Analyzing Bullish and Bearish Divergence Using the Stochastics Oscillator in Gold Trading

Gold divergence trades come from signals in the stochastic oscillator indicator.

Divergence in gold trading indicates that a price rally or retracement is losing momentum and could reverse. It suggests that late buyers or sellers are still moving the price in one direction, while the majority of traders have stopped trading in that direction, anticipating a correction or pullback.

There are four types of divergence trading setups

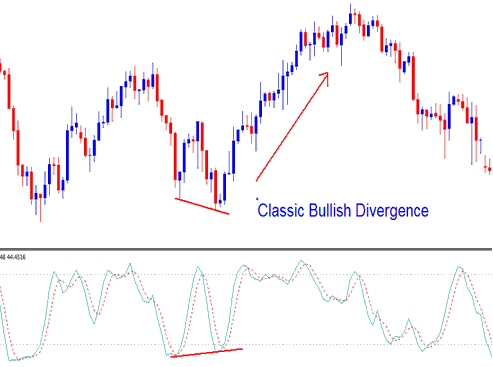

Example 1: Classic Bullish Divergence Trading Setup

A clear Bullish Divergence pattern observed between the stochastic indicator and the price action is subsequently followed by a price increase.

Stochastics Indicator Classic Gold Bullish Divergence

When the market registers new troughs but the Stochastic indicator fails to surpass its prior low points, this divergence signals an imminent reversal of the downward trend, making a bullish recovery highly probable.

In the example, price hit a new low. But the Stochastic did not match it. The indicator should have dropped too. Since it did not, this sets up a classic divergence trade.

Gold classic divergence setup is even stronger because there is combination of a divergence trade setup and then followed by a rise above the 20% indicator level. This combines the Overbought and Over-sold levels with this divergence trade setup.

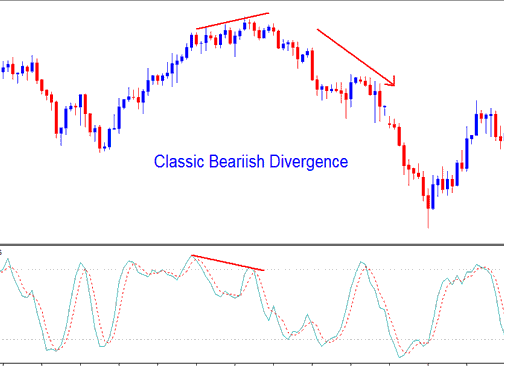

Example 2: Classic Bearish Divergence

A classic bearish divergence setup on Gold, as observed in the stochastic oscillator technical indicator, is subsequently followed by a decline in price.

Stochastic Indicator Classic Gold Bearish Divergence

When the price reaches new peaks, but the Stochastic oscillator indicator fails to move beyond its preceding high, this signals an impending reversal of the upward trend, suggesting that a bearish divergence trading opportunity for gold is about to materialize.

This classic gold trading bearish divergence trade setup is even stronger because there's a combination of a divergence with a dip below the overbought 80 level.

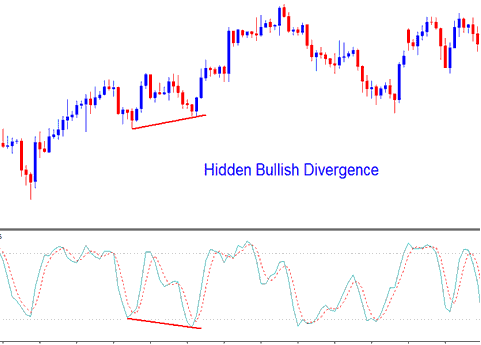

Example 3: Hidden Bullish Divergence Setup

Hidden bullish divergence in gold shows a pullback in an uptrend. This setup is great to trade. It follows the trend direction, not a reversal.

Stochastic Indicator Hidden Gold Bullish Divergence

The stochastic oscillator hit a lower low, but the price made a higher low than before. Bears tried to drive XAUUSD down, as the stochastic showed. Yet the price did not drop to a new low. This spot works well for a buy trade. In an upward trend, you do not need to wait for more confirmation. Just buy while the trend heads up.

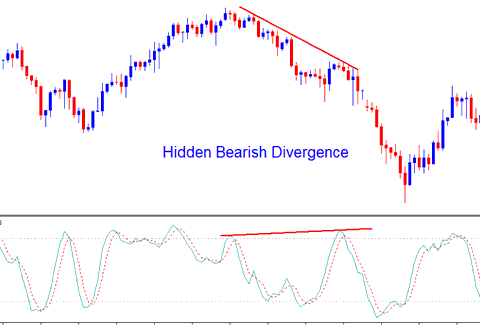

Example 4: Hidden Bearish Divergence Setup

The setup displaying Hidden Gold Bearish Divergence signals a corrective movement within a declining price channel.

Stochastic Hidden Gold Bearish Divergence

Hidden gold trading bearish divergence setup is the best type of divergence setup to trade, because you aren't trading a trend reversal, but you're trading within the direction of price trend. This is the best place to open a sell trade, since it's even in a downward trend there's no need to wait for a confirmation trading signal, because you're selling in a downward trend.

More Guides & Courses:

- Live Trading Charts for Gold Analysis

- Drawing upward trend lines for XAU/USD in MetaTrader 5.

- Drawing XAU/USD Channels in MetaTrader 4

- Adding the Standard Deviation Indicator for Gold Analysis on MT5

- Stochastics Indicator Technical XAU USD Indicator Strategy

- How Do You Read the XAU/USD Indicators List?

- Techniques for Drawing Trendlines in Swing Gold Trading

- Understanding Gold Chart Patterns

- Different Broker Types for XAU/USD Market

- Looking at the Demarker Gold Indicator