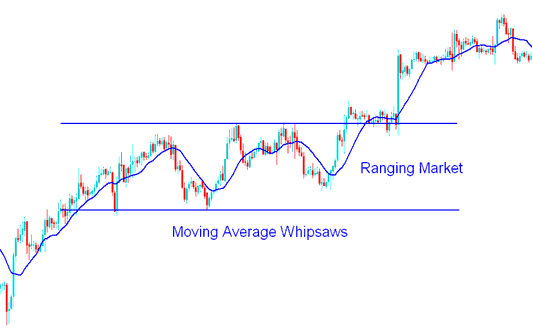

Moving Average Whipsaws Fake Outs in Ranging Sideways Market

Best Strategy for Moving Averages Indicator

The moving average is a beneficial charting aid for trading once a discernible market trend has emerged. Nonetheless, the MA technical tool is susceptible to false signals when prices are oscillating within a sideways, range-bound market.

During a ranging market, moving averages (MA) tend to produce false signals, known as whipsaws, due to price volatility. The price fluctuates around the average, sometimes indicating a bullish trend before quickly switching to sell signals.

For this precise reason, it is advisable not to use the Moving Average indicator when attempting to trade gold within a market environment that is consolidating sideways.

Range-Bound Market and Whipsaws - How to Trade XAU/USD in a Range Market

That's why it's good to use this trading average indicator with other indicators to get better gold trading signals.

Learn More Lessons & Courses:

- Tutorial Guide for Learning How to Use the MetaTrader 5 Platform

- How the Stochastic tool works in XAUUSD markets that are going up or down, or sideways.

- Steps to put in and set up an XAUUSD order to wait in the MT5 platform.

- Calculating the value of one standard XAUUSD lot in gold trading.

- Utilizing Support and Resistance Zones in Gold Trading Operations

- Want to figure out the margin required for XAUUSD? I'll show you.

- Gold: When a Trendline Breaks and Signals a Change

- Acceleration Deceleration Indicator: Trading Strategy Lesson

- Interpreting MT4 Trend-lines and Channels Effectively on MetaTrader 4 Charts

- How to Read XAU/USD Charts - A Quick Guide