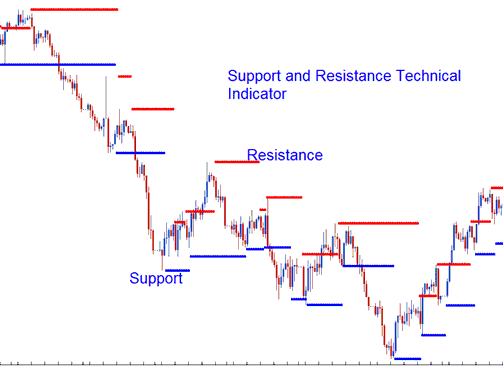

Gold Support and Resistance Analysis with Trade Signals

Support and resistance are some of the most common concepts in gold trading. Most traders draw horizontal lines to mark these important levels.

Specific indicators automate the process of plotting support and resistance levels on charts.

In these technical levels price can either bounce off these levels or breakout through these regions.

Once a resistance zone is breached, the price of gold will increase, and that resistance will become a support area.

If a support level is broken gold price will move lower & this level will turn to a resistance.

However, within a market exhibiting a strong trend, this specific signal frequently produces erroneous entry signals (whipsaws): therefore, the superior crossover to utilize is the Zero Line Cross-over Signal, which is less susceptible to false breakouts.

Once gold price has broken through a support or a resistance then it is likely that the xauusd price will continue moving in that specific direction until such a time that it gets to the next support or resistance zone.

The more gold tests a support or resistance level and bounces, the stronger it gets.

Gold Analysis and How to Generate Signals

A trend-lines approach is used to determine these values.

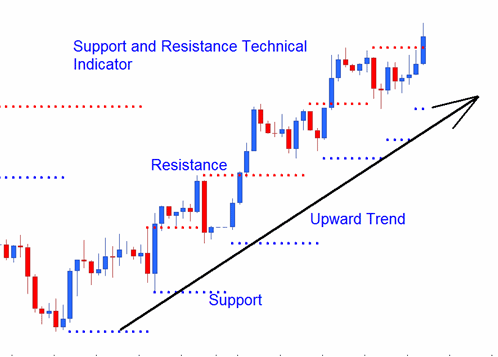

Upwards Trend

In an upwards gold trend the resistance & support will generally head upwards

Upwards XAUUSD Trend

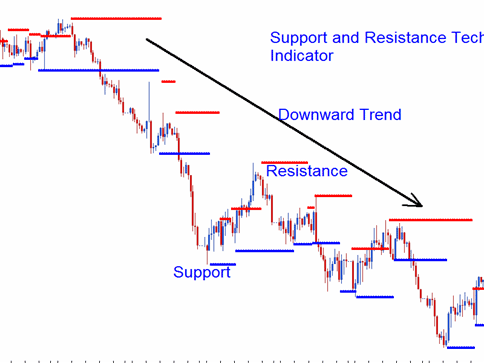

Downwards Trend

In a downward gold trend the resistance & support will generally head downwards

Downward Gold Trend

Acquire More Courses and Topics: