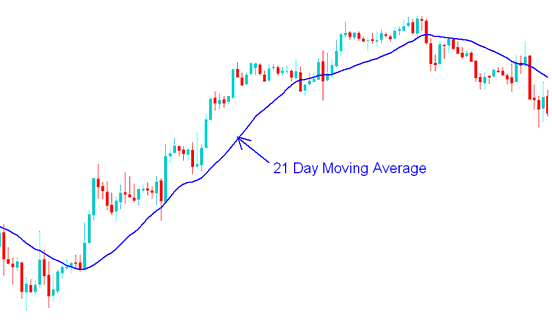

21 Day Moving Average(MA) - MA Trade Strategies Examples

Learn More Lessons & Courses:

- How Do You Trade Using the Market Training Introductory Course to Download?

- Can you start trading XAU/USD with $1000 in a standard XAUUSD trading account?

- Drawing Upward Trendlines and Channels on Gold Charts

- How to Log In and Sign In on a MetaTrader 4 Account Described

- How to Recognize a XAUUSD Candle

- Analyzing Gold Charts – What Counts as Gold?

- How do you add the Stochastic Oscillator for gold to a trading chart in MT4?

- Top XAU/USD Courses and Tutorials for Analyzing XAU USD

- How do you trade using the Ehlers Fisher Transform indicator?

- Comprehensive Tutorial on Types of Candlesticks and Definitions