What should you remember when setting a stop loss for a gold trade?

The secret to setting stop loss orders in gold trading is to not put them too close or too far, and not right at support or resistance areas.

A few pips below the support or above the resistance levels is the best place.

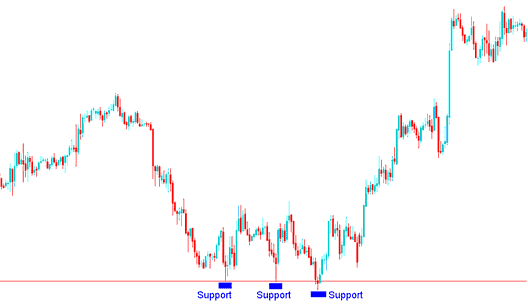

If you're going long, look for a support level just below where you enter. Set your stop order around 10 to 20 pips below that support. The example below shows exactly where you might set your stop loss just under that support level on the chart.

Support Level for Putting StopLoss Gold Order Level for Buy Trade

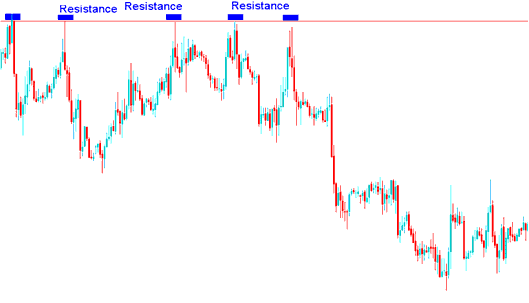

For a short sale, find resistance above your entry. Set the stop loss 10 to 20 pips above it. The chart example shows placement just over the resistance.

Establishing a Resistance Level for Positioning a Stop Loss on a Gold Order Intended for a Sell Trade

Use Stop Loss Orders to Lock Profits, Not Just Cut Losses

One good thing about a stop order is you don't have to check the xauusd market every day to see how it's doing. This is really helpful if you can't watch your open positions for a long time, or if you want to go to bed after trading all day.

The drawback is that a transient change in price might trigger the stop orders you placed at the xauusd price. The trick is to select a stop-loss order percentage that limits the downside risks while allowing trading prices to vary within the daily range.

People see these orders as tools to cut losses, which is why they call them stop-loss orders. You can also use them to secure gains. Then, they become trailing stop-loss orders.

Set a trailing stop at a percent below the current gold price. As the trade moves, adjust that level. This stop lets gains grow. It also locks in profits if XAUUSD flips against you.

These orders can also be used to eliminate risk if a trade transaction becomes profitable. If a trade makes some significant gains then the stop loss order can be moved to break-even point, the point at which you opened buy, thence ensuring that even if the Gold trade position goes against you, you will not make any loss, you will break-even on that trade.

Trailing stop orders help make the most profit and protect it as the price increases, and they limit losses when it goes down.

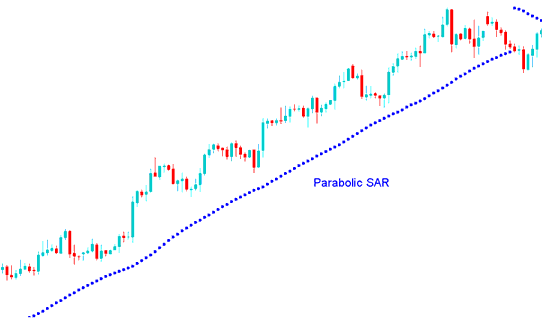

For instance, trail your stop with the parabolic SAR dots as price moves.

Parabolic SAR for Placing Trailing StopLoss Gold Order in Gold

One strategy to consider is adjusting your stop loss order by a predetermined number of pips at regular intervals - be it every hour, every few hours, or even every 15 minutes - based on the timeframe you are utilizing on your chart.

In the XAUUSD example above, the trader used the Parabolic SAR indicator (set at 2 and 0.02) as a trailing stop loss. Each time a new SAR dot appeared, the trader moved up their stop loss, locking in more profit, until the price hit the SAR and the trend flipped.

Conclusion A stop-loss order is a straightforward yet essential tool that many traders neglect to use. Whether it's to limit significant losses or secure profits, this tool is beneficial across nearly all trading styles.

Points To Remember When Placing These StopLoss Orders

Remember these important things:

- Be careful with the levels where you put these stop loss orders. If gold normally fluctuates 20 points, you do not want to set your stop loss order too close to that range else you'll be taken out by normal price volatility

- Stop Loss Gold Orders take the emotion out of a decisions & by setting one you put preset point of exiting a losing position, intended to control losses.

- Traders can always use indicators to calculate where to set these zones, or use the concepts of Resistance & Support to decide where to set these stop loss orders. Another good indicator used to put these stop orders is the Bollinger bands indicator where traders use the upper and lower band as the limits of price therefore placing these orders outside the bands.

Learn More Courses:

- XAUUSD Trend-line Breakout Indicator MT4 Trade Platform

- How to Calculate Required Gold Margin

- What's a XAUUSD Morning Star Candle in Gold?

- Learn XAU/USD Analysis Trade Examples Described

- Reversal Trade Patterns: A Beginner's Guide to Identifying and Trading Setups

- Configuring Fibonacci Extension Levels Indicator in MT4

- MT4 Web Trader Web Based Gold Platform Software Login

- How to Add Buy Stop XAU/USD Order & Sell Stop XAU/USD Order in the MT5 Platform

- How do I draw trendlines on MT4 for gold trading?

- XAUUSD Platform/Software MT5 iPad App Course Tutorial