Details on XAUUSD Contracts, Including Leverage, Margin, Spread, Bid, and Ask Price

Lots & Contracts

XAUUSD transactions are executed using standard contracts, commonly known as lots. One standard contract or lot of XAUUSD comprises one hundred ounces of gold, equating to 100 units of XAUUSD.

The gold contract covers the ounces of XAUUSD to buy or sell in online gold markets. A standard lot equals 100 ounces times the current gold price. Traders don't handle the physical gold. The contract stands for those 100 ounces.

The terms 'one standard lot' and 'one standard contract' mean the same thing, so you can use them in place of each other.

Why Trade Units of XAUUSD of 100 Ounces

The reason that very big amounts are used when trading Gold is to make each pip (profit) worth more money in value.

The Gold price moves are measured in points also known as pips.

1 point of an ounce of gold represents 1 Cents only, therefore the price moves are calculated using very small price moves XAUUSD, XAUUSD Metal will be quoted as 1247.01

Last Digit Marks the Pip at Second Decimal.

Now, to explain why XAUUSD is traded in amounts of one hundred ounces, we'll use the example below to explain it:

Gold moves about $5 on average each day. That's 500 points or pips. If one point equals a cent, trading one ounce nets $5 max. XAUUSD example with one contract.

In online Gold Trading, a trader will not trade a single ounce of XAUUSD - Gold is transacted in lots of 100 ounces thence in online trading a xauusd trader would be trading 1 contract which's 100 times more the value of the ounce of XAUUSD that has been used on the exemplification laid-out above. Hence, in the above example using on contract of xauusd to trade if gold moves $5 or 500 pips instead of a xauusd trader making only $5 dollars profit, the trader will multiply their profit by 100 because they will now be trading a contract worth 100 ounces of XAUUSD, meaning the total profit would now get multiplied 100 times, and instead of making $5 a xauusd trader would now make $500 profit from this trade.

Furthermore, a closer proximity of the closing price to the session's low price signifies greater distribution for that specific forex currency pair.

Gold Contract

A holding of 100 ounces of XAUUSD, where each ounce is valued at $1247.00 based on the prevailing Gold chart price at this moment, translates to one XAUUSD contract having a total equivalent value of $124,700 (calculated as 100 * 1247).

This means a gold trader needs $124,700 in their account to buy 1 lot of XAUUSD at current prices. How does a small-capital retail trader afford that?

How can a trader afford to invest $124,700?

That is a very good question: the answer is LEVERAGE and MARGIN

In Online XAUUSD trading, you don't need $124,700 Dollars to trade XAUUSD, with leverage and margin you only need $1,300 to trade a contract of XAUUSD, but how?

We shall illustrate using the illustration shown:

Leverage & Margin

In Gold Trading a small deposit can control a much bigger transaction and this is what is known as leveraging, an option which gives Gold traders the ability to make nice profits & at the same time keep their trading risks to a minimum because they'll only be using little of their money, A gold trader will trade XAUUSD contracts/lots on borrowed capital, therefore a trader having a deposit of $1,300 only can borrow the rest using leverage ration like the 100:1 leverage ratio - which means that the trader can borrow $100 dollars for every $1 dollar in their trading account, to put it in simpler terms, the trader can borrow 100 times what they've deposited.

A trader with $1,300 can borrow 100 times that amount. With leverage, they control $130,000. This lets them trade 1 lot of XAUUSD.

Leverage is represented in the form of a ratio, e.g. 100:1 means that an online XAU USD online trading broker will give a xauusd trader $100 dollars for every $1 that the trader has - that's the broker will give the trader an option/choice to borrow 100 times more the amount which they deposit. Leverage option of 200:1 also means that the broker will offer the trader an option/choice to borrow 200 times the amount that they deposit in their account.

Margin refers to the amount of money that your Gold broker requires to enable you, as a trader, to operate with a leveraged sum. It's also the initial deposit made when opening your account. For example, if you deposit $2,000, then your margin stands at $2,000.

