RSI Indicator Divergence Trade Setups

A divergence setup is one technique gold traders employ: it requires examining both the chart and at least one additional indicator for confirmation. For this demonstration, we will utilize the RSI.

Look for XAUUSD divergence by finding two chart points. The price hits a new high or low, but RSI stays flat. This shows a gap between gold price and momentum.

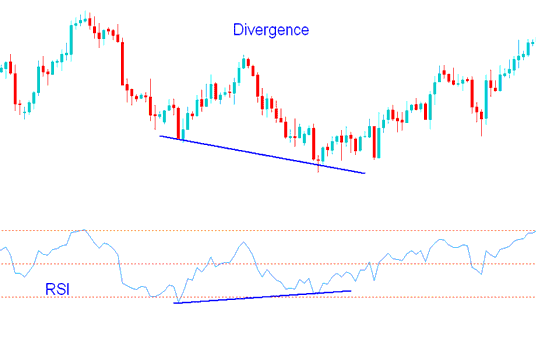

RSI Divergence Example:

In the chart below we identify 2 points, point A and point B (swing highs)

By using RSI, traders analyze peaks formed by it, specifically those directly linked to Chart points A and B for detailed insights.

We then draw one line on the chart and another line on the RSI indicator.

RSI Divergence Trading Setup - Trade Divergence using RSI Indicator

How to identify divergence setup

In order to spot this xauusd trade divergence setup we look for the following:

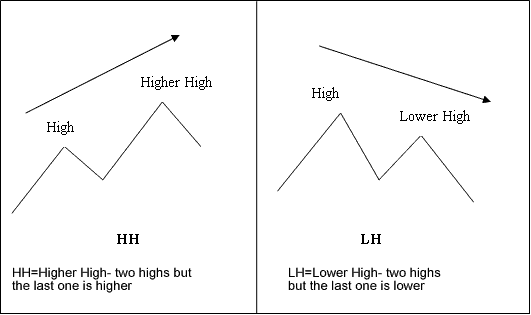

HH = Higher High - 2 highs but the last is higher

LH = Lower High : 2 highs but last one is lower

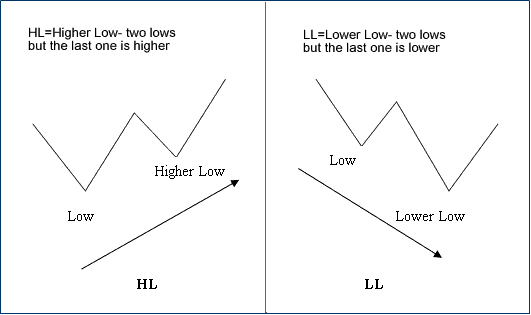

HL = Higher Low : two lows but the last is higher

LL = Lower Low : 2 lows but the last one is lower

First let us look at the illustrations of these trading terms

Divergence Terms Definition

Trade Divergence Terms Definition Example

There are two different types of trade divergence setups:

- Classic Divergence

- Hidden Divergence Trading Setup

Get More Topics and Guides:

- Discover XAU/USD Systems and Gold Trading Strategies

- How Do You Trade Gold Symbols in MT4 Platform?

- Discover XAU/USD Systems and Gold Trading Strategies

- How to Use the Chande QStick Indicator for Trading

- Understanding Bollinger Bands and Indicators in Trading

- Add Fibonacci Expansion Levels to MT4

- Recommended Online Platforms for XAU USD

- Placing New XAU/USD Orders on the Gold MetaTrader 5 iPad App

- Placing Buy Limit XAU/USD Orders Below Current Market Prices

- Doji Candles and Marubozu Candlesticks Pattern