How to Calculate Leverage and Margin in Gold Trading

Leverage is defined as the capacity to manage a substantial sum of capital by using only a small portion of one's own funds and borrowing the remainder - this specific characteristic is what draws numerous traders and investors to the online XAUUSD market.

Example: This shows what trading leverage means. If your broker offers 100:1 leverage, pick it as the top choice for any account you trade.

With this, you borrow $100 for each $1 in your XAUUSD account.

To put in another way your broker gives you $100 for every dollar on your account. This is what is referred to as leverage.This means if you open a trading account with $20,000 and your leverage is 100:1, then your get $100 dollars for every $1 dollars you have, the total amount of capital you'll control after deploying leverage is applied is:

If for $1 dollar the broker gives you $100

After that, you will have a total of if you have 20,000:

20,000 dollars multiplied by 100 equals 2 million dollars.

You now have control over $2,000,000 worth of investments.

New gold traders wonder about leverage for accounts like $20,000, $50,000, or $100,000. Pick 100:1 when starting a live account, not 400:1.

What is Margin?

Margin is the amount of money required by your broker to allow you as a trader to continue to trade with the borrowed amount.In other words the question what is margin in Gold trading? Can be explained as the money required to cover open Gold trades and is expressed in percentage. For 100:1, the amount you'll control is 2,000,000 dollars as is explained in the above exemplification.

Can you really say that putting $20,000 into something is the same as putting $2,000,000? No, it's not. Here's how it helps: leverage turns your $20,000 investment into the same power as a $2,000,000 one, or it turns your $50,000 investment into the same power as a $5,000,000 one. So, where does this extra money appear from? It's borrowed from the trading platform, and it's called Leverage. The money that you borrow comes from the initial $20,000 of your own funds that you put into your account. In other words, this gives the ability to use a large sum of money while only putting up a small amount and borrowing what's left. Without it, trading XAUUSD wouldn't make as much money, but you can choose not to use leverage when trading XAUUSD, by selecting the 1:1 ratio, but then you probably won't make money as it would take too long to see any profit. Leverage is the element of trading that leads to profit when trading online.

Example of how to calculate leverage:

Margin required in this case is 20,000 dollars (your money) if it is expressed as a percent of 2,000,000 dollars which you control it is:

If leveraging = 100:1

20,000 divided by 2,000,000 times 100 equals 1%

Margin required = 1 %

(1/100 *100 = 1%)

A Request to "TradeGoldTrading - Could you simplify this as I am a Novice Trader"

Here's how margin works: say you have $20,000 in capital and, after leverage, you control $2,000,000. Your $20,000 is just 1% of the total - that's your account margin requirement.

