Stop Loss Key Points - Tips for Setting Orders Right

The key to setting stop losses in XAUUSD isn't to set too tight or too far and not precisely on the support resistance levels.A few pips below support or above resistance levels are the best place which to set stop loss orders.

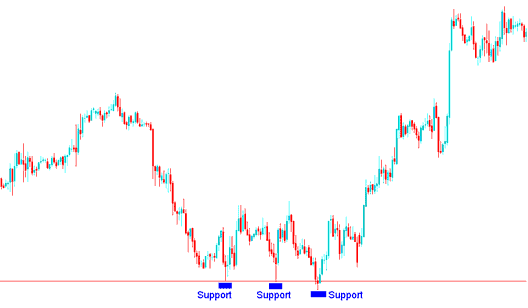

a If you are going long (purchasing Gold pair), simply seek out a nearby support level below your entry point and place this stop loss order roughly 20 to 30 pips below that support area. The graphic below illustrates the point at which a gold trader may place their stop loss orders on the Gold price chart, immediately below the support level.

Where to Put the Stop Loss When Buying Gold, Using the Support Level on Gold Charts

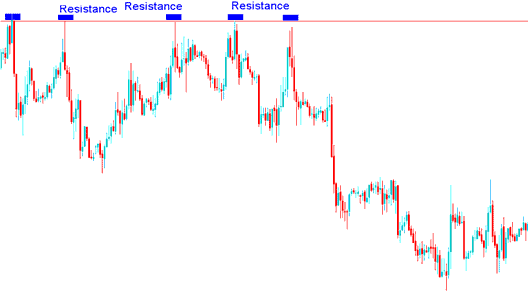

When shorting gold, find a resistance level above your entry. Set the stop 20 to 30 pips above it. The chart below shows this setup just past the resistance.

Establishing the appropriate stop-loss placement for a sell transaction based on the resistance level visible on the chart.

You can also utilize stop loss orders to secure profits, not just to avert losses

A good thing about using a stop loss order is that you don't have to check the XAUUSD Gold price chart every day to see how it's doing. This is helpful if you can't watch your trades for a long time, or if you want to sleep after trading Gold all day, but still want to keep that one XAUUSD trade open.

The bad thing about a stop loss is that the price where you set these orders could be triggered by a small, quick change in the XAUUSD price. The trick is to choose a stop loss percentage that lets the Gold price go up and down normally during the day but still protects you from losing too much money.

Stop losses limit losses, as the name says. They also lock in profits when trailing with price.

For a trailing stop loss it is set at a percentage level below the current Gold market price. This trailing stop loss order level is then adjusted as the trade transaction unfolds. Using a trailing stop loss level allows you to let profits run while at the same time guarantees that should the market turn you will have locked in some of your trading profits.

Use stop loss orders to cut risk on winning XAUUSD trades. If gold moves up enough, shift the stop to your entry price. This locks in no loss if it turns against you. You break even on the deal.

Trailing stop-loss orders serve the dual purpose of securing and maximizing gains as the price of Gold appreciates, while simultaneously capping losses during periods of price decline.

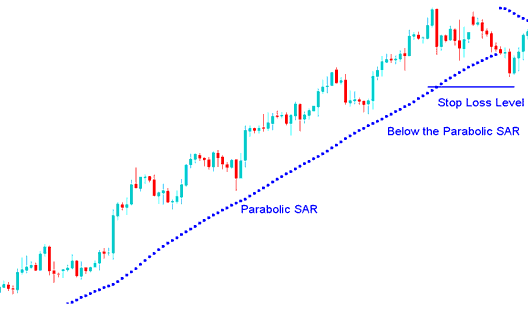

A great way to set a trailing stop is with the parabolic SAR indicator. Just keep moving your stop loss to match the SAR level as the chart updates.

Parabolic SAR Sets Trailing Stops for XAUUSD Trades

In another case, a trader shifts the stop loss by some pips every few hours, or each hour, or every 15 minutes. It depends on the XAUUSD Gold chart timeframe they pick.

In the preceding illustration, the Parabolic SAR, configured with parameters of 2 and 0.02, served as the trailing stop-loss level for the displayed chart. The trader would have continuously moved this trailing stop level upward in sync with each new SAR plot until the point at which the Parabolic SAR indicator was reached, signaling a trend reversal.

Conclusion

Stop-loss orders are an essential tool in trading, yet many traders fail to utilize them effectively. This tool can prevent excessive losses and secure profits across various investment strategies.

Points To Remember When Placing Stop Losses

Here are several essential points to keep in mind:

Place stop losses with care. If gold price swings 50 points often, avoid setting them too tight. Normal volatility could trigger them early.

Stop loss orders remove emotions from trades. They set a clear exit for losses. This protects your account balance.

Gold traders often turn to indicators to pick stop-loss levels. They also draw from support and resistance ideas to place stop orders. The Bollinger Bands in MetaTrader 4 help too. Traders set stops just beyond the upper and lower bands, using them as price boundaries.

Learn more from tutorials, lessons, and courses.

- What Does the Gold Margin Level Mean on MT5 Software?

- How to Determine Where to Place a Stop Loss Order

- A Tutorial Course on Price Action Trading Strategies

- How Do You Trade the Difference between Sell Stop XAU USD Order & Buy Stop XAU USD Order?

- RSI Technical XAU USD Indicator Analysis

- What Does it Mean to Go Long a Gold instrument?

- XAUUSD Psychology Principles of XAU USD Market

- How to Trade Fibo Extension Settings on MetaTrader 4 Platform

- How to Add SL XAU/USD Order on MT4 Trade Platform