What is the Meaning of Fib Retracement?

How Do You Interpret Fib Retracement?

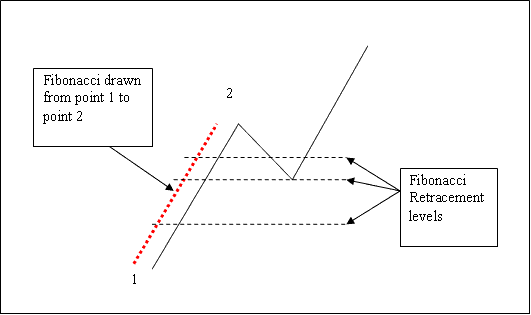

Fibo Retracement is an indicator used in gold trading to calculate price retracement levels in an up-ward or a downward trend. These pullback levels are then used by traders to open trades and open trades at better price after price has retraced & resumes moving in the original trend direction.

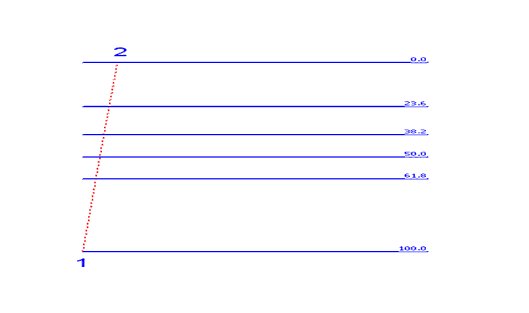

What's the Explanation Fib Retracement Levels?

- 23.6% Gold Trading Fib Retracement

- 38.2% XAUUSD Trading Fibonacci Retracement

- 50.0% XAUUSD Trading Fibonacci Retracement

- 61.8% Fib Retracement

How Do You Interpret Trading Fibonacci Retracement Levels?

38.2% and 50.0% Fibo Retracement Levels are most used and most of the time this is where the price retracement will reach. With 38.2 % Fibonacci Retracement Level being the most popular and most widely used retracement level in gold trading.

61.8% Fib Retracement Level is also commonly used to set stop loss orders for trades opened using this trading retracement strategy.

Fibonacci Retracement Levels indicator is plotted in direction of the market trend as illustrated in the two example below.

What is the Explanation of Fib Retracement?

What is the Explanation of Fib Retracement?

What is the Definition Fibonacci Retracement Levels?

What is the Definition Fib Retracement Levels?