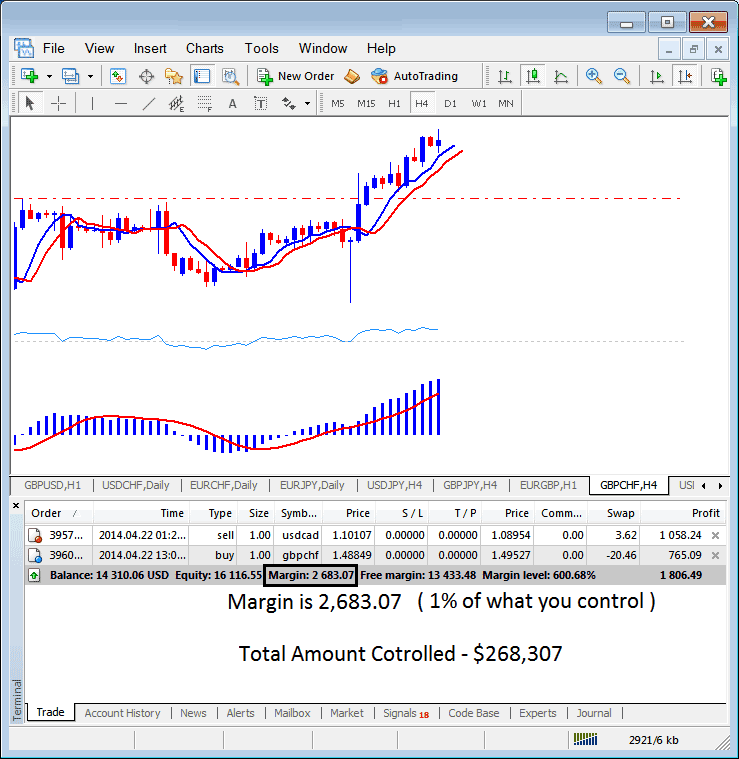

In the example below, the leverage sits at 100:1. The margin, at 1%, comes to $2683.07. So the trader controls $268,307 total. With leverage, they use a small amount of their own cash and borrow the rest. At 100:1, that 1% margin equals $2683.07. Full value then hits $268,307.

MetaTrader 4 Trade Panel - Web Tool for Gold and Currency Deals

If leverage = 50:1

Then the margin requirement = 1/50 *100= 2 %

If you possess twenty thousand dollars,

20,000* 50 = $1,000,000.

20,000 / 1,000,000 * 100 = 2 %

(Simplify - your capital is $20,000 after applying leverage you now control $1,000,000 - $20,000 is what % of $1,000,000 - it's 2 %) that is your account margin requirement

If leverage = 20:1

Thus, the margin requirement equals 1 divided by 20 times 100 equals 5%.

If you have $20,000,

20,000* 20 = $400,000 dollars.

20,000 / 400,000 * 100 = 5 %

That is your account margin requirement because you now manage $400,000 with a capital of $20,000 after using leverage (Simplify - your capital is $20,000 after applying leverage you now control $400,000 - $20,000 is what % of $400,000 - it is 5 %).

If leverage = 10:1

Then the margin requirement is = 1/10 *100= 10%

If you have $20,000,

Twenty thousand multiplied by ten equals two hundred thousand dollars.

20,000 divided by 200,000 times 100 equals 10 %

(Simplified: with $20,000 capital, leverage provides control over $200,000 – what percentage is $20,000 of $200,000? – it is 10%) this constitutes your required account margin.

Differentiating Between Maximum Leverage and Used Leverage Simplified

However, you should note that there is a difference between max leverage (leveraging given by your broker which is the highest leverage you can transact with if you choose to) and used leverage (leveraging depending on the lots you have opened/open trades). One is the broker's set leverage (Maximum leverage) and the other is the trader's leverage used (Used leverage). To describe this concept we will use the example above:

Should your broker offer you a maximum leverage of 1:100, but you only open trades equivalent to $100,000, your actual utilized leverage will be:

$100,000 dollars (1 lot): $10,000 dollars (your money)

Used leverage - 10:1

Suppose you have utilized 10:1 leverage, yet your account maximum stands at 100:1. This scenario implies that even with a maximum allowance of 100:1 or 400:1, you are not obligated to employ the full extent. It is prudent to cap your actual usage at 10:1, while retaining the option for a 100:1 maximum setting on your account. This surplus leverage creates what is known as Free Margin. As long as a trader maintains Free Margin in their account, the broker will not automatically liquidate their positions because the margin requirement remains above the necessary threshold. Should your free margin drop below this required level, your broker is compelled to close all open transactions through a mechanism called a margin call. Ensuring sufficient free margin acts as protection against trade closures resulting from a margin call scenario.

In trading XAUUSD one of your rules: money management rules on your XAU USD plan should be to use leverage below 5:1. In the above screen-shot example, the trader trading currencies USDCAD and GBP/CHF is using $2683.07 dollars, as their margin the total controlled leveraged amount is $268,307, but the trading equity is $16,116.55 dollars, hence used leverage is ($268,307 divided by $16,116.55) = 16.64 : 1Used leverage 16.64 : 1

We have illustrated the example of a XAUUSD trader engaging in currency trading. Now, download the MT4 platform, open a practice trading account, and initiate a trade of 1 lot of XAUUSD while determining the leverage used for that transaction.

Leverage and Trading Gold Lots

In XAUUSD trade - xauusd is traded as lots, commonly referred to as contracts. 1 contract or 1 lot of XAUUSD is made up of 100 units of Gold. 1 unit of XAUUSD is the Ounce. Therefore, 1 lot of Gold is equal to 100 Ounces of XAUUSD.