With leverage it is possible for retail XAU USD traders or retail Gold traders to trade the online XAUUSD market. Leverage option of 100:1 means that for every $1 dollar on your account you can borrow $100 dollars, this borrowed $100 dollars will be given to you by your online Gold trading broker.What this also means is that the broker also requires you to maintain $1 dollar on your account for every $100 dollars that they've provided you with.

XAUUSD Contract Trade IllustrationIf your trading account holds a deposit of $1,300, and your XAUUSD broker grants you leverage of 100:1, this means your available trading power is boosted to $1,300 multiplied by 100, equalling $130,000, allowing you to trade for up to one full Gold contract.

With $1,300 controlling $130,000, that 1% margin ties up your funds at 1% of the total.

A Gold broker may specify a margin requirement of 1%, which equates to a leverage ratio of 100:1. If the margin requirement is 2%, this translates to a leverage ratio of 50:1. For example, $1 controls $50 worth of assets under a 2% margin.

Because of leverage and margin, retail traders of XAU USD don't have to put down all the money for the entire contract and lot they want to trade. When they open their accounts, they can trade using leverage, which means they have what's called a margin account. This means the money in their account acts as a margin for the leverage they will be using when they trade.

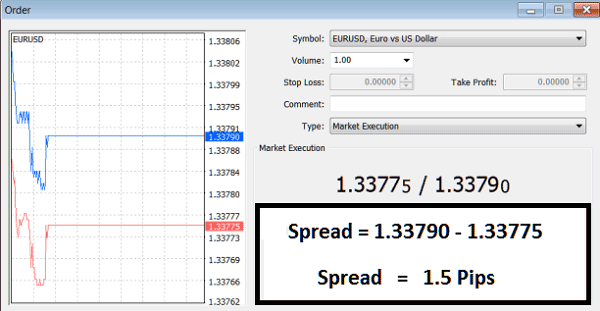

Spreads mark the gap between your buy price and the broker's sell price.

The spread represents the difference between the bid price and ask price. These values can also calculate spreads for trading metals like gold.

Gold Spreads on MT4 Software Platform

Example illustration of How to Calculate Gold Spreads

The Bid ASK Price of Gold is 1247.11/1247.63

The spread is 1247.63 - 1247.11 = 0.52

Spread is 52 pips

This spread is the profit that the XAUUSD broker makes.

Bid/Ask Price

Bid Price Is Where You Sell

Ask Price Is Where You Buy

If the quote for EUR USD is 1247.11/1247.63Bid/Ask= 1247.11/1247.63

So: Bid Price =1247.11Ask Price =1247.63

Mini Lots & Micro Lots

As a note, there's also the fraction of 1 Lot in XAUUSD trading, these fractions of the standard lot are provided by Gold brokers so that to make XAUUSD more affordable to traders with the minimum capital which is required being as little as $100 dollars.

Parts of a standard Gold contract are called Mini Lot, which is 1/10 of a standard XAUUSD contract, & Micro Lot, which is 1/100 of a Standard XAUUSD contract.

Mini Lot Means 10 Ounces of Gold: Micro Lot is 1 Ounce

These mini Gold trading lots were introduced to make the online spot Gold trading market more accessible to the retail XAUUSD investor and also attract more and more retail Gold investors. Maybe this is why online XAU USD trading has become very popular, even with as little as $100 dollars anyone can enter this market.

Additional Instructional Material, Directions, and Instruction Sets:

- Creating a Gold Strategy To Trade XAU USD with

- How Do You Trade XAU/USD in MT5 Trade App?

- What's a Standard XAU USD Account in XAU/USD?

- Types of XAUUSD Bar Charts & Types of Bar Charts in XAU/USD

- Buy Stop vs Sell Stop Orders for XAUUSD

- Trading XAU USD Using the RSI 50 Center Line Method

- What is the Way to Set Up the MT4 Gold Platform Program?

- How Do I Calculate XAU USD Price Action?