What's Rectangle Consolidation Patterns?

How do you recognize a rectangle consolidation pattern in XAUUSD trading?

A Beginner's Guide to Identifying and Trading the Rectangle Consolidation Pattern: Best Chart Patterns Lesson

Patterns for Intraday Trading - Patterns Guide

This guide covers Rectangle patterns for Gold trades. Spotting them on XAUUSD charts is key to using these setups well.

Rectangle Consolidation price setups commonly form on XAUUSD charts & this chart pattern analysis guide explains and describes how to trade & analyze charts using Rectangle Consolidation trading setups.

Rectangle Pattern

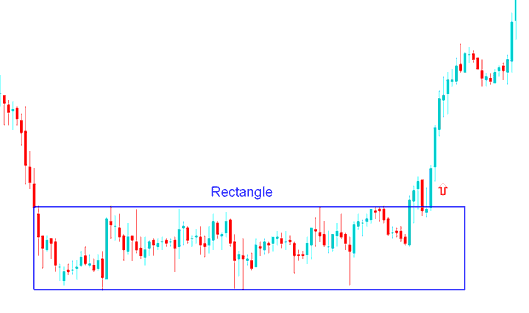

A Rectangle consolidation pattern is a range with narrow trading price action which forms a market consolidation period in Gold market. The trading range is defined by 2 parallel trend lines which are horizontal and show the presence of support & resistance. This pattern formation is plotted on a chart using a rectangle, hence, the name rectangle chart pattern.

Concerning this rectangular consolidation formation, the XAUUSD trading value generates numerous peaks and troughs, which can subsequently be linked using parallel horizontal trend lines. This structure develops over a significant duration, thereby giving the chart presentation its characteristic rectangular appearance.

A break out of price action from this rectangle consolidation chart pattern forms when either of the horizontal line is penetrated and the range signal of the rectangle is broken. An up side breakout of the rectangle consolidation chart pattern formation is a buy trade signal. A down-side breakout of the rectangle consolidation chart pattern is a sell xauusd trade signal.

Rectangle Consolidation Pattern

Following an upward breakout in the Gold market, the price eventually breaches the consolidation range and maintains an upward trajectory.

Examine More Topics & Courses: