Gold Trading Market Hours and the Three Major Sessions for Gold Trading

The online Gold market is open all day: it starts on Sunday night (5 PM EST) and stops on Friday afternoon (4 P.M. EST) - that is five and a half days a week.

However, even though the gold market is open 24 hrs a day, as a xauusd trader you need to realize certain times of day are more suitable than others in trading Gold so as to devise an effective and time efficient Gold trade strategy.

Know the peak hours for trading to catch more chances. That's when most deals happen in the markets.

Although the market lacks defined mandatory opening and closing times across the week, the trading day is conventionally segmented into three key sessions: Tokyo, London, and New York.

At first, the right time to trade may not seem vital. But picking the best times is key to success as a trader.

The best time to trade Gold is when the market is most active and thence has the largest volume of financial trading transactions. A more active online market creates a good chance to make some profit while a calm & slow market is literally a waste of time resource - turn off your computer PC during this time and don't even bother trading XAUUSD at this time.

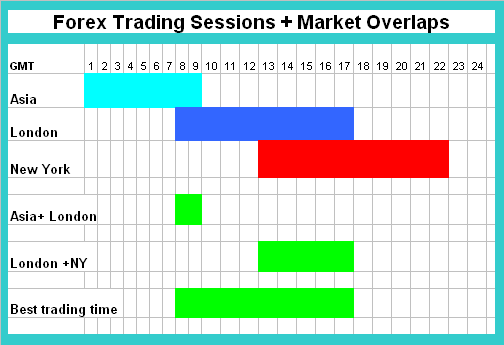

Not every time window within the market is optimal, due to the significant fluctuations in volatility across the 24-hour trading cycle. The table demonstrating the schedule of the Market Sessions is provided below. All times are referenced to GMT 0.

Online Financial Market Trading Hours

These are the busiest times for trading financial items because that's when the big financial companies and major banks in these cities are open. Since these big financial trading places make many large financial trades, the online trading markets also become very busy because there's so much trading happening.

As a gold trader trading during this market time is the best option because there is a lot of movement in the price of financial instruments.

The three major trading sessions are:

Asia Market Session Hours (Tokyo): 00:00 to 9:00 GMT

European Session Hours (London): 7:00 to 17:00 GMT

U.S. Market Session Hours (New York): 13:00 to 22:00 GMT

Trading Sessions Overlaps - Best Trade Times

Sometimes there are hours when two sessions overlap:

Overlap Period for London and Tokyo Sessions - 7:00 to 9:00 GMT: Overlap for New York and London Sessions - 13:00 to 17:00 GMT

Overlapping market sessions see the busiest trading. This brings high volume and better odds for profitable trades.

For illustration, the XAUUSD pair would give good trading results between 13:00 - 17:00 GMT when 2 sessions of Europe & USA are open.

A majority of financial transactions occur during the overlap of the London and US trading sessions. This period offers optimal opportunities for profits in the online XAU/USD market.

Gold prices swing a lot in New York and London sessions. Big firms, hedge funds, and banks trade XAUUSD, currencies, and CFDs then.

Multinationals exchange currencies then to support global business deals. Hedge funds and managed funds trade currencies, gold, oil, and CFDs to invest. Banks swap large sums for clients. They also trade those assets for gains or bets.

Banks also will transact currency transactions/trades on behalf of the tourists wanting to travel around the world or just anyone wanting to exchange money so that to purchase something in another country or make some international transaction.

This makes the online market very active right now, and because there are so many financial trades happening, the price of Gold changes a lot. At this time, the price of XAUUSD Gold will usually go in one way and make a short trend.

As an active trader, it is advantageous to participate when order placement is frequent, as this period ensures ample liquidity and presents numerous profitable prospects in XAUUSD trading. Furthermore, the high liquidity generally leads to more foreseeable market fluctuations, contrasting sharply with low liquidity environments where price action becomes erratic and can devolve into directionless, ranging movement.

After trading Gold for a while, you'll realize that it's simpler to profit from the market when it's trending upward or downward than when it's trading within a range. Because the market tends to trend during the busiest periods, these are the ideal times for XAUUSD.

Asia Market Session Characteristics:

- Least volatile of the 3 market sessions

- Account for 15 % of daily trade transaction turnover

- Typical 20 -30 pip moves

European Session Characteristics:

- Most volatile of the 3 sessions

- 35 % of daily trade volume

- Typical 90 -150 pip moves

US Market Session Characteristics:

- 2nd most volatile of the 3 market sessions

- Accounts for 25 % of daily trade turnover

- Focuses on AUS economic news

US and Europe Session Overlaps Characteristics:

Combines the 2 most volatile trading sessions

The turnover of financial trading operations accounts for 60% of all transactions made in a day.

Focuses on US & European fundamental news

Fast moving Gold prices & XAUUSD pair trends in a particular direction

Typical 100–150 pip moves for the major Gold pair:

Access More Tutorials and Guides

- Analysis of Ultimate Oscillator Indicator Buy Signal

- Bollinger Bands Price Action in XAUUSD Uptrends and Downtrends

- App XAUUSD Platforms

- How Do You Trade XAU USD Patterns Analysis?

- XAU USD Setup Effective XAU USD Strategies

- What is a Gold Margin Call in XAUUSD?

- Instructions on Drawing Trend Lines on Charts in the MT4 Platform

- How to Read and Utilize the Bollinger Bands Indicator

- Method for Calculating XAU USD Price Movement (Price Action)

- How to Place a MT5 XAU USD EA on MT5 Trade Platform