T3 Moving Average: How to Analyze Trades and Spot Signals

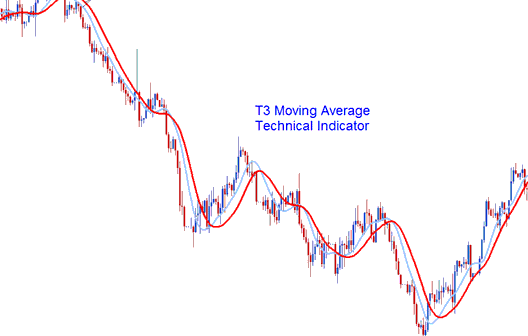

The T3 indicator employs a Smoothing Factor or technique to generate signals that resemble those of Moving Averages (MAs): however, these signals exhibit greater precision than standard MA outputs. The T3 is essentially a refined calculation method derived from the original MA, resulting in a smoother curve with less market lag compared to the Moving Average. This Technical Indicator closely tracks price movement, adapting dynamically to shifts in price direction.

Analysis & How to Generate Trade Signals

The T3 MA is similar to the initial MA(Moving Average), and it can be transacted in the same way as the initial Moving Average indicator.

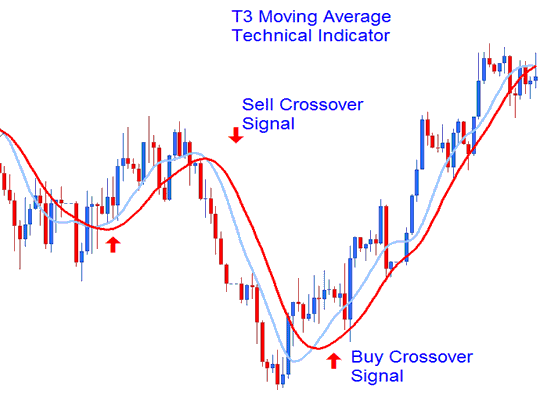

MA XAU/USD Crossover Signal

This Strategy involves using 2 T3 Moving Average & generating trading signals when the two cross each either upward generating an upward trend signal or cross downward generating a downwards gold trend Signal.

Crossover Signal

Crossover Signal

Bullish Trend: Prices are considered bullish provided that the price movement remains above the indicator line. Such a sustained move signals an anticipated continuation of upward price trajectory.

Bearish Trend - Prices hold bearish while action stays under the T3 Average. Price below this tool means it will likely keep falling.

Whipsaws - This smoothed tool avoids false signals. It ignores price spikes, so data stays steady.

More Tutorials and Topics:

- Analysis of the Triple Exponential Moving Average (TEMA) as an Indicator for XAUUSD

- Gold Trading with Divergence in XAUUSD Analysis

- How to Read XAU/USD Charts - A Quick Guide

- Understanding XAUUSD Sell Limit Orders

- List of Online Gold Brokers in Australia

- How to Add Commodity Channel Index(CCI) Gold Indicator on Trading Chart

- Set Take Profit Orders on Gold Mobile App