Rainbow Charts Analysis & Rainbow Charts Trading Signals

Developed by Mel Widner

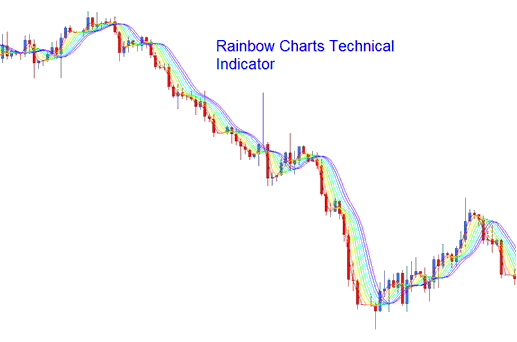

This technical tool operates as a market trend-following indicator, analogous to Moving Averages (MAs), constructed using a two-period simple moving average (MA). This base MA is then smoothed iteratively to generate a sequence of ten distinct moving averages. The initial moving average serves as the foundational figure: the subsequent one is computed based on the first, the third based on the second, and so on. This process results in a rainbow-like contour reflecting the market trend, with each moving average rendered in a unique color for visual differentiation.

XAU/USD Analysis & Generating Trade Signals

Bullish Trend/ Upwards Gold Trend

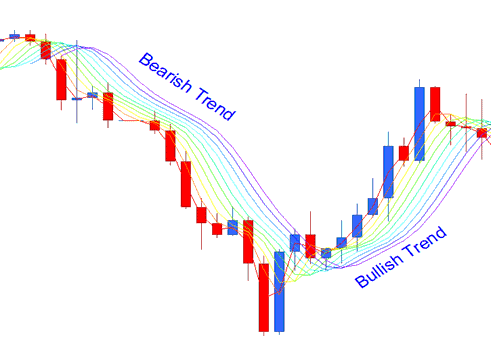

When the trend in the market is Upwards/bullish trend, then the rainbow will be heading upward, the least smoothed line will be at the top of the technical indicator, this is the red line and the major smoothed out line - Violet will be at the bottom of the technical indicator, this is the violet line.

Bearish Market/Downwards Trend

Should the market trend be decidedly bearish (downward), the Rainbow Charts will display a downward orientation: the highly smoothed line (Violet) will situate itself at the bottom boundary, while the line exhibiting the least smoothing (Red) will appear at the apex.

XAU/USD Trend Continuation Signal

As the market keeps going in one direction, either up or down, the rainbow charts stay closely aligned with the price. When the price moves farther away from the rainbow charts, it is more likely that the price trend will keep going: this is seen as a sign to continue trading with the trend. The indicator lines will also keep getting wider, which is also another signal to continue trading with the trend.

XAU/USD Trend Reversal Signal

When the price begins to move across the rainbow charts, this is interpreted as a shift in the trend. The widening or narrowing spread between the lines of this technical indicator also suggests a trend reversal in the market. The reversal confirmation occurs when the price penetrates all lines of the rainbow charts, and the direction indicated by the rainbow chart indicator also changes accordingly.

More Topics and Lessons available: