Stochastic Momentum Index for Gold: Analysis and Signals

Developed & Created by William Blau.

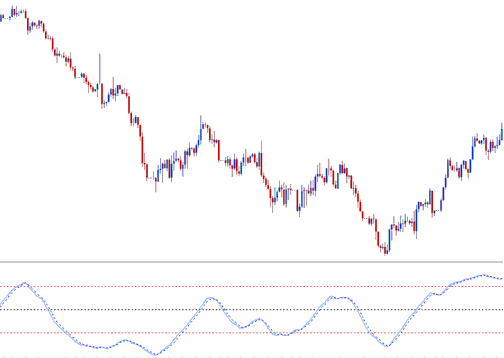

The Stochastic Momentum Index, SMI, is like a changed version of the regular Stochastic Oscillator Technical technical indicator, which makes the stochastic movements smoother.

Construction of SMI Indicator

Calculation of this technical indicator involves comparing the current price against the average mean across a defined number of periods.

Instead of showing these values as they are, they are made smoother using an Exponential MA, and then these smoother values are shown to make the SMI.

When closing price is greater than the average mean of the range, the SMI will move upwards.

When the price at closing is lower than the range's average value, the SMI will subsequently move downward.

This tool shows values between +100 and -100, and it is also less likely to give false signals compared to the stochastic oscillator trading tool.

Gold Analysis and Generating Signals

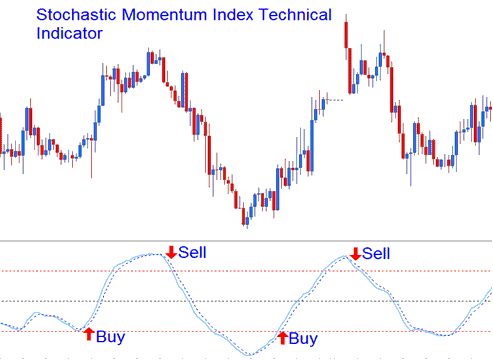

Buy & Sell Signals/ Cross-over Signals

You can use the SMI to find buy and sell signals using the method below: Buy when the SMI goes up and sell when it goes down.

Buy & Sell Signals/ Crossover Signals

Overbought/Oversold Level Cross overs

- Overbought levels above +40

- Over-sold levels below -40

A buy signal is made when this thing drops below the level where it's too sold, then goes back above that level and starts to climb.

Sell Signal is generated when this oscillator rises above over-bought level and then falls below this level and starts to move downwards.

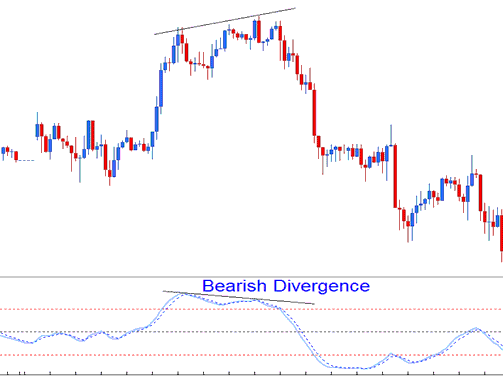

Divergence XAU/USD Trading

The example below highlights a bearish divergence between price and the Stochastic Momentum Index (SMI). When this divergence occurred, the market trend reversed and began moving downward.

Bearish XAUUSD Trade Divergence

Get More Topics and Lessons:

- Chaos Fractals: Technical XAU/USD Indicator for Day Trading

- How Do You Trade Using Recursive Moving Trend Average Indicator to Buy and Sell?

- Understanding Stop Loss vs Limit Orders for XAU/USD Trades

- Best XAU/USD Indicators for Intraday Trading Gold

- Foundational Concepts of the XAUUSD Market for Novice Traders

- How to Download Install and Login on MetaTrader 4 for Windows PC Computer for Mac PC Computer for Android App & iPhone App

- Complete Learn Tutorial Training Course Tutorial

- Bearish Morning Star Candlestick Pattern

- Brokers Offering Standard XAUUSD Accounts

- Improving Gold Trading Performance Through Mastery of XAUUSD Trading Psychology