Gold Volume Breakout Strategy

OBV Breakout Strategy is based on the popular stocks strategy, where stock investors traders use volumes to try and predict price direction, based on the concept "Volumes precede price", in market, there is no central clearning house where gold volumes are aggregated, so in traders use a technical indicator which will estimate and measure the volumes. This indicator is referred to as OBV - On Balance Volume.

Volume Precedes Price

Volume comes before price, making it a useful early indicator. Understanding how to read this volume indicator helps traders make smarter choices about where the market might go next. Traders can use volume indicators to plan a break-out strategy.

An increase in volume indicates that capital is beginning to enter the gold market. Since volume typically precedes price movements, a subsequent price rise can be anticipated - this relates to the XAUUSD Breakout Strategy Indicator. When the On Balance Volume indicator trends upward, it signifies that buyer activity surpasses that of sellers.

A decrease in volume indicates that cash is beginning to leave a gold. The next thing is that the price will drop since volume will come before price. The technical indicator On Balance Volume shows that there is more selling volume than buying volume when it is trending downward.

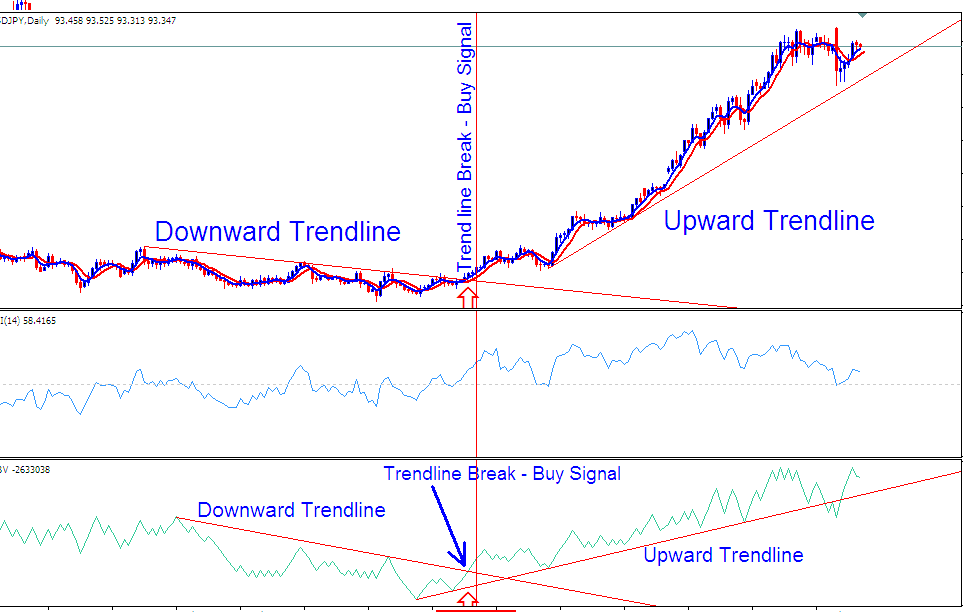

When a downward OBV (On Balance Volume) trend line is breached, it often signals that sellers are closing their sell orders, taking profits as a result.

Also, when the line going up on the OBV indicator is broken, it means that buyers are starting to end their buy trades and take the money they have earned.

Because the On Balance Volume (OBV) indicator provides directional context to volume data, thereby forming an overall trend indication, a trader can juxtapose these two - the established price trend direction and the trend direction indicated by the OBV technical indicator. These two directional indicators should ideally align and move in concert: however, whenever a divergence or disconnect emerges between the price trend and the indicator's trend, a gold trader must pay close attention to determine the opportune moment to exit the current trade or to initiate a new order based on the resulting trade signal.

On Balance Volume serves as a leading indicator, enabling a trader to avoid entering the market past the optimal time. The OBV Indicator is also valuable for signaling when to secure profits prematurely, before a trend reversal erodes all accumulated gains.

Example of this Method

Indicator for OBV Breakout Strategy - Gold Volume Break out Method Using OBV Breakout Indicator

Study More Tutorials & Topics:

- Things to Think About When Choosing Your XAUUSD Broker

- How Do You Trade a XAU/USD Pull Back?

- Types of XAU/USD Trends – What Sets Them Apart?

- What Amount of Power for $50 Trading Account?

- How to Draw a Downward Channel?

- How to Modify a Trade Take Profit Order Within the MT5 Platform

- Understanding the Alligator Indicator Interpretation

- MT4 Margin Level: Explanation of How to Figure Out XAUUSD Leverage on MetaTrader 4 Software

- Adding Average True Range Indicator to Gold Charts on MT4

- How to Use the SMA Indicator for Buy Forex Signals