Support and Resistance Zones on Charts

This idea ranks among the top ones in XAUUSD trading. It points to chart lines that block prices from moving past key spots in one way.

Support

This level functions to prevent an asset's price from declining further, effectively acting as a floor because it prohibits the market from dropping below that specific valuation point.

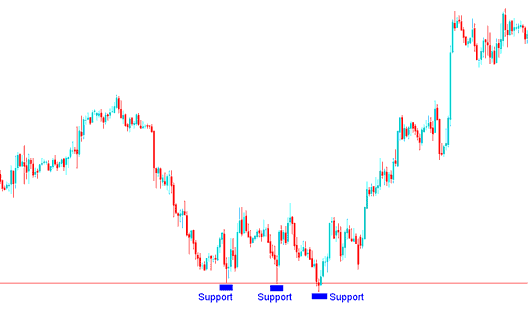

Example:

In the depicted and clarified example below, it is observable that the price experienced a downward movement until it encountered a support area.

After the price reached this level, it experienced a minor upward correction before continuing its descent until it encountered the support level once more.

The process of hitting a level & bouncing back is referred to as testing the support.

Support levels gain strength the more frequently they are tested, resulting in upward market bounces: the example depicted and explained below shows this level being tested three times without breaking. Eventually, the prevailing market trend reversed and began moving in the opposite direction.

Traders pick a level for gold buys. They set orders there with stops a few pips below.

In the trading example shown, the market price did not fall below this specific level, meaning prices could not go lower.

These areas are good spots where a downward trend may change, get support, and start going back up.

At this point, demand for gold jumps, making it a solid time to open a buy trade, with your stop just a few pips below.

People who sell gold also use this support as a place to set their take profit target for their short sell positions too.

Another factor suggesting a potential trend reversal at this specific level is the closure of sell positions by sellers, which reduces the downward trend's momentum. Subsequently, a consolidation phase may occur, leading to a possible shift in trend direction.

Resistance

Technical resistance levels act as ceilings that restrict an asset's upward movement, preventing further price increases beyond those points.

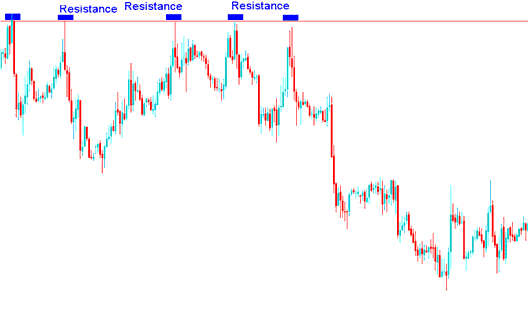

Example:

The illustrated example below shows that the price increased until it reached a resistance level.

Once the price hit this level it retraced slightly then resumed going up until it hit the resistance level again.

The resistance holds and is tried & tested for 5 times without breaking.

The more times a resistance zone is tested the stronger the it is.

Once they pick this level, traders tell their brokers to sell at that level and also set a stop loss that's a few pips higher than that level.

In the trading situation above, the price did not go higher than this point. This area represents a level that the price could not surpass.

These spots are good places where a price going up might change direction after facing resistance and start going down in the other direction.

This shows sellers are eager to unload gold around this area. It's usually a good spot to start a sell trade, with stop-losses set a few pips above.

This zone of resistance is also a level where buyers aim to secure profits by setting their targets for buying positions.

Here's another reason why the trend might change at this level: when the people who are buying start selling their buy positions, the upward trend gets weaker, and the price will likely stay in one place for a while before changing direction and starting to fall.

Get More Topics and Tutorials:

- A Detailed Explanation of Interpreting the Double Bottom Chart Formation in Trading

- Trading the Head and Shoulders Pattern

- How do you trade using the Ehlers Fisher Transform indicator?

- Looking to build an indicator-based trading strategy? Here's how.

- Reliable MetaTrader XAUUSD Broker Data

- What does 1:100 leverage mean for XAUUSD?

- Using the MetaTrader 5 gold trading platform efficiently.

- Navigating the MetaTrader 4 Software: Using the Navigator Panel

- Analyzing Gold Charts – What Counts as Gold?

- Techniques for Trading and Managing an Upwards Channel on the MT5 Platform?