If XAUUSD costs $1200 per ounce, trading one lot of gold means 100 ounces. That's a contract worth $120,000. With 100:1 leverage, a trader needs just $1200 as margin. They borrow the rest from the broker.

Margin accounts let traders control a large amount of money with only a small amount of their own money, borrowing the rest. With this account, you can borrow money from your broker to trade Gold lots: these Gold lots are worth around $120,000.

The amount of borrowing power your account provides you what's called "leverage", and is usually expressed/represented as a ratio - a ratio of 100:1 means that you can control resources worth 100 times more than your deposit amount or the balance amount on your account.

In trading terms, having a 1% margin in your account enables you to control a trade valued at $120,000 with a deposit of $1,200.

However, trading this account increases both potential for earning profits as well as losses. In online you can never lose more than what you invest, losses are limited to your deposits and usually and generally brokers will close a transaction that extends beyond your deposit amount by executing what's known as a margin call. Traders must thence try to keep their trading margin level above that which's required by their online broker. By using equity management principles & keeping your used leverage below 5:1, then as a trader can learn how to manage this and keep your risks to a minimum.

Update: it is now possible with certain brokers to incur losses exceeding your initial deposit online: hence, when establishing an account, seek out a Negative Balance Protection Policy (NBP), which guarantees you cannot lose more capital than you have deposited.

Advantages of Leverage

As mentioned above, this type of trading account provides you more buying power and the potential for more profits or losses. How this works is: a 1% margin allows you to control a trade size of $2,000,000 with $20,000. When you open a transaction with $2,000,000 small market changes in the price of the XAUUSD Gold metal can result in large profits/losses.

Gold price changes use points called pips. The US dollar trades to two decimals: the last is a pip. XAUUSD at $1200.50 means each pip on a $120,000 lot is $1 profit. A move to $1200.51 gains $1. A $1 shift equals 100 pips. A $3 daily move, or 300 pips, means $300 profit or loss.

Supposing you now decided to use more leverage and trade 10 lots of Gold at once - When you're trading 10 lots of $120,000 then each pip is worth $10 dollars profit. So if this price moves up 1 pip to $1200.51 you will make $10 profit. $1 change in the price of Gold is equal to 100 pips, if a Gold moves by $3 (300 pips) in one day, you make $3000 dollars, if this move is against you, then you lose $3,000.That it isn't best to open trades with $1,200,000 dollars - (10 lots of $120,000 = $1,200,000 of opened positions) just because you can, but you can open transactions of $120,000 or $240,000 as the maximum so that a 1 dollar move you'll make $100 or $200 respectively and if the move is against you - you only lose $100 or $200 respectively and not a lot in terms of your trading account equity. There's also the method of equity management and risk management lessons that traders will learn on the next lessons so as to understand more about leverage and also learn how to trade with leverage in a manner that will help them earn profits in the long term.

If the price goes from 1200.00 to 1200.50, which is a change of 50 pips, you make $50. If you had $20,000 of currency without using leverage, the price change from 1200.00 to 1200.50 would only make you $0.5 dollars. So, the good thing about trading Gold online is that it can greatly increase your profit, multiplying it by 100, 50, or 20 depending on the trading leverage you use.

You do not need a math calculator for these figures. Many platforms handle the math, show the levels, and draw them for you. In MT4, for instance, they appear in the trade window. Hit CTRL+T on your keyboard to open it while MT4 runs. The levels sit just under your active trades.

More Lessons, Tutorials, and Courses:

- Understanding the Difference When Trading Sell Limit & Stop

- Equity Management Strategies and Techniques Applied to XAUUSD Trading

- How Do You Read Where to Place XAU USD Stop Loss using Fibonacci Pullback XAU USD Indicator?

- Versions of Desktop Software for the MetaTrader Platform

- How Do You Modify Take-Profit XAUUSD Order on MetaTrader 4 Software?

- How to Save Your Workspace or Trading Strategies on MT4 Software