Techniques of Setting Stop-Loss Orders in XAUUSD

Traders using a xauusd system must have math that tells them where to place the trade order.

A trader can also place a stop loss order in accordance to the technical indicators used to set these orders. Certain indicators use math equations to calculate where the stop loss order should be set so that to provide an exit point. These technical indicators can be used as the basis for setting these stop loss orders.

Other traders also place and set these orders according to a pre-determined risk reward ratio. This technique of setting depends upon certain math equations. For example illustration a ratio of 50 pips stop loss can be used by a gold trader if the trade has potential to earn 100 pips in profit: this is a risk : reward ratio of 2:1

Others just use a pre-determined percent of their total trading equity balance.

To effectively implement a stop-loss order, it is recommended to employ one of the following established techniques:

1. Percent of equity balance

This is based on the % of trading account balance that the Gold trader is willing to risk.

If someone wants to risk 2% of their money, they decide where to put the order based on how much they have bought or sold.

Example:

If a trader's account has $100,000 and they are okay with risking 2%, then how big of a position they open for Gold will depend on where this 2% stop loss is.

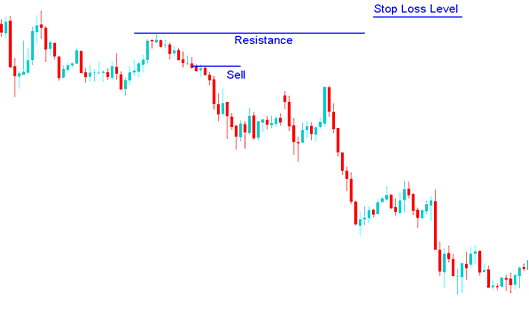

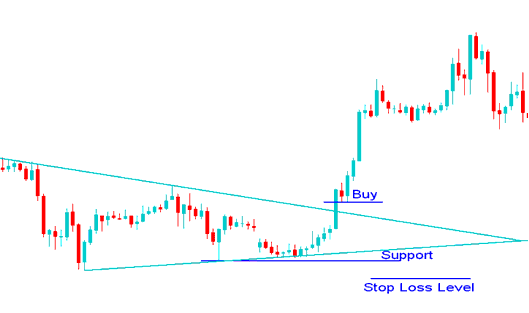

2. How to set a stop loss order based on support and resistance areas

An Alternative Method for Establishing Stop Loss Placements Involves Employing Charted Support and Resistance Levels.

Because stoploss orders often gather at key points, when price tests and touches one of these technical levels, others are triggered, like falling dominos. Stop losses often build up just above or below resistance/support areas.

A resistance/support level should be like a barrier for trading price movement, this is why they are used to set stop loss orders, if this barrier is breached and broken price movement can move towards the in the opposite direction of original trade, but if this barriers (support and resistance zones) are not broken the price will continue heading in intended direction.

Stop Loss level using a resistance zone

Place Order Above Resistance Level

StopLoss Order level using a support Level

Placing order below the Support Line

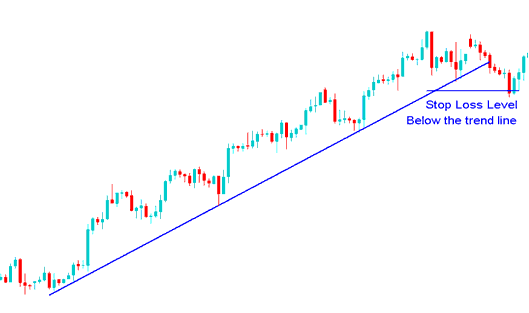

3. TrendLines

A gold trend line can help set stop losses, meaning you can set your trade order just below the trend line. If the trend line remains intact, the online trader can keep making profits while also placing an order that locks in the profits once the trend line is broken.

Putting order below the trend line

Examples of where to set this order using trend lines.

Explore More Tutorials:

- What Happens After a Reversal Doji Candlestick?

- ADX Momentum Breakout XAUUSD Indicator

- XAUUSD Lesson Guide Topics Key Concepts in XAUUSD Online

- ADX Momentum Breakout XAUUSD Indicator

- How to Choose & Select Your Gold Style Tutorial Lesson for Different XAUUSD Traders

- XAU/USD Charts Analysis How to Interpret/Analyze XAU USD Charts

- How to Activate a MetaTrader 4 XAUUSD Automated Expert Advisor(EA) in MT4 Platform

- Comprehensive Training Resource Guide for XAUUSD Trading Principles

- Development Process for a Gold Trading Strategy Based on the Bull Power Indicator

- XAU/USD Key Concepts Described