Methods of Setting Stop Loss in Gold Trading

We observe from the preceding chart that a breach of the trend-line on the AD indicator was succeeded by a breach of the price trend-line itself.

A Gold trader also has the capability to establish stop-loss orders based on the indicators employed for their determination. Specific indicators utilize complex mathematical calculations to ascertain the precise placement for stop-loss orders, aiming to establish an optimal and ideal point of exit when trading Gold. These analytical chart technical indicators can serve as the basis for setting these protective stop-loss placements.

Other online Gold traders also place these stop loss order orders according to a predetermined risk to reward ratio. This method of setting these orders depends upon certain math calculations based on Gold chart price movements. For example a ratio of 50 pips stoploss order can be used by a gold trader if the trade position has potential to earn 100 pips in profit: this is a risk : reward ratio of 2:1. Also, a ratio of 30 pips stoploss order can be used by a gold trader if the trade has potential to earn 90 pips in profit: this is a risk : reward ratio of 3:1

Some traders risk a fixed part of their full account balance.

To set a stop loss order it is best to use one of the following methods:

1. % of trading equity balance

This risk management methodology revolves around the proportion of the account equity that the trader is prepared to jeopardize on any single Gold trade. For instance, if a trader consents to risk 2% of their total account balance, they will then calculate the necessary distance for setting their stop-loss order based on the precise volume of the trade they have bought or sold.

Example:

If a trader has got a $100,000 account and is willing to risk 2%

If the online trader buys 5 lots

1 pip = $5

Then setting at 2%

2 % is $2,000 dollars

2000 /5 = 400 pips

Stop loss = 400 pips

If the online trader buys 10 contracts

1 pip = $10 dollars

Then setting the stop at 2 %

2 % is $2,000 dollars

2000 /10 = 200 pips

Stoploss = 200 pips

If the trader buys 20 contracts

1 pip = $20 dollars

Then setting at 2 %

2 % is $2,000

2000 /20 = 100 pips

Stoploss = 100 pips

2. Setting StopLoss using Support and Resistance Zones

An alternative methodology for setting stop-loss orders involves using established support and resistance boundaries identified on XAUUSD charts.

Stop losses bunch up at key spots. Price hits support or resistance and triggers chains. They pile just above resistance or below support.

A resistance or a support area should act like a stopping point for Gold price movement, so these levels are used to set stop losses: if this barrier breaks, the Gold price movement can go toward the opposite direction of the original Gold price trend, but if these barriers (support & resistance levels) don't break, then the XAUUSD price will keep going in the planned direction.

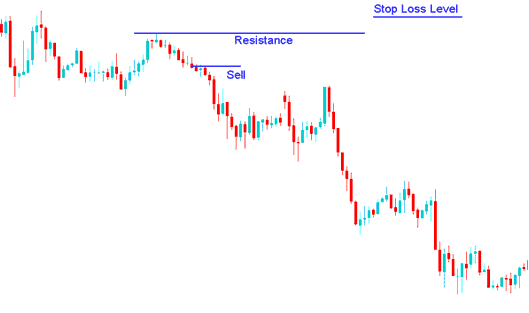

Stop Loss Order Setting using a Resistance Level

Setting StopLoss Orders above the Resistance Level

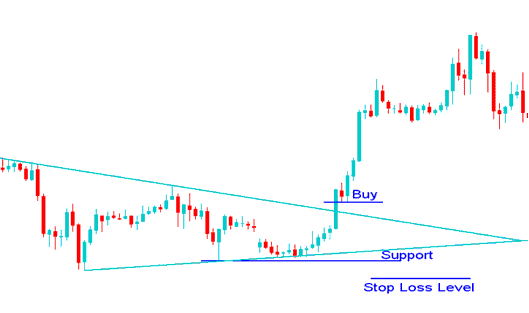

Stop Loss Order Setting using a Support Level

Setting Stop Losses below the Support Zone

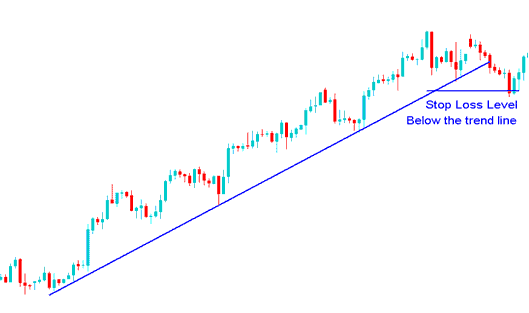

3. Setting Stop Losses Using Trend lines

Trend lines present a useful mechanism for placing stop losses: the order should be positioned just beneath the trend line when the market is ascending, and just above the trend line during a descent. Provided the trend line remains unbroken, a gold trader can continue accumulating gains while simultaneously having a stop loss order in place to secure profits immediately upon the trend line's breach.

Setting the stop loss order below the Gold price trend-line

Example illustration of where to set this stop loss order using trendlines in an upwards trending XAUUSD market.

Study More Lessons & Topics:

- How Can You Load a MT4 XAUUSD Chart Template on MT4 Software/Platform?

- How do I trade using the Relative Strength Index?

- How Do You Sign In in to MetaTrader 4 XAU USD Account?

- Identifying Key Support and Resistance Zones for XAUUSD.

- MT5 Software Tools for XAUUSD Line Studies

- Kase Peak Oscillator XAU/USD Indicator & Kase DevStop 2 Gold Indicator Analysis

- Read Fibonacci Extensions Indicator on MT5

- Interpreting Fibonacci Pullback Levels on the MetaTrader 4 Platform

- How to Trade Knowing the Difference Between a Sell Limit Order and a Buy Limit Order

- Types of Gold Methods & XAU USD Strategy Methods