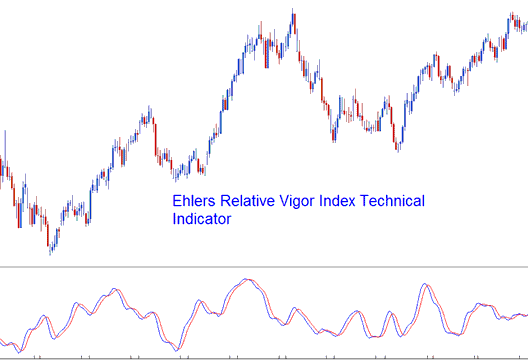

RVI Analysis & Relative Vigor Index Signals

Developed by John Ehlers

The Relative Vigor Index combines the older concepts of analysis with modern digital signal processing theories & filters to create a practical and useful indicator.

The basic principle behind it is simple -

- Prices tend to close higher than they open in up-trending markets &

- Prices close lower than they open in down-trending markets.

The momentum (vigor) of the move will therefore established by where the prices end up at the close of the candlestick. The Relative Vigor Index plots two lines the RVI Line and the signal Line.

The RVI index is essentially based on measuring of the average difference between the closing and opening price, & this value is then averaged to the mean daily range & then drawn.

This makes the index a responsive oscillator that has quick turning points which are in phase with the market cycles of prices.

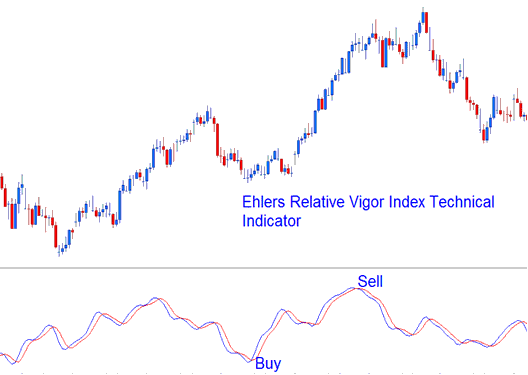

Metal Analysis and How to Generate Signals

The Relative Vigor Index is an oscillator. The basic technique of interpreting the index is to use the cross-overs of the RVI and the Signal-Line. Signals are generated when there is a cross over of the two lines.

Bullish Signals - a buy signal forms when the RVI crosses above the Signal Line.

Bearish Signals - a sell signal forms when the RVI crosses below the Signal Line.

Buy & sell signals generated using the crossover method