Trade Setups Involving RSI: Identifying and Utilizing Hidden Bullish and Hidden Bearish Divergences

Hidden divergence signals trend continuation. It happens when price pulls back to test a past high or low.

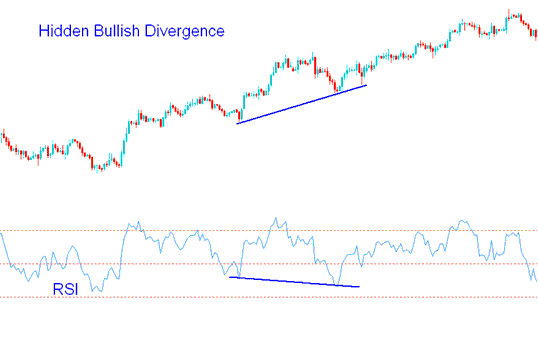

Hidden RSI XAUUSD Bullish Divergence

A hidden RSI gold trading bullish divergence setup happens when the price makes a higher low (HL), but the oscillator trading shows a lower low (LL).

A hidden bullish divergence setup occurs when there is a retracement in an upward trend.

RSI Trade Hidden Bullish Divergence - Hidden Divergence Setup

This setup, showing a difference that's not obvious, proves that the price going back down is finished. This difference in trading secretly points to strong energy behind a trend that's going up.

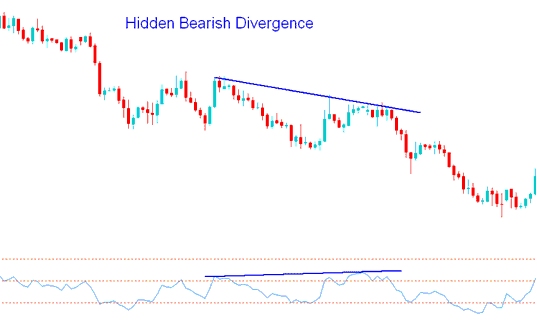

Hidden RSI XAUUSD Bearish Divergence

Hidden RSI gold trading bearish divergence appears when the price makes a lower high (LH), but the technical indicator shows a higher high (HH).

Hidden Bearish Divergence Happens During Pullbacks in Downtrends.

Gold Hidden Bearish Divergence - Trading Hidden Bearish Trade Divergence Trading Setup

This specific RSI hidden bearish divergence configuration serves to confirm the conclusion of a price retracement, indicating that the underlying momentum favors a continued downtrend.

Study More Topics and Guides:

- Your Go-To Guide for Learning XAU/USD Trading

- Best XAU/USD Brokers and Trading Software for Beginners

- Detailed Examples and Explanations for Learning Gold Trading Analysis

- How Do You Pick the Best XAU USD System to Trade XAUUSD?

- How to Change Your XAUUSD Feelings and Thinking When Gold

- Where can beginners find a MetaTrader 5 XAU/USD guide?

- Guide to Adding Fibonacci Expansion Levels using MetaTrader 5 Software

- How do you use MetaTrader 5 on Android? Here's a beginner's guide.

- Ehler's Laguerre RSI for Trading Analysis

- Overview of Lot Sizes in Gold for Standard Trading Accounts