Rate of Change Trading Analysis and Rate of Change Signals

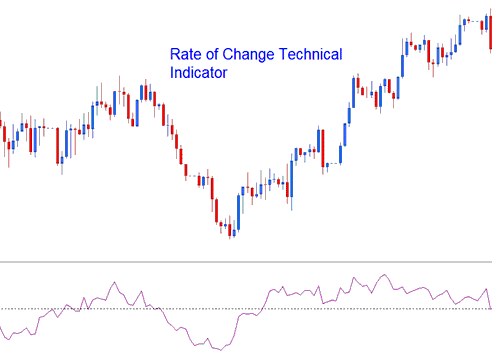

The Rate of Change (ROC) technical indicator measures the variation in the XAU/USD price over a specified number of periods by calculating the difference between the current candlestick and the price of previous candles.

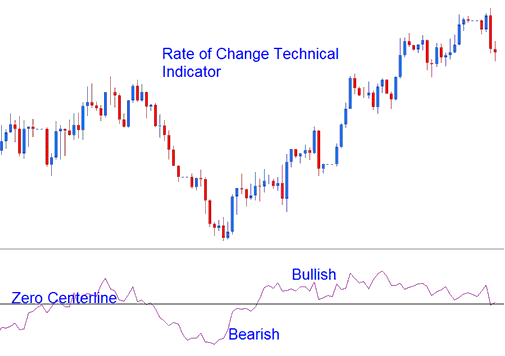

Using Points or Percentages, one can measure and compute the difference. The rate of change oscillates around a zero-center line level, moving in an oscillatory fashion. The zero center line divides the positive and negative levels, with those above being positive and those below being negative.

The higher the changes are in prices the greater the changes in the Rate of Change Indicator.

Trading Analysis and How to Generate Trading Signals

The Rate of Change indicator can be utilized to generate XAUUSD signals via numerous techniques, the most prevalent ones being:

Gold Crossover Signals

Bullish Signal Generation: A buy signal is triggered when the Rate of Change (ROC) crosses above the zero-line benchmark.

A Bearish Signal - a sell signal occurs when the Rate of Change dips below the zero centerline.

Over-bought/Oversold Levels:

Overbought - A higher value indicates that gold is increasingly overbought. Values exceeding the overbought threshold suggest that the xauusd price is overbought, signaling an imminent price correction.

Oversold – The lower the reading, the more oversold gold is. When values drop below the oversold level, gold's considered oversold and a price rally is usually on the way.

The price will remain at the overbought or oversold levels for an extended period of time during strong trending markets, as opposed to price reversing the market trend. As a result, it is preferable to utilize the crossover signals as the formal signals for purchasing and selling.

Trend-Line Breaks

You can draw trend lines on the ROC trading tool just like you draw them on xauusd gold price charts. Since the Rate of Change indicator tells you what might happen soon, the trend lines on the tool will break before those on price charts. When a trend line breaks on the Rate of Change, it could mean the gold price will go up or down.

- Bearish reversal- Rate of Change readings breaking above a downward trend line warns of a likely bullish market reversal.

- Bearish reversal- Rate of Change readings breaking below an upwards trendline warns of a likely bearish reversal.

Divergence XAUUSD Trading

Traders use Rate of Change to spot divergences and potential trend reversals. Four kinds exist: classic bullish, classic bearish, hidden bullish, and hidden bearish.

More Guides:

- Classic Divergence Gold Setup

- How to Trade a Breakout in a Bullish Gold Pattern

- How to Trade Many Gold Shapes that are Used in Gold Trading

- Interpretation of the Morning Star Candlestick Pattern in Gold Trading (XAUUSD)

- What's a Micro Gold Account in Gold Trading? Micro XAUUSD Trading Account Explanation

- Looking to build an indicator-based trading strategy? Here's how.

- Simple XAUUSD Trading Strategy – How to Build One

- Free XAUUSD Margin: An Essential Concept in Gold Trading

- How Do You Trade Gold Upwards Trend?

- How to Use Zigzag Gold Tool in Gold Graph on Gold Software