RSI Gold Bullish and Bearish Divergence Trades - Classic RSI Divergence Setups

The standard divergence pattern in gold charting serves as a potential indicator of an impending trend reversal. This classic divergence setup is sought after when looking for levels where the price might reverse course and begin moving in the opposite direction. Consequently, the classic divergence formation is utilized as a means for low-risk entry and also as an accurate point for exiting a trade.

- Classic trading divergence is a low risk method to sell near the top or buy near the bottom of a trend, this makes the risk on your trade positions are small relative to potential reward.

- Classic trading divergence is used to predict the ideal optimum point at which to exit a trade

There are two different types of RSI Classic divergence setup patterns:

- Gold Classic Bullish Divergence Trading Setup

- Gold Classic Bearish Divergence Trade Setup

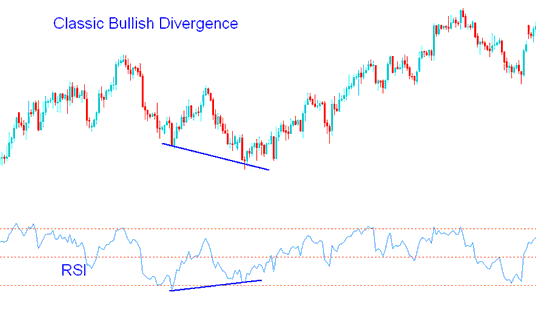

Classic Bullish Divergence Trading Setup

A typical gold bullish divergence happens when the price makes lower lows (LL), but the oscillator makes higher lows (HL).

Classic Bullish Divergence - RSI Gold Methods

Classic bullish trading divergence warns of a possible change in the market trend from downwards to upward. This is because even though the price moved & headed lower the volume of sellers who moved price lower was less just as is illustrated by the RSI. This shows underlying weakness of the down-ward trend.

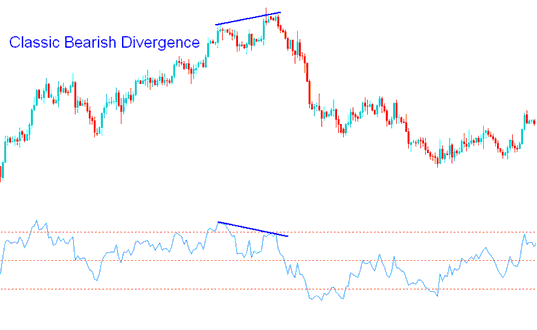

Classic bearish divergence

Classic gold trading bearish divergence occurs when price is displaying a higher high ( HH ), but oscillator technical is lower high (LH).

Trade Classic Bearish Divergence with RSI Strategies Methods

A bearish divergence in classic gold trading signals a potential reversal from an upward to a downward trend. Although prices may have increased, the purchasing volume from buyers (bulls) that drove prices higher was diminishing, as illustrated by the RSI. This indicates a decline in the strength of the upward movement.

Examine More Topics & Lessons: