Confirm Hammer and Hanging Man Candle Patterns for Reversals

Hammer Bullish Candlestick Patterns

Reversal candle setups occur after an extended prior market trend. Hence, for a candlestick pattern setup formation to qualify as a reversal setup there must be a prior trend.

The reversal candlestick setups are:

- Hammer Candlestick Pattern and Hanging Man Candle Pattern

- Inverted Hammer Candle-stick Pattern and Shooting Star Candlestick Pattern

- Piercing Line Candle-stick Pattern & Dark Cloud Cover Candlestick Pattern

- Morning Star Candlesticks and Evening Star Candles

- Engulfing Candlesticks Patterns

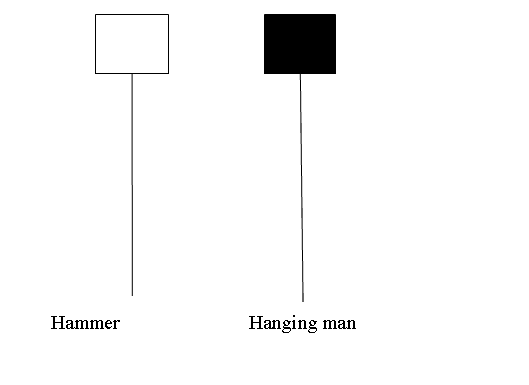

Hammer Candlestick Pattern Hanging Man Candlestick

Hammer Candle Pattern and Hanging Man Candlestick Pattern candlesticks look alike and similar but hammer is bullish reversal pattern and hanging man is a bearish reversal pattern.

Hammer Candle Pattern and Hanging Man Candle Pattern

Hammer Candle

Hammer is a potentially bullish pattern which forms during a downward trend. It's named and called so because the market is hammering a bottom.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times the length of real body.

- Has no upper shadow or very small upper shadow if present.

- The colour of the body is not important

Hammer Candlestick

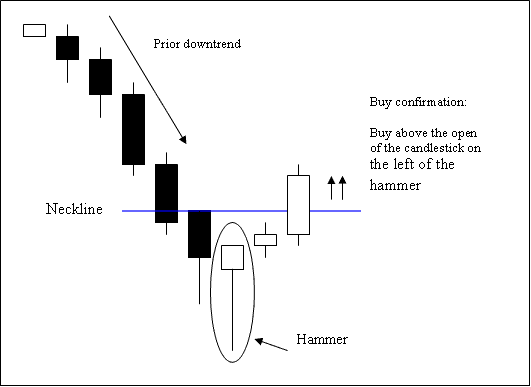

Analysis of the Hammer Candlesticks Pattern

The signal to buy is verified when a candlestick ends above the first price of the candle to the left side of where the hammer candlestick pattern is forming.

Stop orders should be placed a few pips just below low of the hammer candlestick.

Hanging Man Candlestick

This specific pattern formation is considered a potentially bearish reversal sign that manifests during an established uptrend. It derives its name from its visual resemblance to a figure suspended from a high noose.

A hanging man candle has:

- A small body

- The body is at the top

- Lower shadow is 2 or 3 times length of real body.

- Has no upper shadow or has a very small upper shadow if present.

- The color of the body is not important

Hanging Man Candle

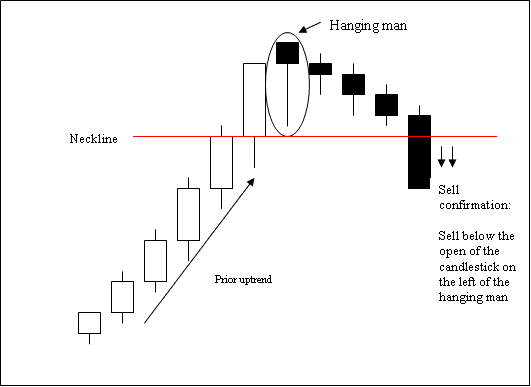

Analysis of the Hanging Man Candlesticks

The signal to sell is confirmed when a candle that shows falling prices closes below where the candlestick opened on the left side of the hanging man pattern.

Stop orders should be set a few pips just above high of hanging man candlestick.

More Guides & Tutorials:

- Adding Bulls Power Indicator for Gold in MT4 Charts

- How Do You Trade MT4 Downward Gold Trend line in MetaTrader 4 Platform/Software?

- Techniques for Predicting XAU/USD Trend Reversals and Identifying Corresponding Signals

- Gold on MT5 Trade Software Download Chart Templates

- A Guide on Trading the XAU/USD Price Action by Utilizing Support and Resistance Levels

- How do you use the Zig Zag gold indicator on a chart?

- Reading Ehler MESA Adaptive Moving Average Signals

- Logging into a Gold Account on MetaTrader 5